As a seasoned researcher with over a decade of experience in the ever-evolving world of cryptocurrencies, I find the 8-year cycle theory of Ethereum intriguing. Having witnessed numerous bull runs and bear markets, I can’t help but marvel at the cyclical nature of these digital assets.

Based on recent studies, it appears that Ethereum‘s price could be following an 8-year pattern instead of the traditional 4-year trend seen in Bitcoin. This might account for Ethereum’s relatively poor performance compared to Bitcoin this year. Considering this, technical analysis indicates that Ethereum’s price may have a significant room for growth within its current cycle, particularly if Bitcoin experiences a substantial correction.

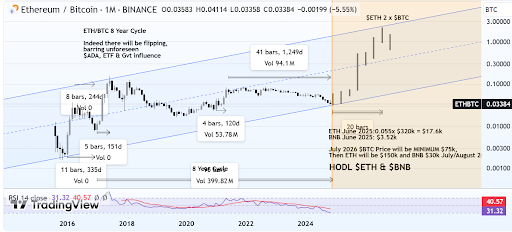

Understanding ETH/BTC’s 8-Year Cycle

As a researcher, I’ve delved into the technical analysis of the Ethereum-Bitcoin (ETH/BTC) chart, and an intriguing pattern between these two cryptocurrency giants has caught my eye. Specifically, the chart indicates that Ethereum’s price has predominantly underperformed Bitcoin’s price over the past few years. This trend has become more pronounced since July of this year.

In contrast to Bitcoin’s price, which adheres to a recognized 4-year cycle tied to its halving events, Ethereum’s price trend appears to be unique, possibly following an 8-year cycle based on historical data. This disparity is often noticeable during bull runs and bear markets, where Ethereum and its related ecosystem tend to trail behind Bitcoin. Remarkably, this discrepancy has been particularly evident in the ongoing bull market, as Bitcoin has surpassed several new peak prices while Ethereum remains below $4,000.

In essence, every 8 years for Ethereum, it seems to exhibit a pattern that may offset Bitcoin’s price fluctuations as they peak within their respective cycles. This phenomenon supports the idea of an “altcoin season,” where investors tend to sell off their Bitcoins and instead invest in the altcoin market.

Based on an analysis conducted on the TradingView platform, it appears that the 4-year pattern of Bitcoin’s price could lead to a significant drop by 2026, as predicted by its Power Law trend. However, this potential decrease in Bitcoin’s value may be offset by a concurrent increase in Ethereum’s price, which could take it to its peak in the 8-year cycle by 2026.

Projected Peak For Ethereum Price In Mid-2026

According to an 8-year cycle theory, it’s predicted that Ethereum’s price will reach its maximum around mid-2026. This peak coincides with the low point of Bitcoin’s 4-year cycle, creating a sort of balance between the two major cryptocurrencies. During this timeframe, Ethereum’s value is expected to soar to record highs because Bitcoin will be entering a phase of price correction. Moreover, BNB could serve as a stabilizing force alongside Ethereum as Bitcoin’s price decreases.

The forecast indicates that the Ethereum price might escalate to approximately $17,600 by June 2025, and Binance Coin (BNB) could increase to around $3,520 at the same time. By July or August 2026, Ethereum’s potential value is estimated to soar to an impressive $150,000, while BNB might reach as high as $30,000.

Currently, Ethereum is being exchanged for approximately $3,385, Binance Coin (BNB) is valued around $660, while Bitcoin stands at a price of about $98,150.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-11-25 15:40