As a seasoned researcher with a penchant for deciphering market trends and a particular fondness for Bitcoin, I am thrilled to report that the retail interest in our beloved cryptocurrency has made an explosive return! The latest surge in price has brought us closer than ever before to the elusive $100,000 target.

The data collected from various on-chain signals indicates that retail investor interest in Bitcoin seems to be reviving after the recent surge in its price.

Bitcoin Retail Interest Has Returned In Explosive Fashion

Bitcoin has experienced a significant spike recently, approaching the anticipated $100,000 mark more closely than most predicted. After investor enthusiasm for the asset seemed to dwindle during Bitcoin’s prolonged period of consolidation, this recent surge has reignited interest once again.

In our ongoing conversation, we’re referring to the investor group under focus as retail, encompassing smaller-scale holders. A key indicator that suggests their reentry into the market is the number of New Addresses, which monitors the total count of newly created Bitcoin addresses appearing for the first time online.

According to a recent post by the market intelligence platform IntoTheBlock, there’s been a significant spike in the creation of new Bitcoin addresses, implying a high volume of new account openings.

The New Addresses can register an uptick when new investors join the network or when old ones who had sold earlier come back to the asset. The metric also goes up when existing users create multiple wallets for privacy.

In cases where a significant surge happens, as observed recently, it’s more plausible that this is due to increased adoption. Consequently, the current trend in the indicator might suggest a high rate of recent adoption for the cryptocurrency.

It’s clear from the graph presented that daily Bitcoin New Addresses have reached a peak of 442,000 – the highest since March of this year. This surge might be due to larger investors entering the network, although their numbers may not be substantial. However, it appears that retail investors are driving most of this recent adoption.

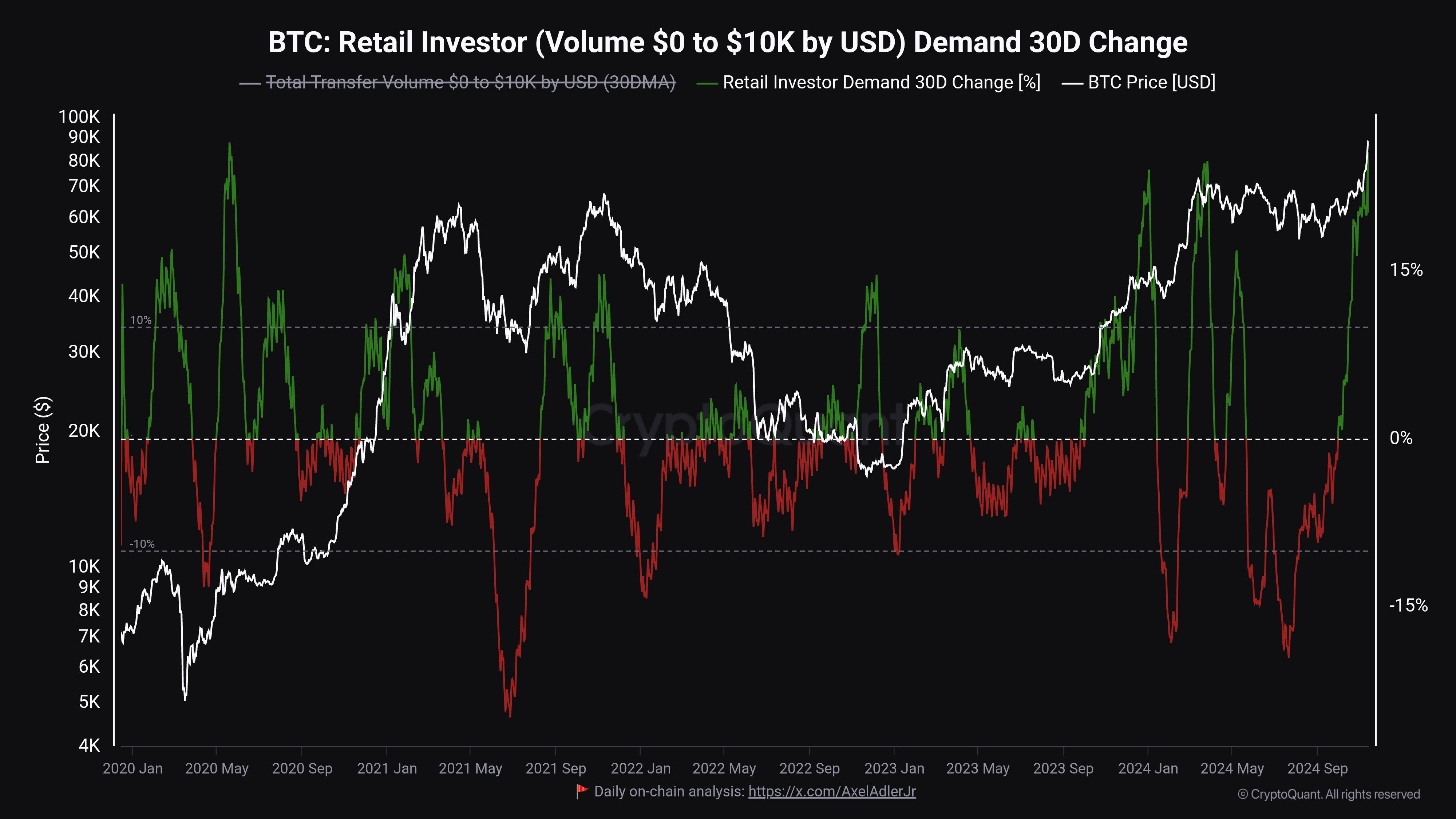

A different metric, the Retail Investor Demand 30-Day Change, offers insights into current activities by both established and novice retail investors. Notably, as per the analysis of CryptoQuant community analyst Maartunn in a recent post, this particular indicator has witnessed a significant surge recently.

This measure monitors retail investor activity based on the number of transactions. Since these investors usually don’t have large account balances, most of their transactions involve relatively small amounts. Therefore, we can gauge their transaction volume by considering data from transfers valued under $10,000 only.

As an analyst, I’ve noticed a significant surge in the 30-day volume of retail investments. This increase is quite substantial and hasn’t been observed at such high levels for over four years.

As a crypto investor, I can’t help but notice the resurgence of retail trading, evident in the skyrocketing value of Dogecoin, elevated funding rates, and an uptick in online searches for Bitcoin. It’s a clear sign that the market is heating up once more!

BTC Price

In the last 24 hours, Bitcoin experienced a slight dip, with its value currently hovering around $88,300.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Delta Force Redeem Codes (January 2025)

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

2024-11-15 15:04