As a seasoned analyst with over two decades of experience in traditional and digital markets, I find myself consistently impressed by Ethereum’s resilience and meteoric growth this November. Having witnessed firsthand the dot-com boom and bust, as well as the 2008 financial crisis, I can attest that the current surge in ETH price action bears striking resemblances to those historic bull runs.

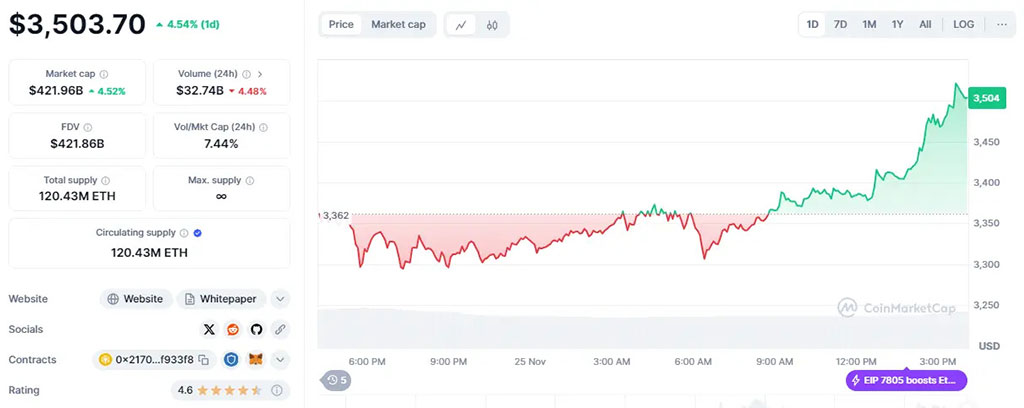

Ethereum, represented by ETH, currently stands at $3,460, drawing considerable interest in crypto markets this November. In the past 24 hours, it has shown a volatility of 3.6%. Its market capitalization towers at an impressive $417.03 billion, with a massive 24-hour volume of $33.74 billion. Notably, Ethereum surged by 40% this month, breaching the $3,500 mark for the first time since July, even as Bitcoin (BTC) set numerous all-time highs during the same period. Ethereum’s steadfastness and increasing investor appeal are noteworthy amidst this market dynamics.

Over just seven days, Ethereum experienced an impressive surge of 12.60%, causing its value to soar from $3,031 to a high of $3,515. At the same time, Ethereum staking saw an all-time high increase in activity. According to crypto analyst Maartunn, weekly net flows for ETH staking reached unprecedented heights, indicating a substantial change within the market. Previously, withdrawals from ETH staking had been more frequent than deposits, but this new trend is drawing attention as it highlights a significant shift in the market dynamics.

📈 Weekly Ethereum Staking Inflows Reach +10k ETH: After prolonged periods of outflows, there’s been a change – more ETH has been deposited than withdrawn for staking. Over the past week, 115k ETH were deposited compared to 105k ETH that were taken out.

— Maartunn (@JA_Maartun) November 24, 2024

Ethereum Staking Records 10K ETH Net Inflow

Based on IntoTheBlock’s analysis, there has been a significant reversal in Ethereum staking, as there has been a weekly inflow of approximately 10,000 ETH after a period of outflows. New data shows that 115,000 ETH was deposited compared to 105,000 ETH being withdrawn. This trend indicates a decrease in supply, which could potentially slow inflation and boost prices. When supply decreases while demand continues to rise, it can often trigger price surges, making Ethereum more valuable in the market.

The increase in prices and advancements in the staking platform have significantly contributed to the recent revival. These upgraded staking systems encourage investors to hold onto their ETH, thereby reducing the available supply in circulation. The growing scarcity of ETH, as indicated by a higher stock-to-flow ratio, is an important factor that usually boosts asset value. This scarcity becomes more pronounced when demand remains strong, which often leads to increased prices.

Furthermore, it’s noticeable that significant Ethereum (ETH) holders are increasing their positions, indicated by a rise in monthly staking inflows. This action suggests growing faith among large investors, boosting demand and potentially reducing supply availability. Their accumulation of ETH contributes to market upward momentum, reinforcing the trend of escalating prices.

The combination of rising bets placed on Ethereum and its growing worth has significantly boosted its market success. Right now, ETH is trading slightly above $3,500, which represents a 4.50% increase in the past day. If this buying power continues to prevail, it could push prices beyond the current resistance level of $3,560, potentially paving the path for even more growth.

Analyst Predicts Ethereum to Hit $5,300 – $15,300

As an analyst, I personally concur with Alan Santana’s prediction of a long-term upward trend for Ethereum. In his analogy, he likens Ether to a pervasive, weightless element, highlighting its inherent value and widespread presence. Upon examining Ethereum’s performance on the weekly chart, Santana underscores consistent growth, suggesting a promising perspective for the crypto market overall.

Santana proposed, “Should we debate over $11,300 or $15,300? Here’s another perspective I took into account. You can pick between $7,300, $11,300, or $15,300. But guess what? A $5,300 choice would be manageable, offering a 60% boost and reaching a new record high from the current price,” said Santana.

Read More

- ZK PREDICTION. ZK cryptocurrency

- ARB PREDICTION. ARB cryptocurrency

- XRD PREDICTION. XRD cryptocurrency

- XDC PREDICTION. XDC cryptocurrency

- W PREDICTION. W cryptocurrency

- Who Is Kelly Reilly’s Husband? Kyle Baugher’s Job & Relationship History

- Black Ops 6 needs to add this key feature to curb-stomp cheating

- Here’s Why Adin Ross Deleted His 100K Member Community on X

- FLOKI PREDICTION. FLOKI cryptocurrency

- IMX PREDICTION. IMX cryptocurrency

2024-11-25 16:33