Bitcoin (BTC) has seen significant growth recently, reaching new peak prices since Donald Trump won the 2024 U.S. presidential election. Despite a minor dip over the last day, a return to its previous price could potentially cause issues for those betting on a drop in value.

Bitcoin Bears Could Be Under Trouble

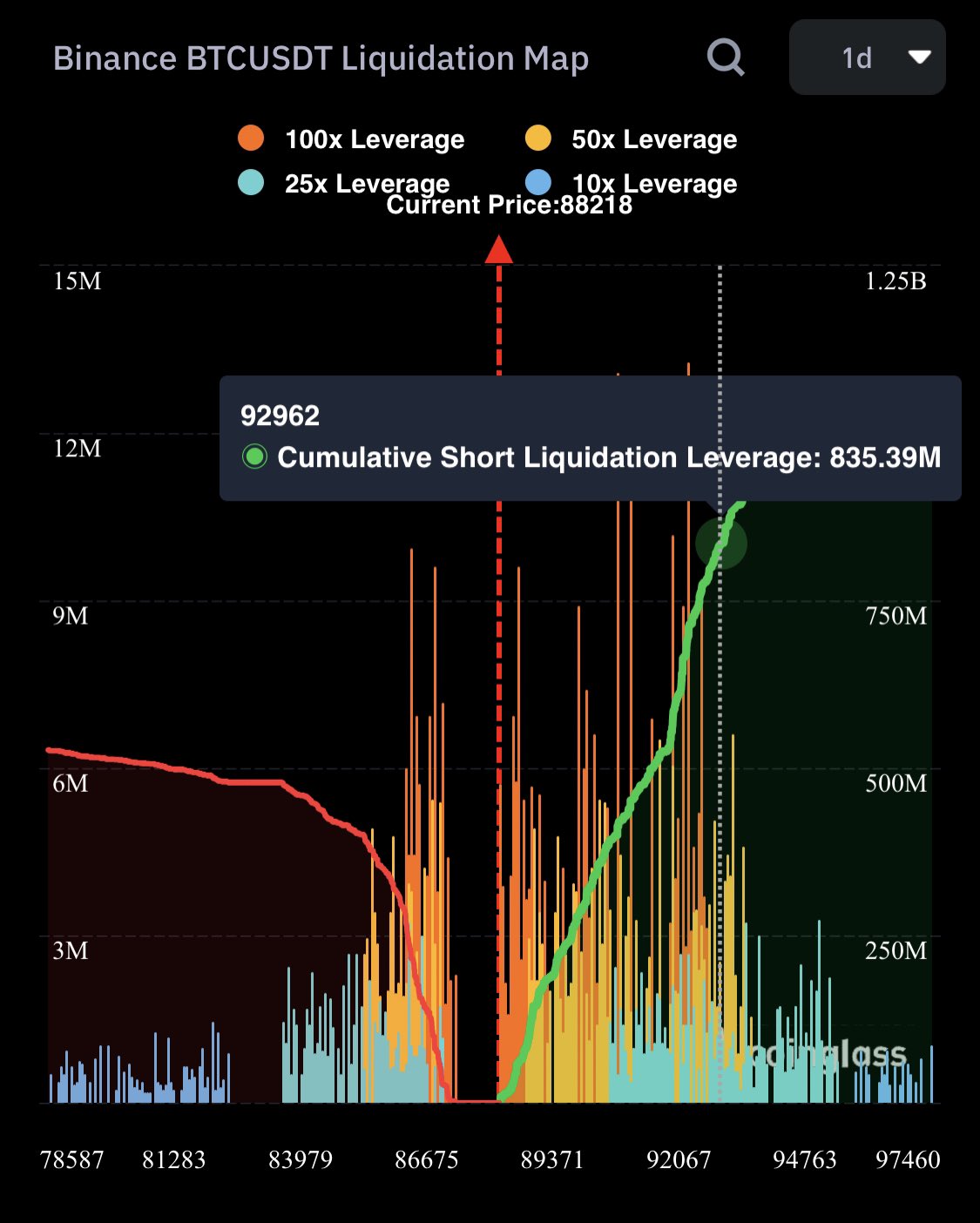

Based on insights by crypto expert Ali Martinez regarding X, approximately $800 million could potentially be liquidated if Bitcoin regains a value of $93,000 or more. It’s worth mentioning that Bitcoin’s all-time high (ATH) currently stands at $93,477.

Currently as I type, Bitcoin (BTC) is being traded at approximately $89,480, showing a decrease of 1.9% over the past 24 hours. On a 4-hour chart, it seems that the next significant support level for BTC could be found around $86,000.

Previously, the digital asset has touched this price level on three occasions, and if it drops again, Bitcoin could potentially slide down to approximately $81,600 – its next significant support. If Bitcoin cannot maintain a position above $81,600, a fall towards $79,700 might occur as a consequence.

If Bitcoin’s price drops, it might benefit the bearish traders. However, if Bitcoin recovers and reclaims the $93,000 level, it could cause significant problems for them. Such a recovery could trigger over $800 million in liquidations, possibly forcing these bearish traders to give up their positions.

According to data from Coinglass, over $508 million in contracts have been closed (liquidated) within the last 24 hours. Out of that total, approximately $355 million were long positions, while around $153 million were short positions.

Based on a recent assessment by well-known crypto expert CryptoKaleo, Martinez’s bearish predictions might indeed hold weight. As per CryptoKaleo, Bitcoin (BTC) could experience a dip to around $86,000 before mounting another bull run aimed at surpassing its all-time highs, potentially even exceeding the $100,000 mark. To put it simply, the analyst is indicating that BTC might undergo a temporary downturn before resuming its upward trend towards new record highs.

In simpler terms, if we’re fortunate enough to achieve this, a slight drop followed by a more significant rise could potentially push altcoins over $100,000. I believe this could be the optimal situation for altcoins, especially when Bitcoin is accumulating around $90,000. Here, we’d focus on altcoins outperforming Bitcoin during this period.

What’s Behind BTC’s Run?

A variety of elements have influenced Bitcoin’s unprecedented price fluctuations over time, such as the recent halving event, the greenlight for Bitcoin ETFs, and a surge in institutional interest in the digital currency.

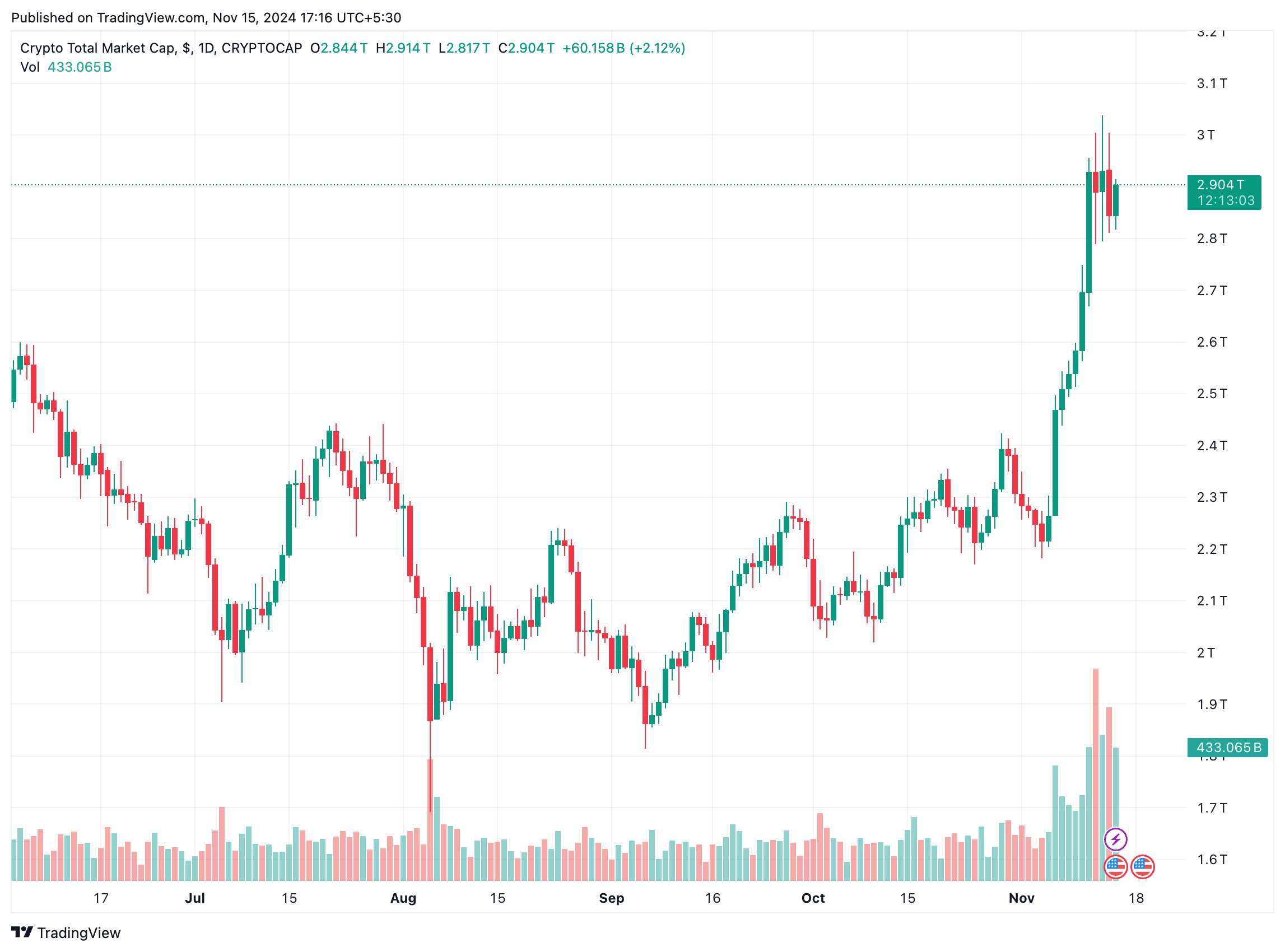

Trump’s election win in the 2024 US presidential race, viewed as pro-crypto, sparked a significant boost for Bitcoin. Since his victory on November 5, Bitcoin has risen from approximately $69,000 to a peak of $93,000, marking a gain of over 30% within a ten-day period.

Even though Bitcoin has experienced significant price surges recently, analysts believe there’s still potential for growth ahead. A recent study, for example, foresees Bitcoin’s bullish trend persisting until around mid-2025, with predictions of a peak at that time.

Furthermore, since profits have been moderately realized during this upward trend, Bitcoin (BTC) might soar even higher. Yet, investors need to stay vigilant as there’s a substantial CME gap around the $78,000 mark, which could potentially pull the price downwards, acting like a strong magnetic force for correction.

Currently, the overall value of all cryptocurrencies is approximately $2,904 billion. This represents a decrease of 3.7% compared to the past day’s figures. Notably, Bitcoin maintains a dominance of 60.97%, indicating its stronghold in the market.

Read More

- Ana build, powers, and items – Overwatch 2 Stadium

- The Last of Us Season 2 Episode 2 Release Date, Time, Where to Watch

- Who Is Christy Carlson Romano’s Husband? Brendan Rooney’s Job & Kids

- Why Is Ellie Angry With Joel in The Last of Us Season 2?

- Beauty in Black Part 2 Trailer Previews Return of Tyler Perry Netflix Show

- Paradise Season 2 Already Has a Release Date Update

- Who Is Kid Omni-Man in Invincible Season 3? Oliver Grayson’s Powers Explained

- The Hunger Games: Sunrise on the Reaping Cast Finds Young Haymitch & More

- Arjun Sarja’s younger daughter Anjana gets engaged to long-term boyfriend; drops dreamy PICS from ceremony at Lake Como

- Jr NTR and Prashanth Neel’s upcoming project tentatively titled NTRNEEL’s shoot set to begin on Feb 20? REPORT

2024-11-16 19:17