As a seasoned crypto investor with over a decade of experience in this wild and volatile market, I’ve seen my fair share of bull runs and bear markets. The recent influx of capital into Ethereum ETFs on Friday, November 22, has certainly piqued my interest. After six consecutive days of net outflows, this sudden surge of optimism is a breath of fresh air.

Interest in Ethereum ETFs seemed to decrease over the past six days as there were no daily increases in investment. Yet, the week concluded positively, with a significant surge of funds flowing into these cryptocurrency products on Friday, November 22.

Fresh investment pouring in signifies a change in investor attitude, an alteration that, as of late, hasn’t leaned particularly towards optimism. However, the market is eagerly anticipating that this newfound energy might continue and even spark some upward trend for the value of Ethereum (ETH).

Can Ethereum ETFs Ensure ETH’s Price Recovery?

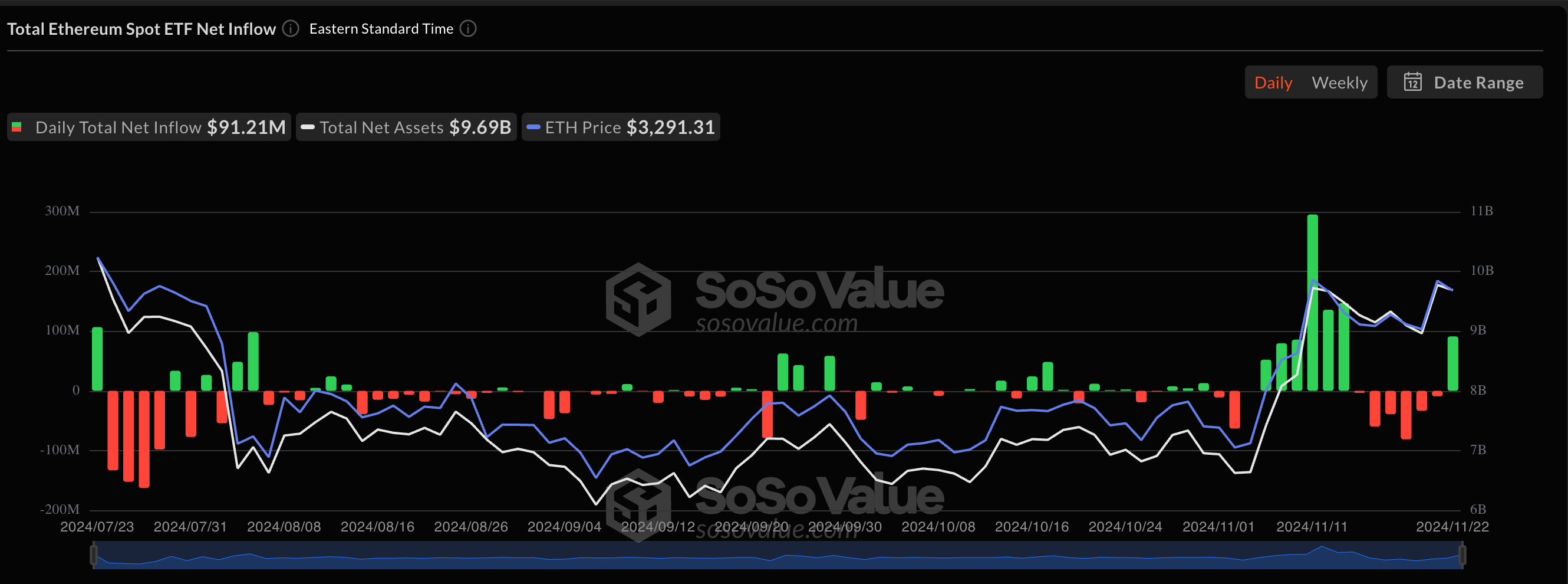

Based on SoSoValue’s most recent data, U.S.-based Ethereum ETFs experienced a significant increase in investments totaling $91.21 million last Friday. This single day growth marks the first instance of net inflow for these exchange-traded funds since November 13.

Data from market sources indicates that a substantial amount of investments were directed towards the BlackRock iShares Ethereum Trust, as evidenced by its ticker symbol ETHA. This cryptocurrency investment product recorded approximately $99.7 million in daily inflows to conclude the preceding week.

On Friday, only Fidelity’s Ethereum Fund (FETH) and Bitwise’s Ether ETF (ETHW) reported an increase in funds, with inflows of approximately $5.76 million and $4.96 million each. Conversely, Grayscale’s ETHE and ETH experienced outflows totaling over $18.5 million and $621,000, respectively.

Previously noted, the Ethereum ETFs saw a resurgence of funds coming in last Friday, marking a reversal from six straight days of outflows. During those six days, a significant amount of $225.6 million was withdrawn from these crypto products.

During the same timeframe when Ethereum ETFs were being withdrawn, the cost of ETH appeared to stabilize but eventually decelerated as well. This pattern underscores the substantial impact that exchange-traded funds can have on price movement, not only for Bitcoin, the world’s leading cryptocurrency, but also for Ethereum.

As the prospects of U.S.-listed Ethereum Exchange-Traded Funds (ETFs) appear to be improving, so too has the value of ETH climbed over the past few days. Investors are optimistic that this favorable trend for the Ethereum ETFs will persist and ultimately boost the price of this particular altcoin.

Ethereum Price At A Glance

Currently, the cost of Ethereum (ETH) is approximately $3,423, representing a 2.1% rise over the last 24 hours. On a weekly basis, ETH has surged by more than 9%, as indicated by statistics from CoinGecko.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-11-24 17:46