As a seasoned researcher with over a decade of experience in the crypto market, I have seen my fair share of bull runs and bear markets. The recent surge in Solana (SOL) price is no exception. After breaking the resistance at $245 and $250, SOL reached new highs, even surpassing Bitcoin and Ethereum.

Solana recently surged past the $240 area, indicating a new growth spurt. The value of SOL is currently holding its ground, potentially targeting a jump that exceeds the $255 barrier as resistance.

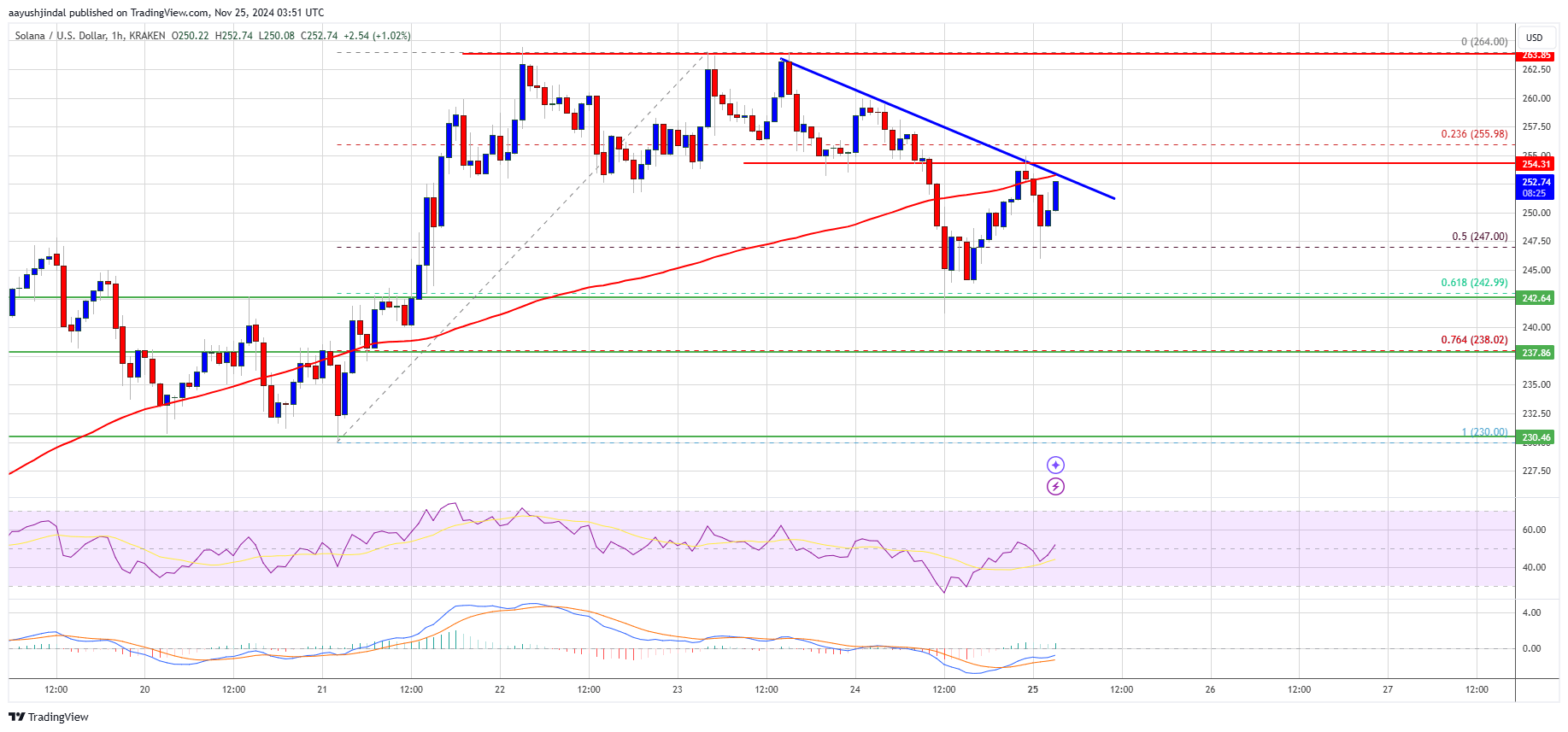

- SOL price started a fresh increase after it settled above the $220 level against the US Dollar.

- The price is now trading below $255 and the 100-hourly simple moving average.

- There is a short-term bearish trend line forming with resistance at $252 on the hourly chart of the SOL/USD pair (data source from Kraken).

- The pair could start a fresh increase if the bulls clear the $255 zone.

Solana Price Eyes More Upsides

The cost of Solana established a firm foundation, triggering a new growth spurt that surpassed the $232 mark, outperforming both Bitcoin and Ethereum. A robust ascent followed, breaking through the resistance at $245 and $250 levels.

The price even cleared the $260 level. A high was formed at $2648 and the price is now consolidating gains. There was a move below the $260 and $255 levels. The price dipped below the 50% Fib retracement level of the upward move from the $230 swing low to the $264 high.

In a different wording, bulls are showing signs of activity close to the $242 support and the 61.8% Fibonacci retracement level resulting from the upward trend that began at $230 low and peaked at $264 high. On the other hand, Solana is currently trading below the $255 mark and the 100-hour moving average.

Positively, the cost seems to be encountering resistance close to the $252 mark. Additionally, there appears to be an emerging short-term downtrend line on the hourly Solana (SOL/USD) chart, with a resistance at $252 as well.

As a researcher, I’ve noticed that the upcoming significant resistance points are near the $255 and $265 levels, with a potential secondary resistance at $275. A successful close above the $265 resistance could pave the way for a steady upward trend, potentially pushing the price towards the $282 level.

Are Dips Limited in SOL?

If SOL doesn’t manage to surpass the $255 barrier, it may initiate a period of decline. The lowest point this decline might find initial support could be around $246. A more substantial support level can be found at approximately $242.

Dropping beneath the $242 mark could potentially push the price down to around $238. If we see a closing price below this new support at $238, it might signal a short-term fall towards the $230 support level.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is gaining pace in the bullish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is above the 50 level.

Major Support Levels – $246 and $242.

Major Resistance Levels – $255 and $260.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-11-25 08:10