As a seasoned crypto investor with over a decade of experience navigating the volatile digital asset market, I must say that the growing whale activity surrounding Ethereum is indeed a bullish sign for this digital currency. Having witnessed multiple market cycles and trends, I have learned to read between the lines when it comes to indicators like these.

It’s been noted by analysts that there’s a rising interest in Ethereum, as it becomes more attractive to major investment groups.

Monitoring whale activity can signal that a particular cryptocurrency might be preparing for substantial growth due to increasing market enthusiasm towards the crypto sector.

Growing Whale Activity

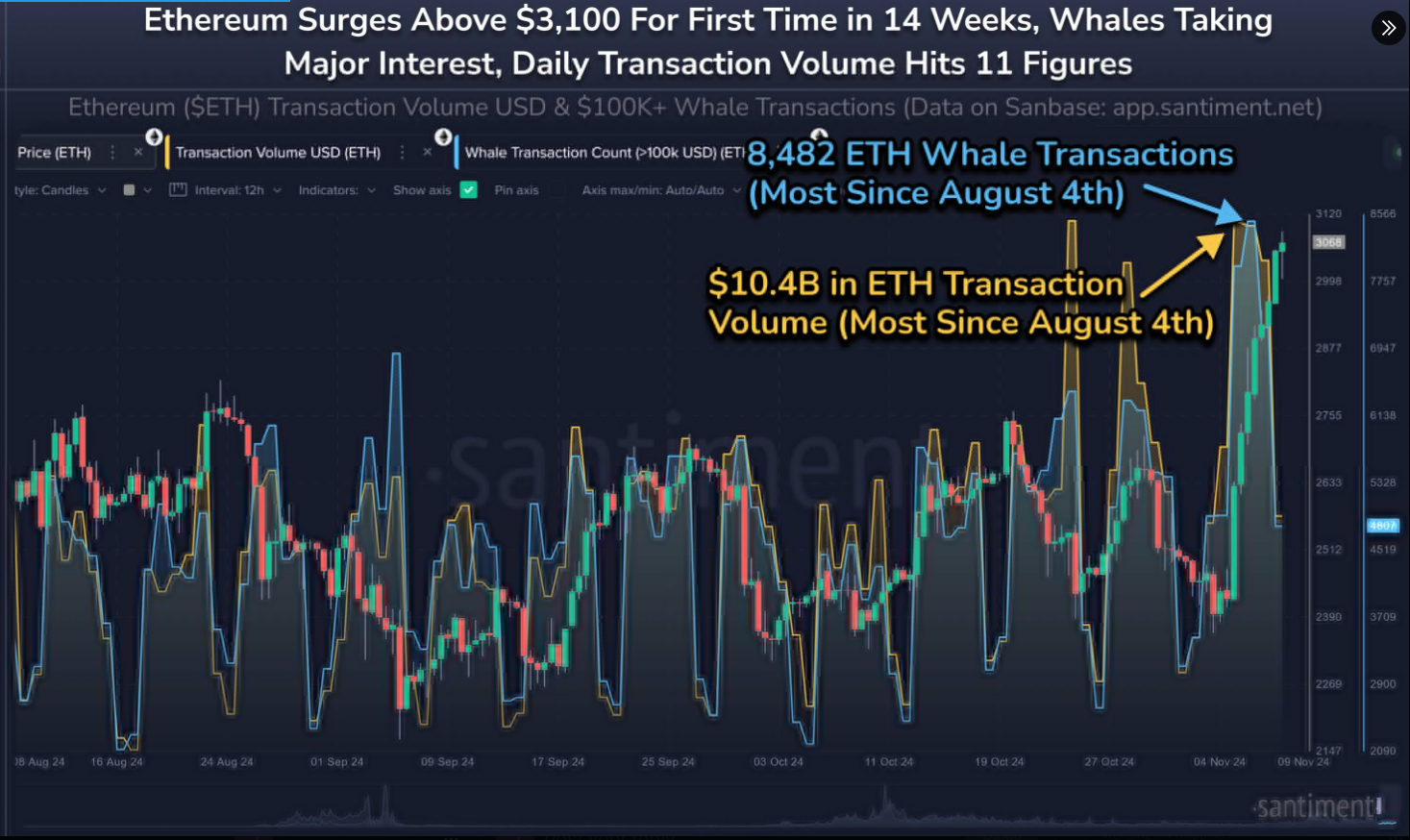

According to Santiment, there’s been a significant surge in the number of large Ethereum transactions over the past few days.

Large-scale investors known as ETH whales possess significant financial power that can sway market opinions and impact the supply of digital coins.

At present, Ethereum is exhibiting growth and holding strong at approximately $3,120. This expansion is reminiscent of the development that propelled it into the second-largest cryptocurrency by market cap, a position it has maintained for the majority of the past eight years.

Whale transaction data indicates a major spike in key stakeholder activity.…

— Santiment (@santimentfeed) November 10, 2024

Experts have pointed out that the daily transactional worth of ETH has surpassed $10.4 billion, primarily driven by increasing activity among large investors (whales) and an escalating number of daily Ethereum transactions. This trend is seen as a positive sign for the digital currency’s network, indicating potential growth.

Additionally, it shows a rising involvement of big investors, individual traders, and institutional entities in Ethereum.

Analysts believe that Ethereum reached a new peak over the past 14 weeks due to increased activity among large-scale investors, or “whales.” This suggests that these higher-risk investors are regaining trust in the cryptocurrency.

Market analysts contend that significant Ethereum purchases or holding by large investors could reinforce the price stability and potential increase. They perceive this behavior as a “positive indication” reflecting the actual health of the market.

On Track To Growth

Experts suggest that the surge in Ethereum transactions might signal a potential approach to a fresh peak price. This heightened activity suggests that Ethereum is attracting interest during a typical bull market trend, which historically has resulted in increased cryptocurrency values.

As of the moment, ETH went up by 5.21% in the past day and is now being traded at $3,184.

Market analysts have pointed out that robust network activity within cryptocurrency often indicates price stability for coins like Ethereum (ETH), making it attractive to both investors and the broader ecosystem. This unique balance tends to draw in more participants in the blockchain sector, ensuring a thriving community.

#Ethereum $ETH at $3,000 today is just the beginning!

— Ali (@ali_charts) November 9, 2024

Only The Beginning

According to analyst Ali Martinez, Ethereum (ETH) breaking through the $3,000 barrier signals a promising bullish trend for the cryptocurrency. He believes this could be just the start of a significant increase, potentially pushing ETH up towards $10,000.

Currently, Henrique Centieiro, a venture capitalist, stated that Ethereum (ETH) is trending towards what he calls the “scarcity model”. He elaborated that over 42.6% of all Ethereum are currently tied up in staking contracts. This could potentially lead to less Ethereum being available on exchanges, creating a situation where supply is reduced, which might spark a surge in price.

He also mentioned that these circumstances and the increasing interest among investors in ETH suggest a promising yield on ETH over a prolonged period.

Read More

- DEXE PREDICTION. DEXE cryptocurrency

- FLOKI PREDICTION. FLOKI cryptocurrency

- WIF PREDICTION. WIF cryptocurrency

- ZEN PREDICTION. ZEN cryptocurrency

- From Season 4 Renewed With Release Date Window & Episode Count

- TURBO PREDICTION. TURBO cryptocurrency

- FIS PREDICTION. FIS cryptocurrency

- SEI PREDICTION. SEI cryptocurrency

- XRD PREDICTION. XRD cryptocurrency

- WLD PREDICTION. WLD cryptocurrency

2024-11-12 07:35