As a seasoned analyst with over two decades of experience in financial markets under my belt, I have witnessed numerous market cycles and trends that have come and gone. The recent surge in Bitcoin (BTC) prices and the potential for an altcoin season is not lost on me.

At this moment, Bitcoin (BTC) is following its historic price path and is being traded around $90,000. But a trading firm predicts that if Bitcoin’s dominance (BTC.D) drops below a significant level, it might indicate the beginning of the much-awaited period where alternative cryptocurrencies, or altcoins, could take the spotlight.

Interest Rate Cuts, Trump Administration To Propel Crypto

In a recent Telegram broadcast, Singapore-based trading firm QCP Capital shared its crypto market analysis. The firm highlighted Solana’s (SOL) recent performance, noting that it outpaced Bitcoin and Ethereum (ETH) over the weekend, surging more than 17% from Friday’s lows.

Although this is the case, QCP Capital has acknowledged that numerous investors are still cautious about the possibility of an approaching altcoin season due to Bitcoin’s consistent ascent towards the psychologically significant $100,000 level. Rekt Capital’s analysis aligns with this perspective, indicating that Bitcoin might be merely starting its parabolic growth phase.

Despite their prediction, QCP Capital anticipates that both Donald Trump’s win in the U.S. presidency and interest rate reductions by the Federal Reserve (Fed) might foster conditions conducive to an explosive growth period for altcoins over the next few months.

Trading Firm Identifies Key Bitcoin Dominance Threshold For Altseason

As per QCP Capital’s analysis, altcoins tend to exceed the performance of main cryptocurrencies following periods of consolidation that occur after substantial price increases in these main cryptos. In simpler terms, when the major cryptocurrencies settle down after a significant rally, altcoins are more likely to show better returns, according to QCP Capital.

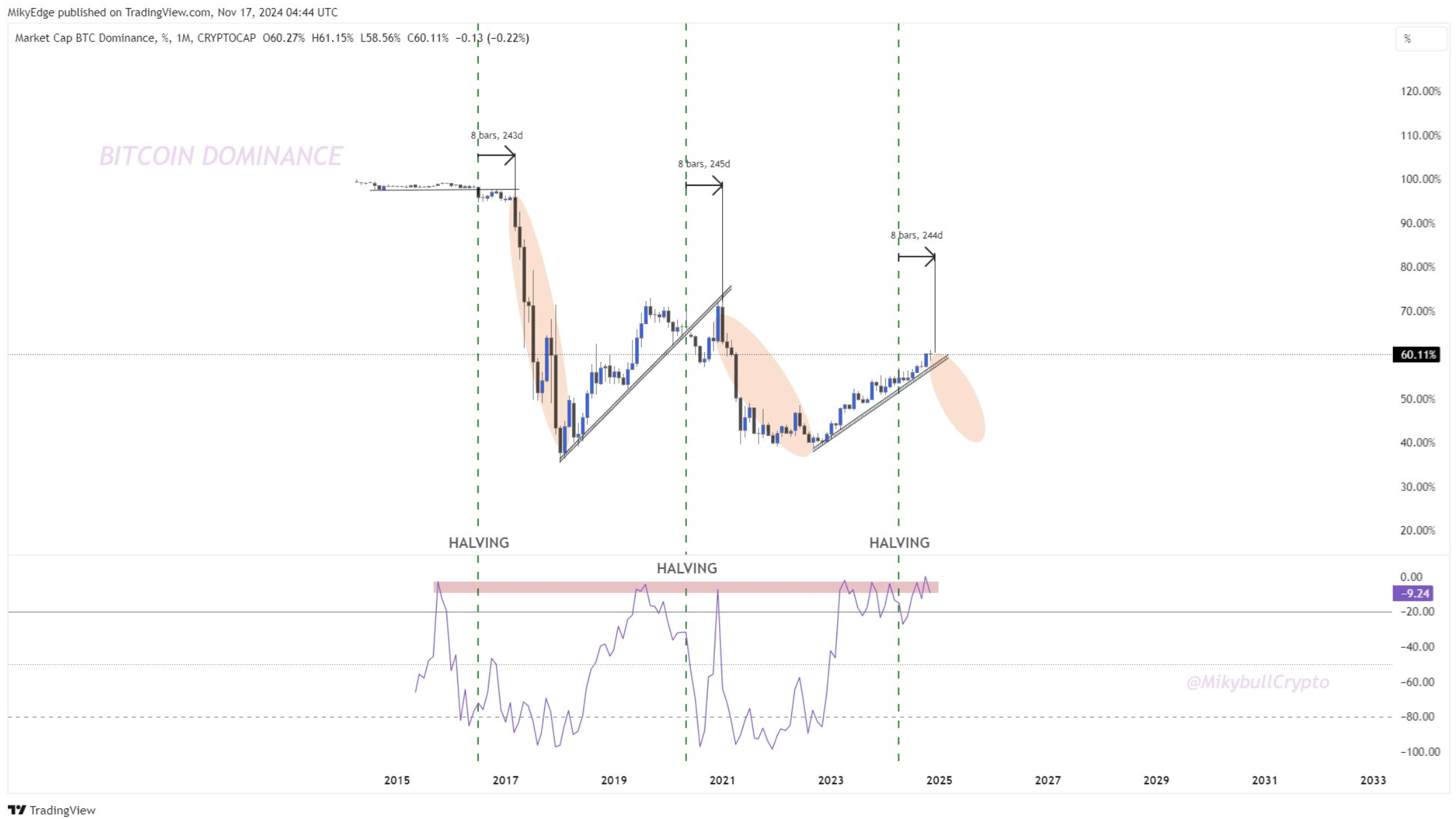

Historically, altcoins have tended to outperform when the major cryptocurrencies (like Bitcoin) stabilize following a strong rally, as profits often shift towards smaller-cap coins. For an altcoin season to begin, Bitcoin’s dominance should ideally drop below about 58%.

At present, BTC.D is at 60.10%. A glance at the weekly chart reveals that the dominance of Bitcoin has been gradually increasing since November 2022, where it was at 39.92%. Over the past two years, many altcoins have struggled to keep pace with Bitcoin’s performance.

In contrast, there’s been a resurgence in altcoins lately, mirroring the increased probability of a crypto-friendly Trump administration. Notably, coins such as Solana (SOL), Cardano (ADA), and Ripple (XRP) have surpassed Bitcoin in terms of performance over the last few weeks.

According to both QCP Capital’s assessment and cryptocurrency analyst MikybullCrypto’s prediction, a downtrend for BTC.D might start as early as December. As per MikybullCrypto, there could be an altseason, starting from late November, that may last until March 2025.

According to some financial experts, Bitcoin could potentially keep rising and might hit $100,000 by the end of this year, as suggested by Tom Lee, the chief analyst at Fundstrat.

It appears that the overall value of altcoins has just broken through an important barrier, suggesting that the much-anticipated “altcoin season” could be arriving sooner than predicted. Currently, Bitcoin is being traded at $91,760 and its price remains unchanged compared to the last 24 hours.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-11-20 02:10