As a seasoned crypto investor with a knack for spotting trends and opportunities, I must say that the recent surge in Ethereum ETF inflows is music to my ears. Having witnessed the rollercoaster ride of Bitcoin’s ETF debut, I can’t help but feel a sense of validation as this trend extends to Ethereum.

U.S.-based Ether spot exchange-traded funds (ETFs) have recently seen their investment returns turn positive for the first time since they were launched in July. The main factor behind this change was a significant increase in investments, with BlackRock’s iShares Ethereum Trust receiving an inflow of $131.4 million – its second-largest on record.

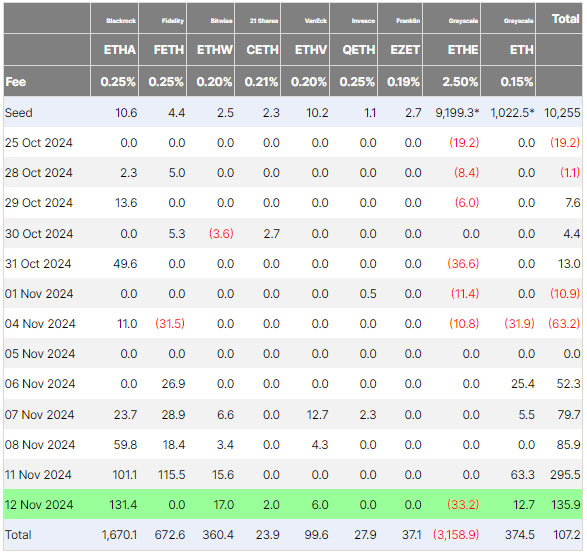

Source: Farside Investors

On the 12th of November, Ether ETFs managed by Farside Investors collectively received $135.9 million in new investments after netting $295 million the day before, marking the highest inflow ever reported. These successive increases have now resulted in a total positive net flow for these nine funds of $107.2 million – a first since their launch.

Ethereum ETFs Inflows Reach $3.1 Billion Milestone

The accumulated inflow into the Ethereum ETF market has surpassed $3.1 billion, which is much more than the current decrease of $33.2 million in Grayscale’s Ethereum Trust (ETHE). Notably, BlackRock’s iShares Ethereum Trust (ETHA) has garnered a total of $1.67 billion since its launch and has yet to experience any days with net outflows, demonstrating impressive performance in the Ethereum ETF market. This strong showing places BlackRock at the forefront of the Ethereum ETF sector.

According to Nate Geraci, president of ETF Store, he highlighted on X that BlackRock’s fund is ranked among the top six ETF launches of 2024. This impressive performance showcases BlackRock’s increasing dominance in the Ethereum ETF market.

Over the past five trading days, Ethereum ETFs such as Bitwise’s ETHW and Grayscale’s ETH have collectively received approximately $650 million in new investments. Specifically, ETHW recorded an inflow of $17 million, while ETH saw $12.7 million. Smaller but still significant inflows were also reported for funds managed by Ark and VanEck.

On November 13th, Geraci emphasized the growing relationship between cryptocurrencies and Exchange-Traded Funds (ETFs) within portfolio management. In his statement, he noted:

Keep in mind, Exchange-Traded Funds (ETFs) serve as a pathway for traditional investors to enter the cryptocurrency market. When this route becomes completely established, it’s likely that we won’t be looking back from it.

He further explained that ETFs act as a gateway for mainstream access to cryptocurrency markets, suggesting that once this bridge is built, the trend will be irreversible. The positive trajectory extended to Bitcoin ETFs as well. Spot Bitcoin ETFs witnessed aggregate inflows of $817.5 million on November 12, according to Farside Investors.

Ethereum Price Surges, Market Cap Hits $400 Billion

Ethereum (ETH) experienced a 22% price increase over the past week, peaking at approximately $3,150 on November 13, as reported by CoinMarketCap. This recent surge propelled Ethereum’s market capitalization above $400 billion, effectively adding to its value the entire market cap of Solana within a span of five days.

Optimism about cryptocurrencies in the U.S. increased following Donald Trump’s presidential election victory, leading to a rise of more than 37% in Ether’s value over the past week. According to CryptoQuant, the total amount of Ethereum held in derivative contracts on exchanges surged from 9.8 million ETH on November 5 to an all-time high of 13 million ETH by November 13.

Trader Alan observed on platform X that Ethereum has recently reached a record peak in futures investment, stressing that this cryptocurrency is once again attracting significant attention as the “leader among altcoins.” Alan highlighted Ethereum’s ongoing significance within the digital currency marketplace.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-11-13 11:36