As a seasoned analyst with over two decades of market experience under my belt, I find myself consistently impressed by Bitcoin’s current trajectory. Having witnessed numerous bull and bear cycles across various asset classes, it is remarkable to see the consistent growth exhibited by this digital currency.

For several days now, Bitcoin has surged beyond the $96,000 threshold following a period of consolidation just under the psychologically significant $100,000 barrier. As the foremost digital currency, it has been consistently shattering record highs over the past three weeks, with yesterday’s close at an unprecedented $98,000—the highest it has ever reached.

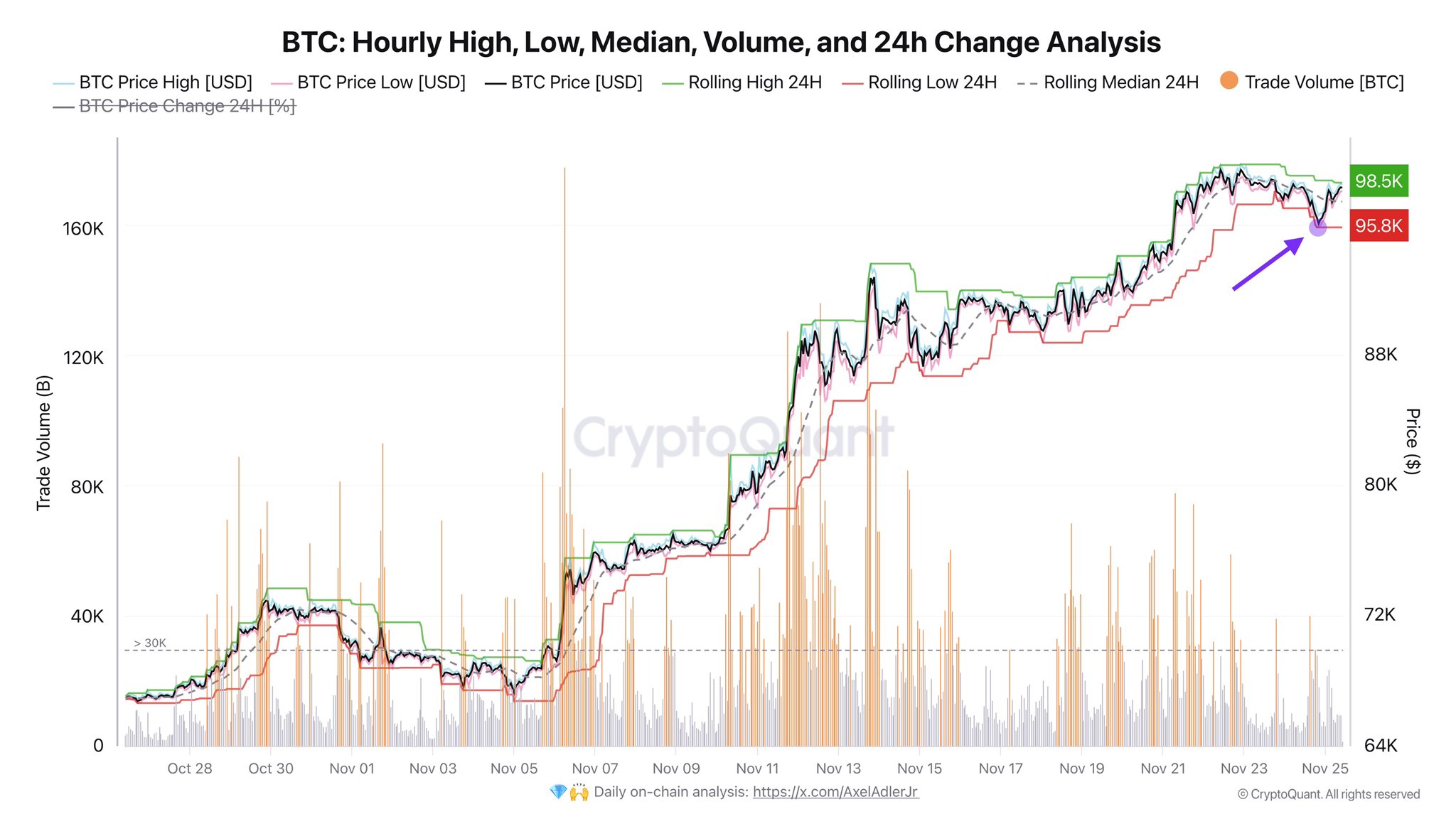

CryptoQuant analyst Axel Adler recently provided an insightful breakdown on asset X. He highlighted that Bitcoin’s recent effort to drop below $95,000 encountered strong resistance, demonstrating the robustness of existing support levels. In Adler’s opinion, the market is now readying for a crucial test at the $100,000 threshold. This level could trigger additional bullish energy or suggest a brief period of consolidation.

As an analyst, I’m closely monitoring Bitcoin’s continuous bullish momentum. If it manages to surge beyond $100,000, it could spark broader market enthusiasm and rekindle interest in alternative cryptocurrencies, potentially defining the next wave of crypto market expansion. Conversely, should Bitcoin fail to breach this critical threshold, a corrective phase might follow, paving the way for a more balanced and long-term uptrend.

Bitcoin Price Action Remains Strong

Bitcoin’s price has shown robustly bullish behavior even after a slight dip from $99,800 to $95,800, which amounts to nearly 4% decrease. However, many investors view this decline as a temporary pause before a possible surge surpassing the significant $100,000 threshold.

In the course of this recent correction, I’ve noticed a remarkable display of resilience that has significantly boosted my own confidence, and that of other market participants. This downturn is being viewed by many as a necessary breather within an extended uptrend, signaling a positive outlook for the market’s continued growth.

Renowned CryptoQuant analyst Axel Adler weighed in on the recent market movements via X, sharing a technical analysis that reinforces Bitcoin’s robust bullish structure. Adler highlighted that pushing BTC to lower demand levels was unsuccessful, further solidifying current support zones.

Based on his analysis, the time seems ripe for Bitcoin to reach and assess the substantial $100,000 mark. As Bitcoin nears this notable milestone, there appears to be a split in investor opinion. Some traders consider the $100,000 price point as an opportune moment to cash out, referencing previous trends of market corrections after significant round-number achievements.

Still, some people are hopeful that Bitcoin’s power will persist, predicting it could soar past $100,000. The predicted peak of this rally varies from $105,000 to $120,000, suggesting a general confidence in Bitcoin’s future value. Regardless if Bitcoin strengthens or keeps rising, everyone is eagerly watching its next steps.

Bullish Weekly Close Could Send BTC Higher

Bitcoin has set a new record for its highest weekly closing price ever, reaching an impressive $98,000. This significant milestone serves as both a technical accomplishment and a morale booster for market participants. It suggests a robust bullish trend that might push Bitcoin beyond the highly sought-after $100,000 threshold in the near future.

Maintaining the current price around $98,000 or higher than $95,000 in the upcoming days is crucial because it represents a strong support area. If Bitcoin manages to hold this level, it could potentially surge towards $100,000 with considerable force. This upward movement would reinforce Bitcoin’s overall upward trend and draw more attention from both individual and institutional investors.

On the other hand, it’s still possible that Bitcoin could continue to consolidate below $100,000. This might require Bitcoin to move sideways for a few weeks to build the necessary strength for its next significant rise. While this period may be disheartening for short-term traders, the consolidation phase would lay a solid base for long-term, sustainable growth.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-11-25 18:40