As a seasoned researcher with over a decade of experience in the cryptocurrency market, I have witnessed the ebb and flow of digital assets like no other. The current performance of Ethereum (ETH) is an intriguing puzzle that has caught my attention.

In the year 2024, Bitcoin (BTC) and numerous other altcoins have delivered near triple-digit percentage returns. However, Ethereum (ETH), despite being the world’s largest altcoin, has lagged behind with only a 36% increase this year. Compared to its counterparts in the altcoin market, Ethereum has underperformed significantly.

2024 saw Bitcoin and many other cryptocurrencies reach unprecedented new peak values. However, Ethereum’s price is currently 40% below its previous all-time high of $4,841 from 2021. This suggests that investor enthusiasm for Ethereum has significantly trailed behind, even with the introduction of a spot Ethereum ETF this year.

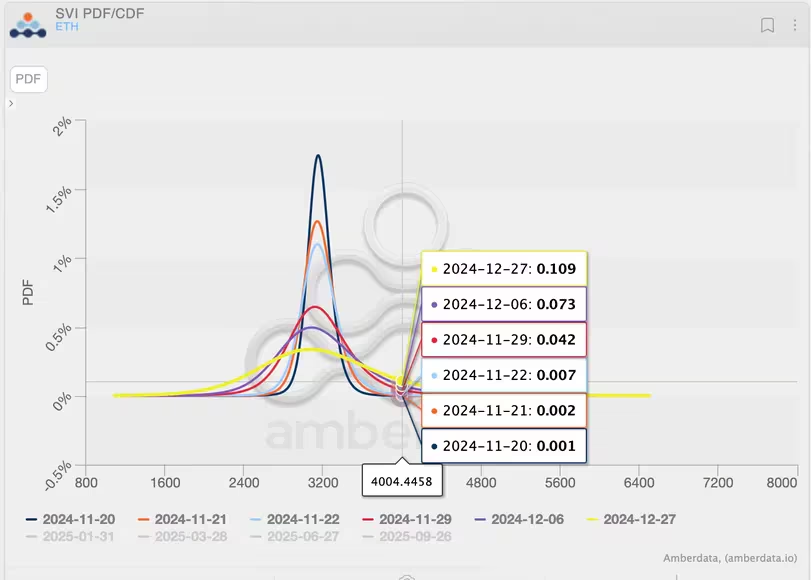

Based on recent findings from Amberdata, it appears that Ethereum’s underperformance may persist until the end of this year. Additionally, there is a slim 10% likelihood that Ethereum will surpass the $4,000 mark by year-end, according to the Ethereum options-based probability density function. In contrast, traders are leaning towards the prediction that Bitcoin’s price could reach $100,000.

Courtesy: Amberdata

The chart illustrates the Probability Density Function (PDF) and Cumulative Distribution Function (CDF), showcasing the likelihood of Ether trading at different price levels over various timeframes. The data is sourced from Ether options trading activity on Deribit, the leading cryptocurrency options exchange.

Why Ethereum Price Is Not Going to $4,000?

Currently, it seems that only a 10% likelihood is being factored into the price by traders for Ether to exceed $4,000 before December 27. This suggests that the expected regulatory shift during Trump’s presidency has not yet significantly increased investor confidence in ETH, although it has positively affected DeFi-focused tokens.

As an analyst, I too believe that Ethereum’s bleak forecast is partly due to its less robust foundational elements. In our recent client communication, Amberdata’s Director of Derivatives, Greg Magadini, echoed this sentiment.

As a researcher, I am observing a significant challenge for Ethereum (ETH), as the perceived value proposition of “sound money” – traditionally defined by its deflationary supply due to transaction fee burn – has seemingly reversed to inflationary supply. This is largely due to the majority of decentralized finance (DeFi) transactions now being executed on Layer 2 (L2) solutions instead of Ethereum’s mainnet (L1). I am convinced that this shift is contributing significantly to the downward trend in ETH prices.

Moving forward, I’ve observed a significant slowdown in the influx of funds into spot Ethereum ETFs, a trend that began a week after the presidential election of Donald Trump. Over the past three days, these flows have even reversed direction, resulting in negative net flows once more.

$ETH: road to $13k

This could be a transformative cycle for #Ethereum.

$10k-$13k is conservative.

— venturefounder (@venturefounder) November 19, 2024

However, despite this, some market analysts continue to be bullish about Ethereum. Interestingly, they don’t just expect a new all-time high but rather the ETH price giving 3x returns from here onwards.

Read More

- Is Average Joe Canceled or Renewed for Season 2?

- Mindhunter Season 3 Gets Exciting Update, Could Return Differently Than Expected

- How to get all Archon Shards – Warframe

- A Supernatural Serial Killer Returns in Strange Harvest Trailer

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Rashmika Mandanna’s heart is filled with joy after Nagarjuna praises her performance in Kuberaa: ‘This is everything…’

- MobLand Season 2: Tom Hardy Show Gets Big Update, Paramount Gives Statement

- Tyler Perry Sued for $260 Million Over Sexual Assault Allegations by The Oval Actor

- ‘Tom Cruise Coconut Cake’ Trends as Fans Resurface His $130 Tradition

- Fitness Boxing 3: Your Personal Trainer review: No punch back

2024-11-19 14:38