As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous market cycles and trends. The current surge in Bitcoin’s price is indeed reminiscent of some of the most significant bull runs we’ve seen in the past. However, what sets this apart is the speed at which it’s happening, fueled by a confluence of factors that are unique to this time.

As a researcher, I’m finding myself invigorated by the recent spike in Bitcoin‘s price, an event that transpired just post-US elections. This surge seems to be driven by a positive market outlook towards the digital currency sector, creating a sense of optimism among crypto investors like myself.

Initial investors of the pioneering cryptocurrency are increasingly showing interest in Bitcoin, given its rapid approach towards the highly anticipated price level of $90,000.

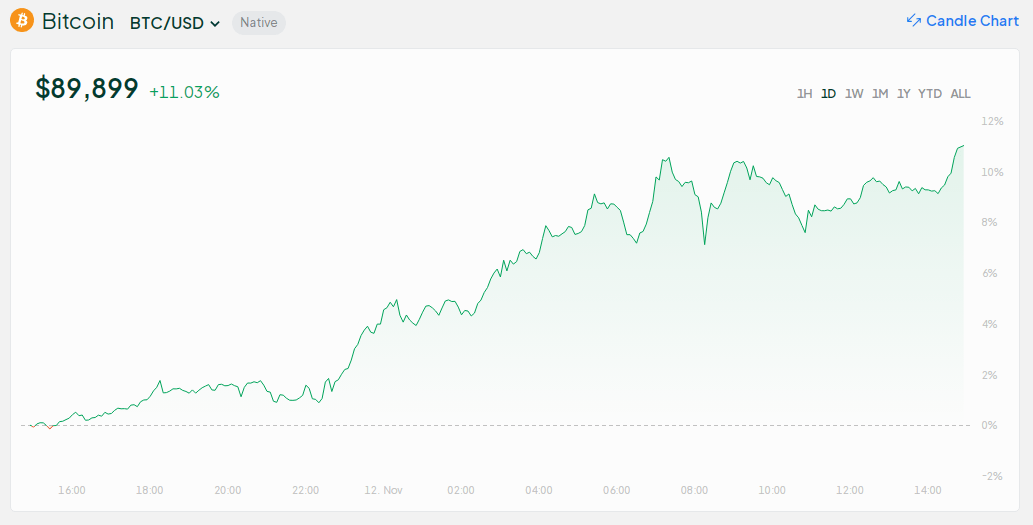

$90K Is Just Around The Corner

The data indicates that Bitcoin’s price is consistently rising, and experts believe it may reach $90,000 faster than initially anticipated.

In just a few days following Donald Trump’s return to the White House, the price of Bitcoin has been climbing due to expectations that the incoming administration will take a positive stance towards the crypto industry.

For the first time, Bitcoin went beyond the $87,000 mark after reaching $87,198, which more than doubled the $37,000 recorded 12 months ago. Then, it slightly slipped a bit on Monday.

On Tuesday morning, Bitcoin reached yet another record peak, soaring to $89,804. This drove its overall market worth up to an astounding $1.77 trillion. Notably, the dominant cryptocurrency experienced a slight dip as long-term investors began making adjustments.

Right now, when I’m typing this, the price of Bitcoin stands at approximately $88,800. On Monday, Bitcoin reached its highest value ever recorded. On the Bitstamp exchange, it was trading at $89,899.

Experts have observed that when Bitcoin’s price rises, its daily trading volume tends to grow as well, currently standing at approximately $133 billion.

Bitcoin: The Domino Effect

Experts note that the optimistic outlook towards Bitcoin is, in turn, influencing other digital currencies within the broader crypto market.

Its price surge is also pulling the price of other digital currencies worldwide.

According to CoinGecko’s recent report, the total value of all cryptocurrencies globally increased by approximately 4.7% over the last 24 hours, reaching an unprecedented peak of $3.11 trillion in market capitalization.

Moreover, over the last seven days, the cryptocurrency market has seen a substantial surge worth approximately $765 billion.

According to a different report, crypto experts have stated that crypto investment products experienced their largest year-to-date investments in digital coins, which totalled approximately $31.3 billion. The overall value of assets being managed reached $116 billion.

If you’re wondering what’s happening with #Bitcoin…

Yes, the incoming Bitcoin-friendly administration has provided a recent catalyst…

But, that’s not the main story here.

The main story here is that we are 6+ months post-halving.

And that means a supply shock has…

— Jesse Myers (Croesus ) (@Croesus_BTC) November 11, 2024

The ‘Trump Pump’

City Index’s senior market analyst Matt Simpson has referred to the current fluctuations in the cryptocurrency market as the “Crypto-Trump Rally”. He suggests that this term is used because numerous investors believe that the Trump administration could potentially foster greater adoption of digital currencies.

Simultaneously, some analysts attributed the optimistic mood in the cryptocurrency market to the prospect of a less regulated sector.

According to Ronald Temple, the main market strategist at Lazard, it was indicated that the new U.S. president intends to remove Gary Gensler as the head of the U.S. Securities Exchange Commission (SEC) on the very first day they take office.

As a passionate crypto investor, I’ve noticed that the Securities and Exchange Commission (SEC) is advocating for stricter rules in the cryptocurrency market. This proposed change has sparked criticism from fellow investors and entrepreneurs within the crypto sphere.

Read More

- POPCAT PREDICTION. POPCAT cryptocurrency

- Odin Valhalla Rising Codes (April 2025)

- Leaked Video Scandal Actress Shruthi Makes Bold Return at Film Event in Blue Saree

- King God Castle Unit Tier List (November 2024)

- Dig to Earth’s CORE Codes (May 2025)

- Who Is Stephen Miller’s Wife? Katie’s Job & Relationship History

- Who Is Ivanka Trump’s Husband? Jared Kushner’s Kids & Relationship History

- The Cleaning Lady Season 4 Episode 7 Release Date, Time, Where to Watch

- All Active Brawl Stars Reward Codes (May 2025)

- Lilo & Stitch Box Office Prediction: How Will the Remake Perform?

2024-11-13 04:17