As a seasoned crypto investor with battle-scarred fingers from numerous market corrections, I can’t help but feel both exhilarated and apprehensive at the same time. The recent liquidations, totaling over half a billion dollars, are like a rollercoaster ride that I’ve been on countless times before – the thrill never fades, but the stomach drops remain as unnerving.

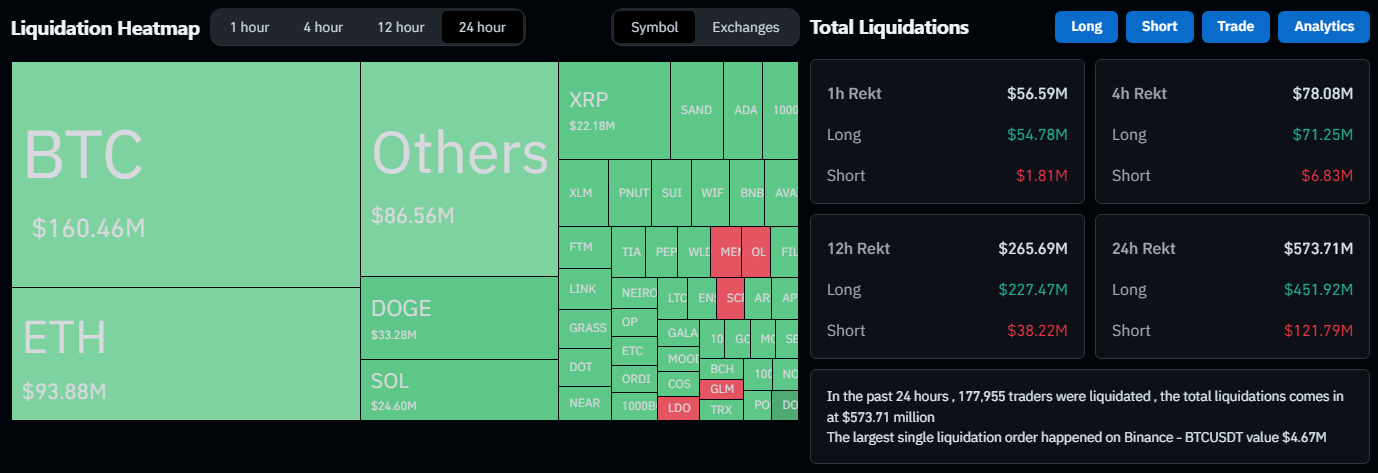

Over the past few days, we’ve seen significant shifts in the world of cryptocurrencies. In a mere day, over half a billion dollars worth of positions were liquidated. A drop in Bitcoin‘s price to its weekly low triggered a wave of sell-offs, resulting in approximately 170,000 traders experiencing losses on their accounts.

According to Coinglass, the reported losses for Bitcoin long positions amount to a staggering $118 million, while Ethereum long positions have seen losses of approximately $54 million. Moreover, there are also losses of around $25 million in long positions for Dogecoin.

The increase in liquidations, along with a drop in market value and reduced trading activity, underscores the volatile nature of trading that many traders now expect. This volatility is seen by analysts as part of a larger trend of corrections following Bitcoin’s recent surge towards almost record-breaking prices.

Bitcoin Dominance & Liquidation Trends

1) Bitcoin’s strong control continues, boasting a market cap of approximately $3.23 trillion, representing more than half (56%) of the entire cryptocurrency sector. A significant trade of $4.67 million worth of BTC/USDT was liquidated on Binance today, demonstrating the high-risk nature of margin trading.

As a researcher, I noticed that even the lesser-known digital assets, or altcoins, weren’t immune to the downturn. In fact, tokens with smaller market capitalizations experienced substantial drops, contributing to an overall loss of around $100 million in the crypto market.

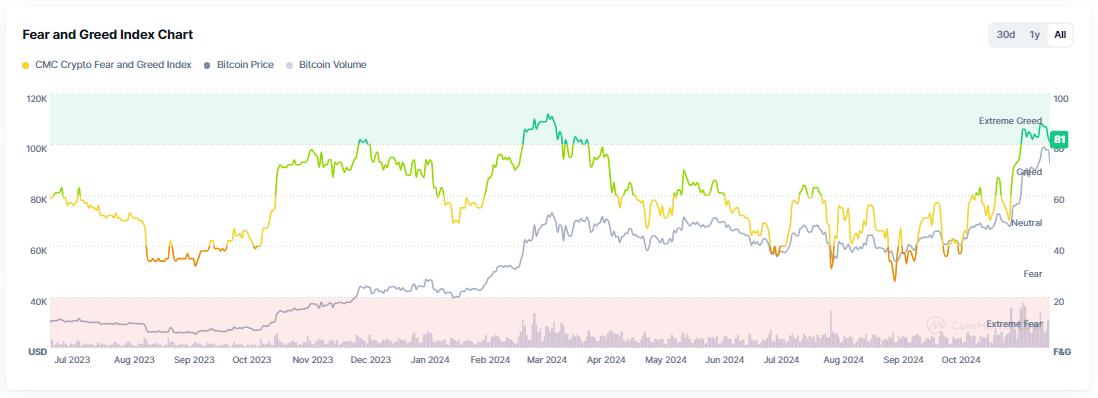

According to certain experts, this recent drop in Bitcoin’s price might be just a typical correction, considering its significant surge of nearly 44% since early November. At the moment, the Crypto Fear and Greed Index indicates a level of 82, implying that the current market sentiment remains “Extreme Optimism” or “Extreme Greed.

Ethereum And Altcoins Maintain Their Poise

As a researcher, I’ve observed that Ethereum, being the second-largest cryptocurrency, has shown remarkable resilience today, even amidst widespread market losses. The mood surrounding it seems uncertain, as evident from the mix of long and short liquidations in Ethereum positions, suggesting a balanced but cautious approach by both buyers and sellers.

For now, digital currencies like Dogecoin, fueled often by excitement from internet memes, have faced the consequences of market adjustments. This serves as a reminder to investors eager for quick returns.

A financial expert named Miles Deutscher has observed that a growing number of traders are resurrecting their trading accounts after a prolonged period of inactivity. This renewed interest stems from the potential of altcoins and Bitcoin’s robust performance, causing him to predict that this heightened activity may result in both expansion and market volatility as trends continue to unfold.

The Road Ahead For Bitcoin

Currently, Bitcoin stands a bit below its record high of $99,750, which it achieved earlier this month, at approximately $92,801. Some analysts predict that the market could experience consolidation before another potential rise beyond $100,000. However, others caution that excessive leveraging might lead to increased short-term volatility.

Investors closely watch market sentiment and economic trends. While the present situation seems to fuel optimism, the cryptocurrency market’s extreme price fluctuations and high risk of excessive borrowing serve as a reminder of its inherent uncertainty.

Read More

- POPCAT PREDICTION. POPCAT cryptocurrency

- ELX/USD

- How Tall Is The Bachelor’s Grant Ellis? Height & Past Jobs Revealed

- Gold Rate Forecast

- Who Is Alex Cooper’s Husband Matthew? Relationship, Age, Job, Kids Explained

- [Vergil Rerun] Verse Piece Codes (February 2025)

- Has Zatima Season 4 Been Canceled or Renewed by BET+?

- Why Fans Think Daniel Kyri’s Darren Ritter Is Leaving Chicago Fire

- One Piece: Who Is Taking Over Franky’s Role?

- Unni Mukundan addresses his ‘no-kissing’ policy in films and REACTS to working with female co-star for first time

2024-11-26 12:04