As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed bull runs, corrections, and everything in between. The current state of Bitcoin, as described by Ash Crypto, seems to be reminiscent of a familiar phase – the ‘thrill’ phase.

Cryptocurrency expert Ash Crypto has disclosed that Bitcoin has moved into the ‘exciting’ stage. The analyst went on to outline potential developments for the leading digital currency as it progresses through this phase of its upward trend.

What To Expect From Bitcoin In ‘Thrill’ Phase

In a recent post on X, Ash Crypto shared that Bitcoin is now moving into an exciting phase. This means investors should brace for increased market swings and potential liquidations. The analyst’s overall view is that the Bitcoin price trajectory will be upward as it consistently sets new record highs (ATHs). Ash predicts that Bitcoin could reach as high as $150,000 in the future.

The chart he provided illustrates that the excitement stage of the market trend occurs when investors and speculators might become overly enthusiastic about the rising market and choose to maximize their investments with leverage. However, as warned by Ash Crypto, this can lead to problems since there will be a high number of liquidations happening during this time.

Even though we’re in a rising market for Bitcoin, it has dropped after hitting record highs on occasion, which helps to eliminate excessively optimistic investors who have borrowed heavily (over-leveraged longs). Alex Thorn, Galaxy Research’s Head of Research, had previously warned that bull markets don’t always move steadily upward and that sharp price decreases are typical.

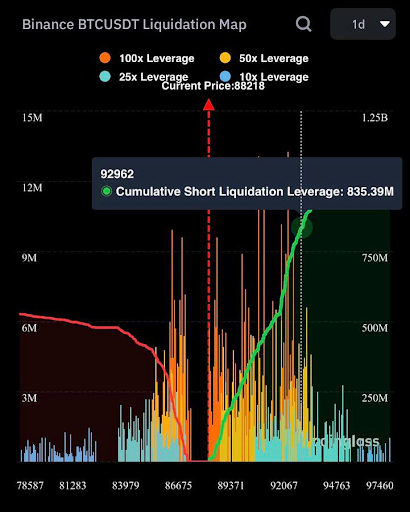

In the end, bears (those who predict a market decline) typically lose out during a bull market, which sees prices increasing. Crypto analyst Ali Martinez has estimated that approximately $800 million could be wiped out if Bitcoin surges towards $93,000 again, a level it reached two days ago while setting a new all-time high of $93,400.

As a crypto investor, I’ve noticed that the price of Bitcoin has dipped below $90,000 after a correction. This slide might be attributed to the unexpectedly high US Producer Price Index (PPI) inflation data. This surprising increase has stirred some uncertainty about whether the Federal Reserve (Fed) will still opt for another interest rate cut in December.

More Price Correction In The Short Term?

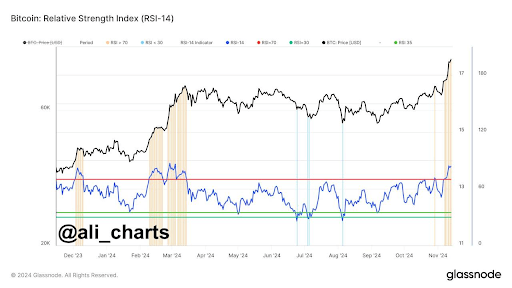

Ali Martinez proposed in a recent post that the value of Bitcoin might dip more in the immediate future. According to his analysis as a cryptocurrency expert, the daily Relative Strength Index (RSI) indicates that Bitcoin is currently overbought, suggesting there may be an upcoming price adjustment.

The decrease in Bitcoin’s price might be due to investors choosing to cash out their earnings. It was disclosed that approximately $5.2 billion in Bitcoin profits have been banked, causing the sell-side risk ratio to jump to 0.524%. Market participants are being advised to stay vigilant and tread carefully. Similarly, the Bhutan Government has joined the ranks of whale investors who are cashing out, having recently sold Bitcoin worth $33 million, following a previous sale of $66 million worth.

Currently as I type, the value of Bitcoin stands approximately at $87,780, marking a decrease of about 2% over the past day, based on information from CoinMarketCap.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Ford Recalls 2025: Which Models Are Affected by the Recall?

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-11-16 06:04