As a seasoned crypto investor with a decade of experience navigating the volatile landscape of digital assets, I’ve witnessed Bitcoin’s incredible journey from a mere concept to a global phenomenon that has captured the imagination and wallets of millions. The latest surge past $82,000 is nothing short of breathtaking, and it feels like we’re watching history in the making.

Bitcoin has repeatedly hit record highs over the past six days, even surpassing $82,000 at one point. This latest achievement further strengthens Bitcoin’s upward trend as it ventures into unexplored regions. This development has grabbed the attention of investors who are bullish and is fueling renewed optimism within the market.

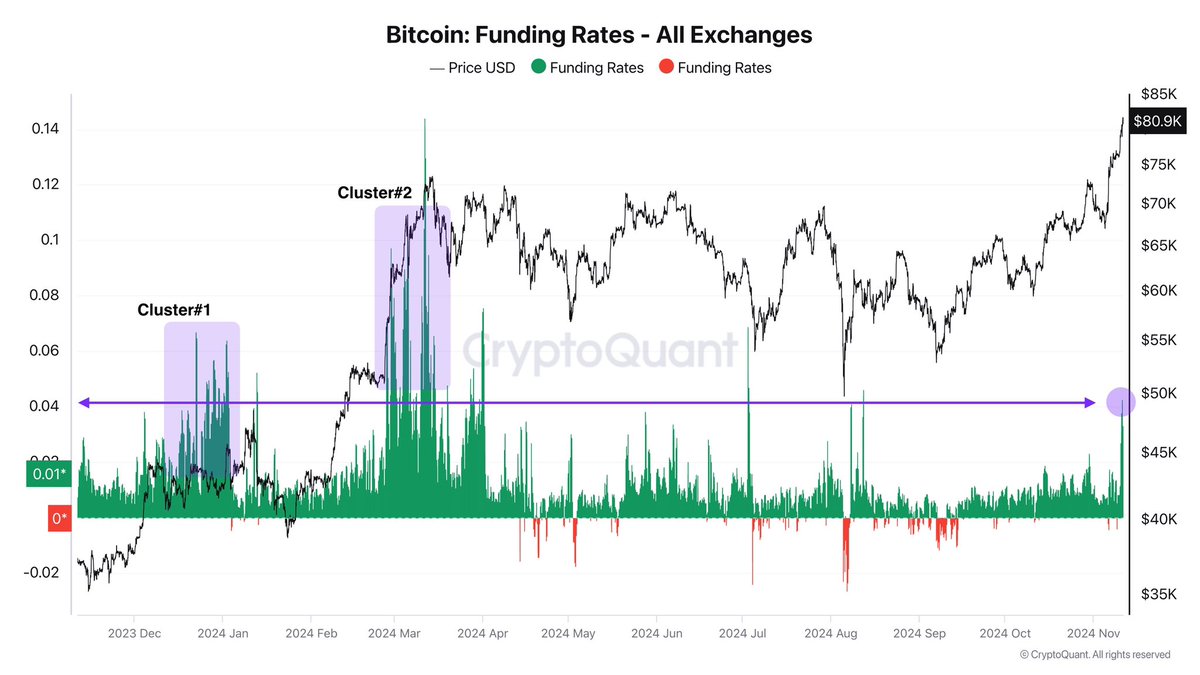

Based on current figures from CryptoQuant, it appears that an increasing number of optimistic investors are entering the market. However, there’s a strong indication that Bitcoin’s surge might still have some distance left to go.

According to CryptoQuant’s analysis, Bitcoin’s current levels are still well below its projected peak in March 2024 based on important indicators. This disparity suggests that Bitcoin might have more room to grow within this market cycle. This gap underscores the possibility that even with its notable gains so far, Bitcoin may be accumulating momentum towards reaching its true cycle’s maximum, implying further potential increases are yet to come.

As a crypto investor, I find myself closely monitoring the market with renewed optimism. Each new level that Bitcoin manages to hold indicates growing investor confidence and a potential continuation of the upward trend. The coming days are pivotal; they could signal just how far Bitcoin might reach as it establishes itself during this phase of the bull run.

Bitcoin Bulls Enter The Room

After nearly eight months of steady movement and intense selling, Bitcoin enthusiasts are back in the game. Now, Bitcoin is 11% higher than its previous record high from March, causing a noticeable shift in the market’s optimism, indicating the beginning of an uptrend.

Based on findings from CryptoQuant analyst Axel Adler’s analysis, there is a consistent increase in the number of optimistic investors in the market, indicating growing assurance. Yet, this upward trend does not match the intense demand witnessed during the March 2024 rally, where both retail and institutional interest peaked at unprecedented levels of excitement.

As a crypto investor, I’ve noticed that although bulls are firmly entrenched in the market right now, the rate at which new retail and institutional investors are jumping on board is still relatively slow compared to what we saw back in March. This discrepancy between current market trends and those witnessed earlier this year hints that Bitcoin’s recent surge could just be the starting point of its ascent rather than a peak in this cycle.

A gradual increase in demand for Bitcoin suggests it might be early in its current bullish trend, offering potential for more growth before hitting a peak in its development cycle.

For investors, this could present a promising opportunity. The subdued retail and institutional excitement level suggests that Bitcoin has yet to capture mainstream attention as it did during previous peaks. If demand rises gradually, Bitcoin may experience sustained growth over the coming months, potentially reaching new highs as momentum builds.

BTC Setting New High

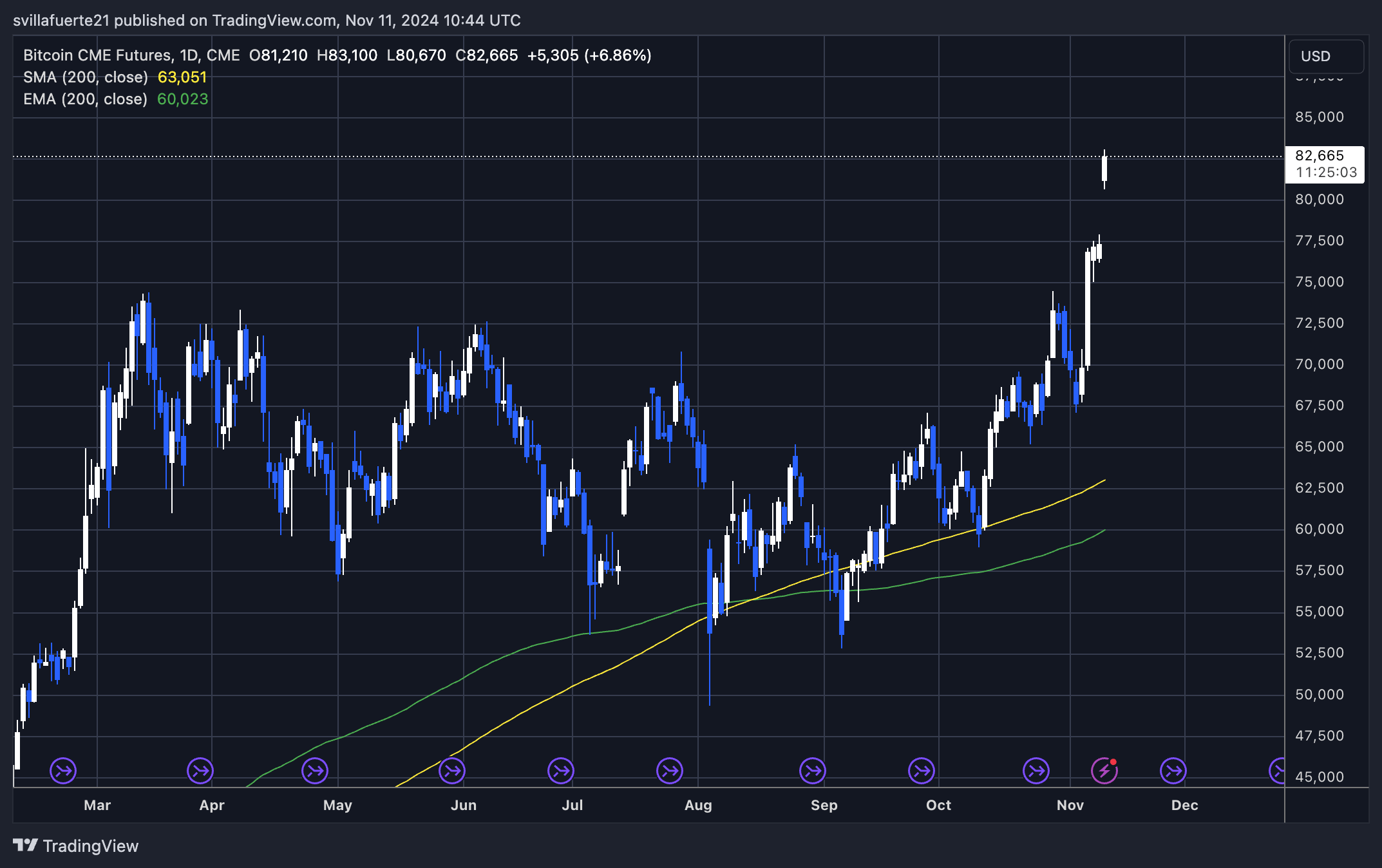

In recent times, Bitcoin has reached a record high surpassing $82,000, a level some investors believed could mark a temporary peak. Yet, the strong movements in Bitcoin’s price suggest that this might not be the absolute zenith just yet. It seems we may need more time to make a conclusive prediction about its maximum point.

Regarding the current upward trend, it’s important to note a possible correction towards $77,000 might occur. This is due to an empty space or ‘gap’ in the CME futures market between $77,000 and $81,000. This gap is significant because it’s a technical level that often triggers price movements as traders aim to fill this gap by closing it.

This coming week is expected to witness a high level of market turbulence since the bulls are currently dominating. Given that Bitcoin has entered uncharted price levels, some traders might decide to cash out their gains, potentially leading to increased selling activity.

Despite a possible short-term correction to around $77,000, the overall sentiment leans bullish. This minor drop could serve as a base for further growth. For now, Bitcoin’s robustness is evident, but it will be intriguing to see how it reacts to market volatility and whether it can sustain this high range or experience a slight dip before continuing its ascent.

Read More

- POPCAT/USD

- The White Lotus’ Aimee Lou Wood’s ‘Teeth’ Comments Explained

- Who Is Finn Balor’s Wife? Vero Rodriguez’s Job & Relationship History

- DYM/USD

- Coachella 2025 Lineup: Which Artists Are Performing?

- Who Is Kid Omni-Man in Invincible Season 3? Oliver Grayson’s Powers Explained

- General Hospital Cast: List of Every Actor Who Is Joining in 2025

- Leaked Video Scandal Actress Shruthi Makes Bold Return at Film Event in Blue Saree

- Beauty in Black Part 2 Trailer Previews Return of Tyler Perry Netflix Show

- Kingdom Come Deliverance 2: How To Clean Your Horse

2024-11-11 22:34