As a seasoned crypto investor with a decade-long journey through the digital asset landscape, I find myself both intrigued and cautiously optimistic about the recent developments in Bitcoin. The miner sell-off of over $2.25 billion worth of BTC is indeed a significant event, one that has historically been a harbinger of local tops or price stalls. However, as we’ve seen time and again, history doesn’t always repeat itself, especially in the dynamic world of cryptocurrencies.

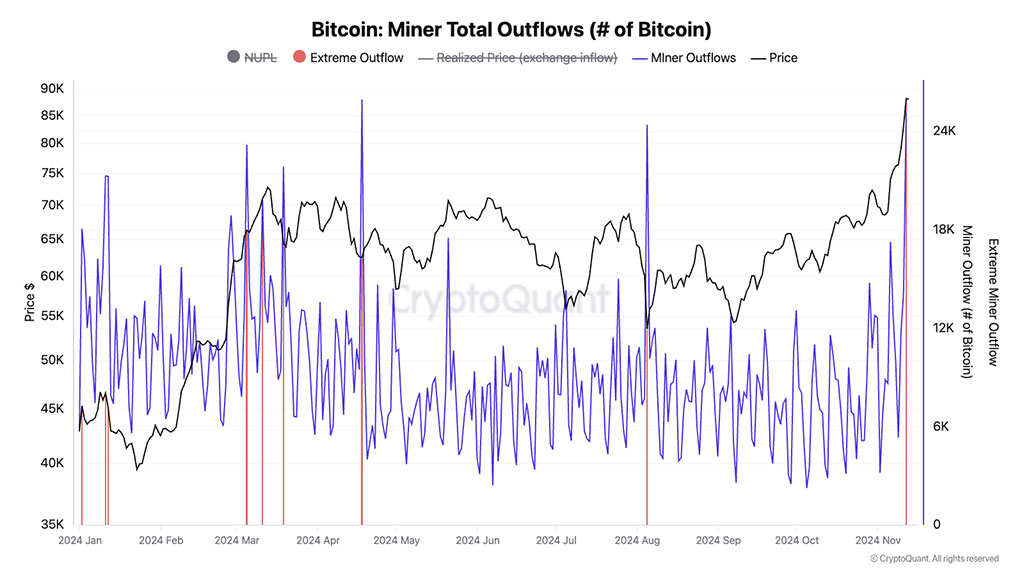

On November 13th, Bitcoin reached its most recent all-time high (ATH) at approximately $93,400. Data from CryptoQuant indicates that miners sold around 25,000 coins on Wednesday, equating to over $2.25 billion. This represents the highest daily miner sell-off since May 2024, as suggested by a surge in Miner Total Outflows, a metric that measures Bitcoin transfers from miner wallets to exchanges.

Source: CryptoQuant

Typically, a surge like this in miners being sold off tends to occur near local peaks or periods of price stagnation, as was the case in early 2024 (indicated by red lines). However, due to the current market excitement and excessive greed, it’s unclear whether this historical pattern will reoccur.

In recent developments, miners have been fiercely vying for the opportunity to create blocks within the Bitcoin network. This week, mining difficulty surpassed 100 trillion units, reaching an all-time high. Remarkably, even amidst the intense competition, miners have managed to remain profitable, with daily earnings escalating from $29 million to more than $40 million over the past two weeks.

As an analyst, I believe the surge in miner profits might be linked to heightened market fascination with Bitcoin following Donald Trump’s election win. This period was perceived as pro-Bitcoin and cryptocurrency by financial experts due to Trump’s stance on these digital assets.

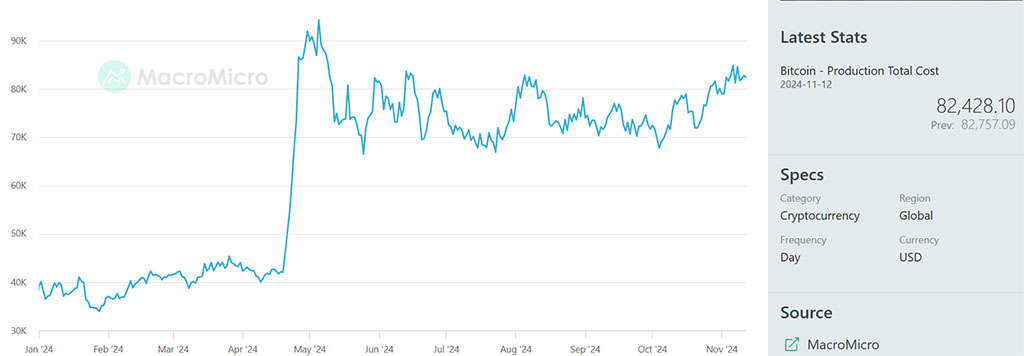

On November 12th, according to MacroMicro data, the average cost of mining a single Bitcoin was approximately $82,400. Given that the market price of Bitcoin stood at around $90,000 on the same date, this implies a profitable margin of roughly $8,000 for each mined Bitcoin, thereby underscoring the current profitability of miners in the field.

Source: MacroMicro

Is BTC Market Overheated?

An escalation in Bitcoin miners selling their holdings might put pressure on the current bull run and potentially undermine the speculation of it reaching $100K. But, when miners are earning more profits, what does that imply about the current value of Bitcoin?

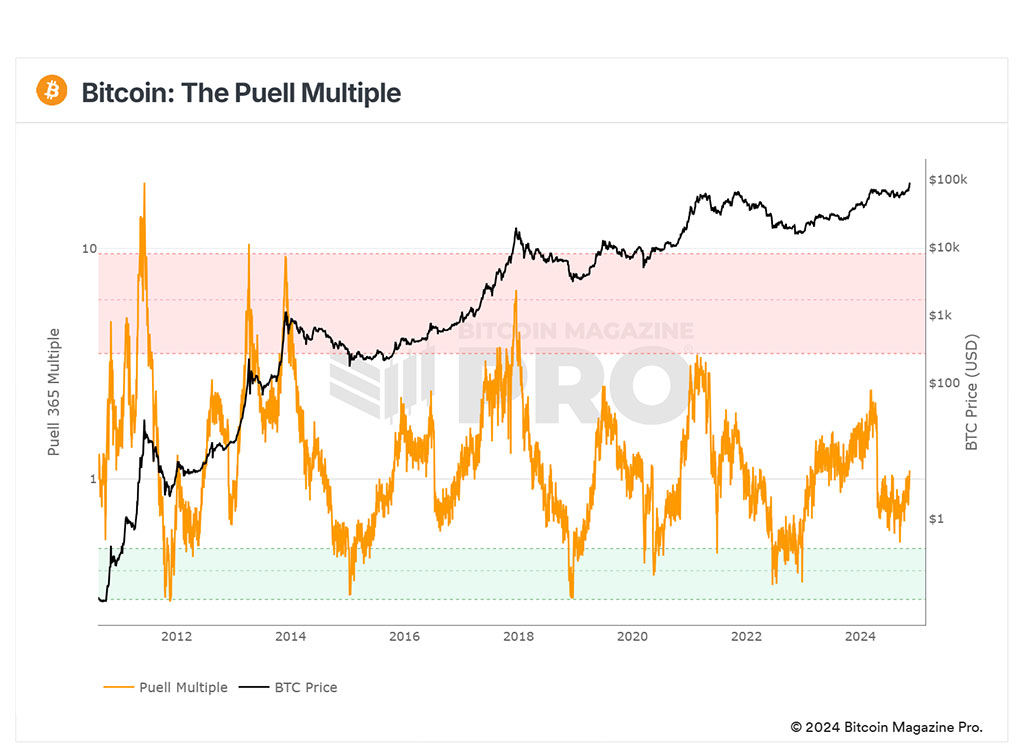

Based on the Puell Multiple indicator, which measures miner profitability and potentially Bitcoin’s value, there was still a possibility for Bitcoin to increase further even though it had surpassed $90K. Historically, in previous cycles, Bitcoin reached its peak when the Puell Multiple fell within the upper band (orange), typically ranging from 4 to 10.

Currently, the given figure peaked, which implies enhanced miner profitability. Nevertheless, this figure only showed a value of 1, signaling ample room for growth before reaching the orange zone’s threshold.

Source: BM Pro

Remarkably, the Puell Multiple seems to be following a similar trend as it did from 2020 to 2021. Back in November 2020, the indicator read approximately 1, then rose significantly to reach its peak (around $69K) in early 2021. If this pattern repeats itself, Bitcoin might reach another peak by Q1 of 2025, as suggested by the Puell Multiple data.

In other words, it seems that the recent surge in BTC price up to $90K doesn’t necessarily indicate that it was overpriced or overly excited. However, if we witness significant miner sell-offs early in 2025, coupled with an overheated Puell Multiple, this could potentially be a worrying sign and should be closely monitored.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Gold Rate Forecast

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

2024-11-14 12:28