As a seasoned researcher with over two decades of experience in the blockchain industry, I’ve witnessed the evolution of numerous projects, some thriving and others fading away. However, Solana’s trajectory stands out as one of the most intriguing and promising.

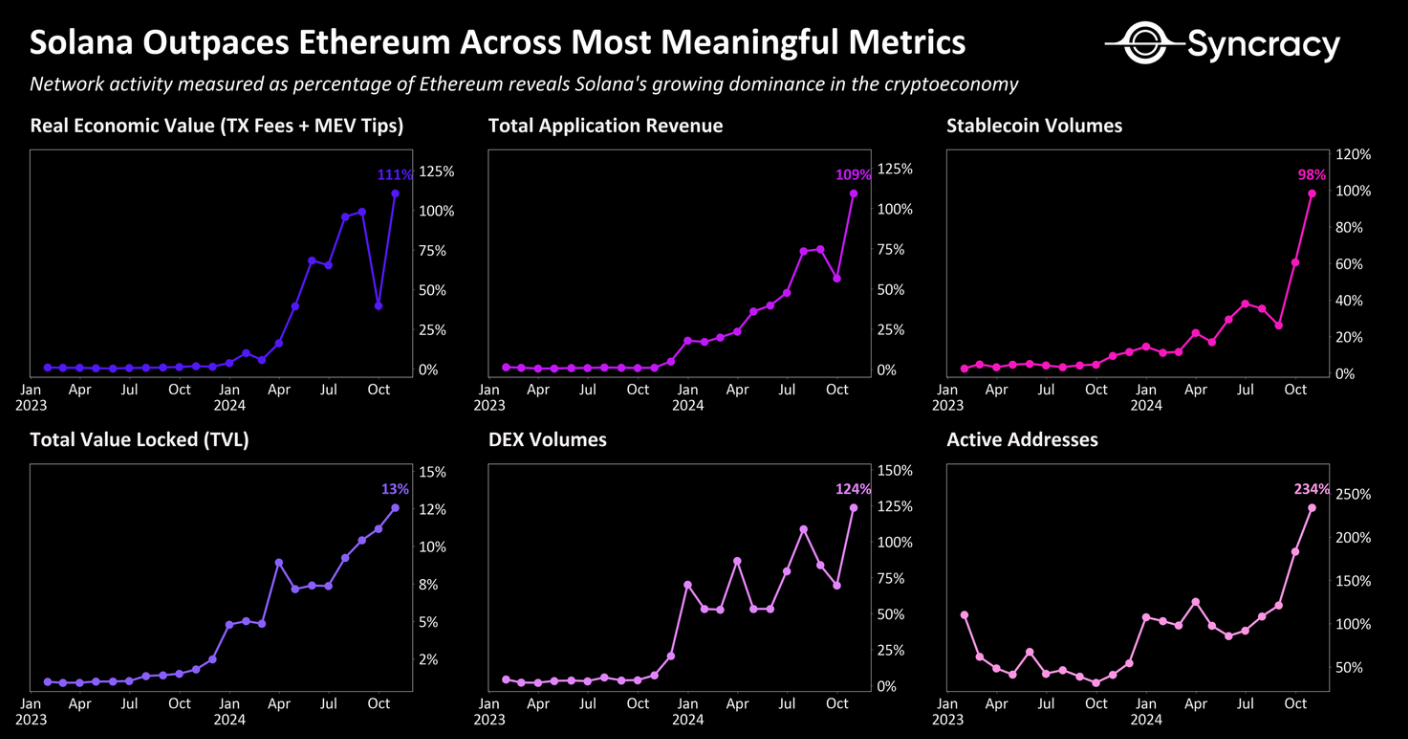

As a crypto investor, I’ve been closely watching the impressive progress of the Solana blockchain network. According to the latest findings from hedge fund Syncracy Capital, in just a short time, Solana has significantly grown its market share and valuation. In fact, these insights suggest that Solana could potentially be valued at 33% of Ethereum‘s worth, showing just how rapidly it’s catching up to the leading crypto network.

This advancement showcases Solana’s significant strides since being deemed an underestimated contender in 2023, largely due to its improved structure, increased transactions per second, and user-friendly development process. Solana has experienced, and is still experiencing, a rising tide of on-chain activity, along with an increase in users and developers, following the resolution of the challenges triggered by the fall of FTX.

Advancement Of App Earnings And Other Metrics

Without a doubt, one significant development this month has been Solana surpassing Ethereum in monthly application income, marking a new milestone. Given the surge in finance and business-oriented applications, this achievement isn’t all that unexpected.

Merchants find Solana highly attractive due to its user-friendly nature for mobile devices and relatively low transaction fees. Additionally, applications such as Pumpdotfun and others are demonstrating the vast capabilities of Solana’s network. Currently, these applications generate approximately $348 million annually.

As an analyst, I’ve observed that as of October 26, approximately 42 million SOL have been locked, marking a two-year peak for Solana’s Total Value Locked (TVL). Meanwhile, Ethereum’s TVL has remained relatively steady, especially within the decentralized finance (DeFi) and decentralized physical infrastructure networks (DePIN), which are experiencing a surge in platform usage. This increase in TVL signifies a growing trust in Solana’s ecosystem.

The Future Of Solana And The Expanding Ecosystem

The popularity of Solana’s ecosystem continues to grow, and in certain areas yet undominated, it even rivals Ethereum. Unlike other networks, Solana’s focus extends beyond retail merchants, and it is gaining traction with several cutting-edge Decentralized PIN (Proof of Infrastructure) protocols. These protocols are designed to motivate users to maintain real-world infrastructure.

The upcoming Firedancer update on Solana’s platform is expected to enhance its ability to handle large amounts of data, bolstering its scalability even more. As Syncracy Capital predicts, this will help keep the price difference between Solana and Ethereum minimal, positioning Solana as a strong competitor in the market.

SOL Price Forecast

By December 14th, 2024, it’s expected that Solana’s value will increase by 12%, reaching approximately $242. Given the current ‘Extreme Greed’ level on the Fear & Greed Index and the ongoing optimistic consumer sentiment, now might be a good time to invest in Solana. Furthermore, considering the network’s efficiency and the recent growth of 30% in the month, there’s a strong possibility that Solana’s price will continue to rise.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-11-14 15:04