As a seasoned crypto investor with over a decade of experience navigating the volatile waters of digital assets, I must admit that the recent resilience shown by Bitcoin (BTC) is nothing short of remarkable. Having witnessed several market cycles, I’ve grown accustomed to the rollercoaster ride that comes with investing in this space. However, the current momentum and robust demand supporting BTC at these levels are truly a sight for sore eyes.

Over the last few days, Bitcoin (BTC) has maintained a position above $88,000, demonstrating strength amidst the uncertainty in the broader market about its next step. The current price trend remains strong, causing some investors to feel frustrated because they are hoping for lower prices and an opportunity to buy in, but Bitcoin seems unwilling to offer such an easy entry point at this time.

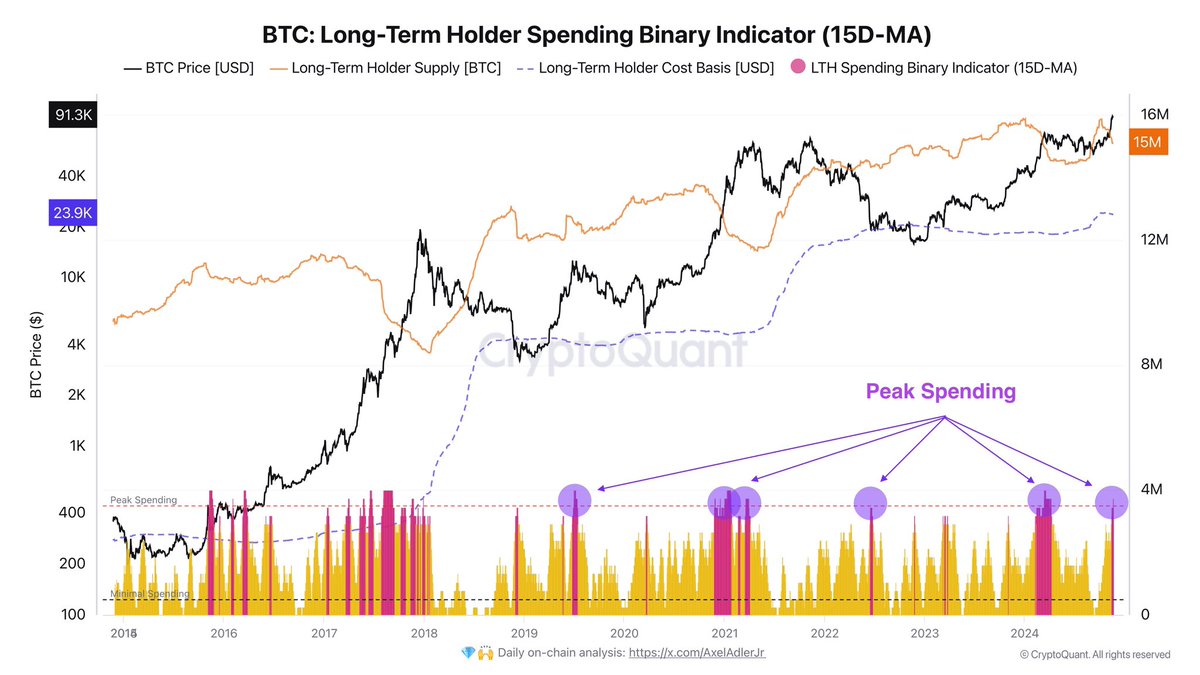

Information from CryptoQuant suggests that long-term investors (LTIs) are presently transferring their Bitcoin holdings more frequently, indicating higher selling rates among them. Interestingly, despite this increased supply, the market has managed to absorb it without causing a substantial drop in price, suggesting robust demand for BTC at current prices.

Right now, Bitcoin is holding steady just beneath its record highs, and people are keeping a close eye to see if it will surge ahead (breakout) or dip down first (retracement). The interaction between increasing interest (demand) and long-term holder distribution could influence Bitcoin’s short-term direction.

Can Bitcoin Set New ATH This Week?

This week, Bitcoin is nearly reaching another all-time high (ATH), currently only 2% below the record $93,483 set on Wednesday. As analysts and investors monitor Bitcoin’s movements closely, there is growing anticipation as to whether it will break through this significant level or enter a period of sustained consolidation instead.

As long as the upward trend continues to be robust, there might be a prolonged phase where the price moves back and forth within a specific range, delaying the next major shift.

According to CryptoQuant analyst Axel Adler’s findings, long-term holders are presently transferring their Bitcoin holdings for distribution. Interestingly, this increased supply hasn’t significantly affected Bitcoin’s price due to a persistent demand that counteracts the selling pressure. This situation underscores the strong market interest that keeps Bitcoin close to its all-time highs.

Adler’s examination additionally highlights the Long-Term Holder (LTH) Spending Binary Marker, indicating intense spending among long-term holders. Concurrently, the increasing number of LTHs implies that some long-term investors are optimistic about Bitcoin’s future value. This combination sets a distinctive scene where robust demand counteracts supply, preserving the bullish trend’s energy.

From my perspective as an analyst, as Bitcoin inches close to its All-Time High (ATH), market players are on tenterhooks, waiting for a clear signal if the price will surge into unexplored territory or halt for consolidation. The decision will significantly influence Bitcoin’s direction in the forthcoming weeks, with investors placing their wagers on the persistence of this robust rally’s upward momentum.

BTC Price Action: Key Levels To Hold

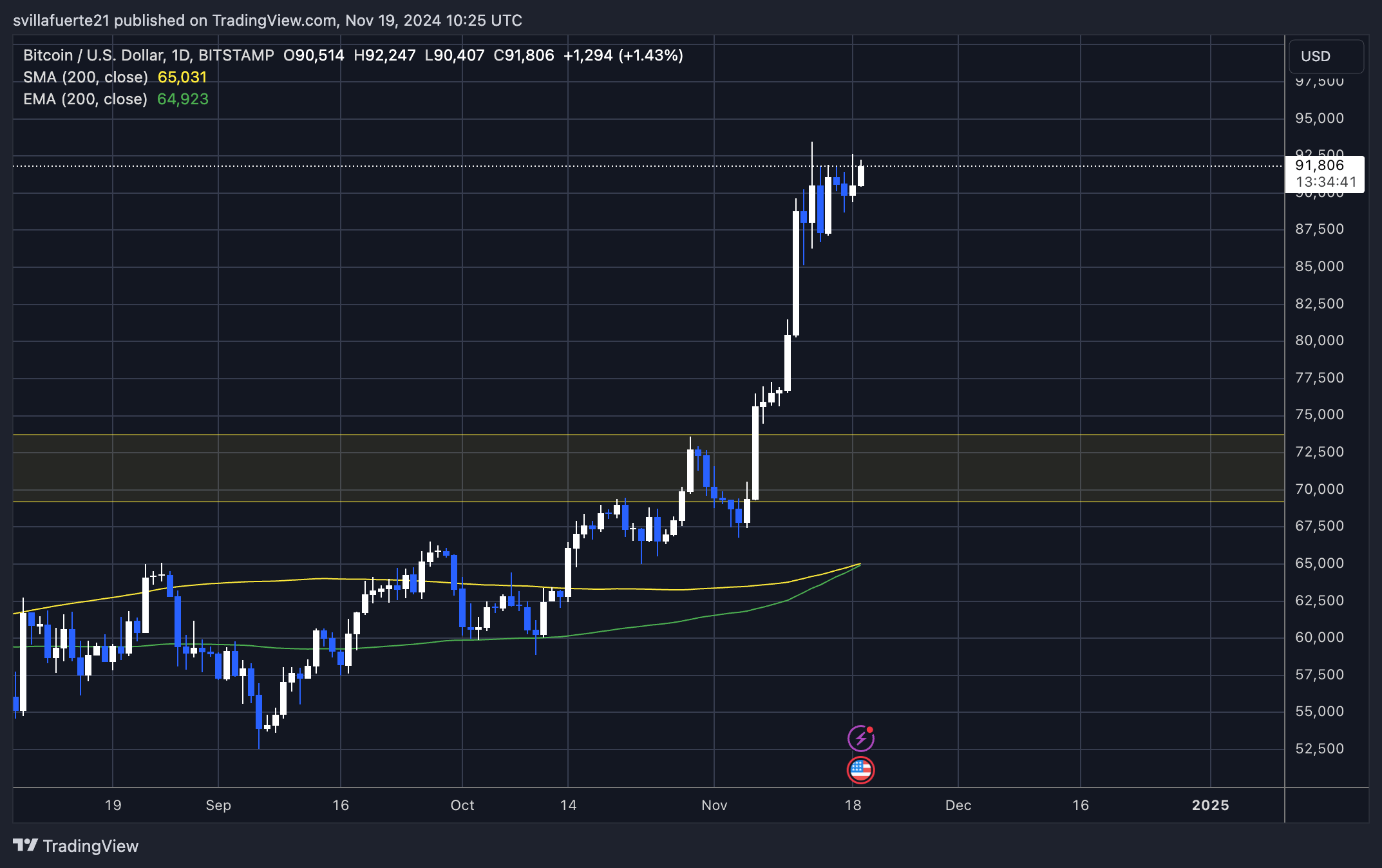

Currently, Bitcoin is being traded at approximately $91,820, after several days of holding steady slightly below its record high (peak). Although there’s been a brief halt, BTC has managed to stay above the critical support level of $87,000 since the last surge, which suggests that this level is crucial for bulls to safeguard. Maintaining this level is essential for preserving upward momentum and paving the way for Bitcoin to venture into unexplored regions.

If Bitcoin falls slightly below $87,000, it might change the market’s mood, possibly leading to a correction as Bitcoin looks for new demand. The next likely support level is approximately $80,000, and if selling pressure increases significantly, there could be a deeper pullback. Such a dip would offer a chance for investors on the sidelines, but it might temporarily halt Bitcoin’s upward trend.

Bitcoin’s price momentum stays firm, fueled by a persistent demand surpassing its supply. This high market interest has effectively counteracted the influence of cashing out and selling, maintaining the overall upward trend.

Watching closely as Bitcoin stabilizes close to its all-time high, traders are focusing on critical points to predict if the trend will head towards fresh peaks or a drop to retest lower resistance areas. The direction Bitcoin takes in the near future is expected to be significantly influenced by this development.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-11-19 23:10