As a seasoned financial analyst with over two decades of experience, I find Arthur Hayes’ latest essay to be a compelling and insightful take on the future trajectory of Bitcoin and the global economy. His analysis draws parallels between historical economic strategies of superpowers like the United States and China, which resonates deeply with my own observations.

In a recent article entitled “Bitcoin: A Million Dollar Coin?”, Arthur Hayes, the co-founder and ex-CEO of BitMEX, presents an argument suggesting that the value of Bitcoin could potentially surge to $1 million. Hayes posits that the economic policies expected during Donald Trump’s second term might create a unique environment conducive to extraordinary growth in Bitcoin.

Hayes compares the economic systems of the United States and China, labeling the U.S.’s approach as “American Capitalism with a Unique Twist.” He proposes that, much like China under Deng Xiaoping and currently under Xi Jinping, the U.S. is shifting towards a system in which the main objective of the government is to maintain power, irrespective of whether the policies are capitalist, socialist, or fascist.

Why The Fiat System Is Broken

In a similar vein to Deng, the individuals governing Pax Americana are more concerned with maintaining their power, regardless of whether the economic system is Capitalist, Socialist, or Fascist. Hayes highlights that America moved away from being purely capitalist in the early 20th century. He explains that capitalism implies that the wealthy suffer financial losses when they make poor decisions; however, such outcomes were effectively outlawed as early as 1913 with the establishment of the US Federal Reserve.

As a crypto investor reflecting on economic shifts, I’ve noticed a significant transition from the traditional “trickle-down” approach to more direct stimulus measures, particularly during times of crisis like the COVID-19 pandemic. It’s essential to recognize that not all quantitative easing (QE) policies are created equal.

Between 2020 Q2 and 2023 Q1, Presidents Trump and Biden broke away from the norm. During this period, their Treasury departments sold bonds that were bought by the Federal Reserve using newly printed money (Quantitative Easing). Instead of distributing these funds to wealthy individuals, the Treasury directly sent checks to citizens. This move resulted in a decline in the US debt-to-GDP ratio because the increased purchasing power among average Americans boosted genuine economic growth.

In the future, Hayes predicts that a possible second term for Trump could bring policies centered around bringing back crucial industries to the U.S., which he suggests would be funded by increased government spending and an expansion of bank credit. He points to Scott Bassett as a likely choice for Treasury Secretary, noting that Bassett’s speeches detail plans to stimulate economic growth by offering tax incentives and subsidies to help move critical industries back to the U.S., essentially aiming for higher nominal GDP through such measures.

According to Hayes, the strategy involves stimulating economic growth by offering government tax incentives and subsidies for companies in key industries such as shipbuilding, semiconductor production, automobile manufacturing, and so forth, to bring these operations back home. Qualifying businesses would then be eligible for affordable bank loans.

He warns that such policies would lead to significant inflation and currency debasement, adversely affecting holders of long-term bonds or savings deposits. To hedge against this, Hayes advocates for investing in assets like Bitcoin and gold. “Instead of saving in fiat bonds or bank deposits, purchase gold (the boomer financial repression hedge) or Bitcoin (the millennial financial repression hedge),” he advises.

Hayes supports his argument by analyzing the mechanics of monetary policy and bank credit creation. He illustrates how “QE for the poor” can stimulate economic growth through increased consumer spending, as opposed to “QE for the rich,” which inflates asset prices without contributing to real economic activity.

In simpler terms, quantitative easing (QE) aimed at benefiting lower-income individuals stimulates overall economic growth. By distributing stimulus checks (stimmies), the Treasury motivated the general public (plebes) to spend money, including purchasing trucks. This increased demand for goods led companies like Ford to profit enough to pay their employees and seek loans to expand production.

Moreover, Hayes delves into proposed regulatory adjustments, including exempting banks from the Supplemental Leverage Ratio (SLR), a move that would allow them to buy an unlimited quantity of government bonds without extra capital restrictions. He contends this could facilitate “unending Quantitative Easing” aimed at stimulating productive sectors of the economy.

He clarifies that if Treasuries, central bank reserves, and corporate debt securities were excluded from the Supplementary Leverage Ratio (SLR), a bank could potentially buy unlimited amounts of these securities without needing to invest in costly stocks. This power lies with the Federal Reserve, which indeed granted an exemption for this period, from April 2020 to March 2021.

How Bitcoin Could Reach $1 Million

As an analyst, I posit that the merger of assertive fiscal strategies and regulatory reforms could ignite a surge in bank lending, potentially escalating inflation rates and depreciating the strength of the U.S. dollar.

By merging legislative industrial policies and the SLR exemption, there could be an explosion of bank lending. I’ve previously demonstrated that the speed at which money circulates with such measures is significantly faster than conventional QE managed by the Fed for wealthy individuals. Consequently, it’s reasonable to anticipate that Bitcoin and cryptocurrencies may perform equally as well, if not superiorly, compared to their performance from March 2020 up until November 2021.

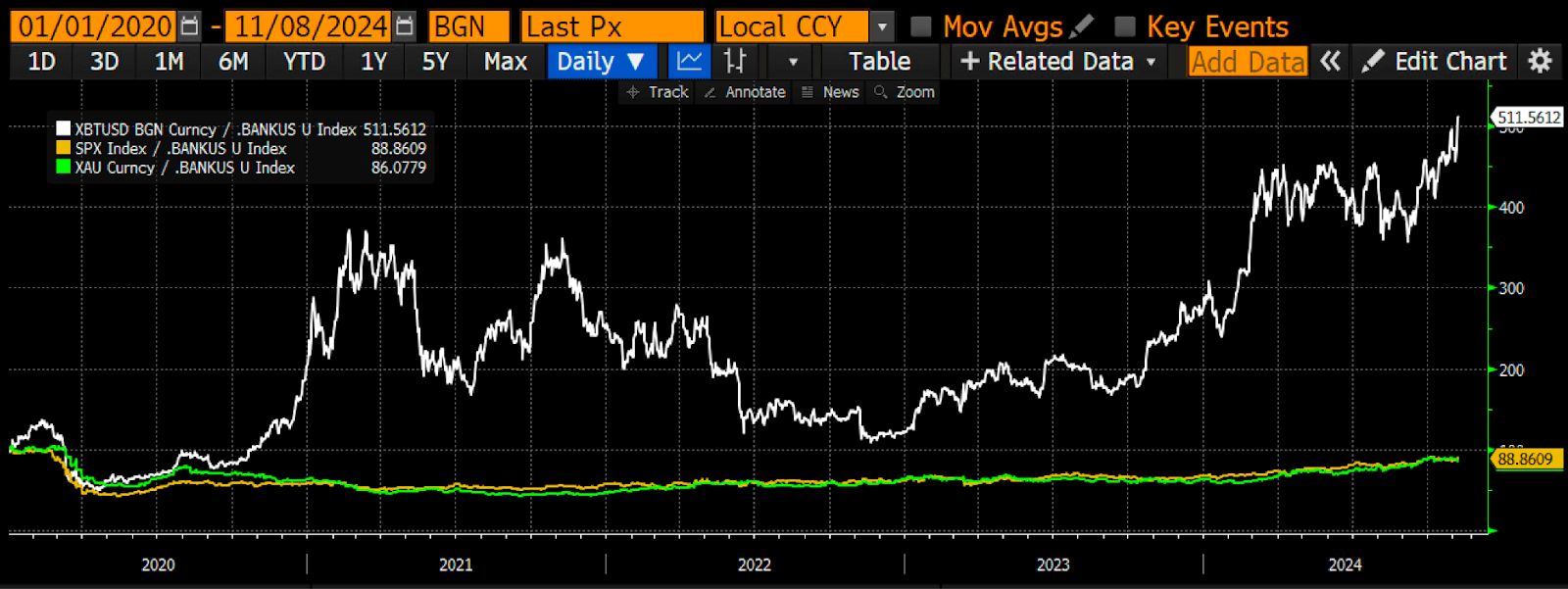

In this kind of setting, he contends that Bitcoin is poised to gain the most, given its limited quantity and decentralized structure. Essentially, he believes that Bitcoin could reach $1 million because prices are determined by demand and supply. As the available Bitcoin decreases, a large amount of fiat money will be competing for a secure investment option, according to his forecast. Hayes supports this viewpoint using his unique index which monitors US bank credit supply, showing that Bitcoin has consistently outperformed other assets when taking into account bank credit expansion.

“What is [..] important is how an asset performs when deflated by the supply of bank credit. Bitcoin (white), the S&P 500 Index (gold), and gold (green) have all been divided by my bank credit index. The values are indexed to 100, and as you can see, Bitcoin is the standout performer, rising over 400% since 2020. If you can only do one thing to counter the fiat debasement, it is Bitcoin. You can’t argue with the math,” he asserts.

In wrapping up his essay, Hayes encourages investors to prepare themselves strategically in light of these impending macroeconomic changes. His suggestion is to invest heavily and hold onto those investments (“Go long and stay long”). If you’re skeptical about the influence of Quantitative Easing on the less affluent, he suggests delving into the economic history of China over the past three decades. This will help you comprehend why he refers to the new American economic system as “American Capitalism with Chinese Characteristics.

At press time, BTC traded at $87,660.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

2024-11-13 03:05