As a seasoned crypto investor with a knack for recognizing trends and patterns, I’ve seen my fair share of market cycles. But the current surge in Ethereum is truly something to behold. The recent 35% rise, pushing ETH to $3,219, has me more optimistic than ever about its potential.

Recently, Ethereum hit a fresh local peak at $3,219, representing a noteworthy 35% spike from its price on last Monday. This swift uptick has sparked considerable enthusiasm among experts and investors who anticipate more growth for Ethereum as it demonstrates resilience against Bitcoin. The upward trend is indicative of growing trust in ETH’s future potential, particularly with key players ramping up their involvement.

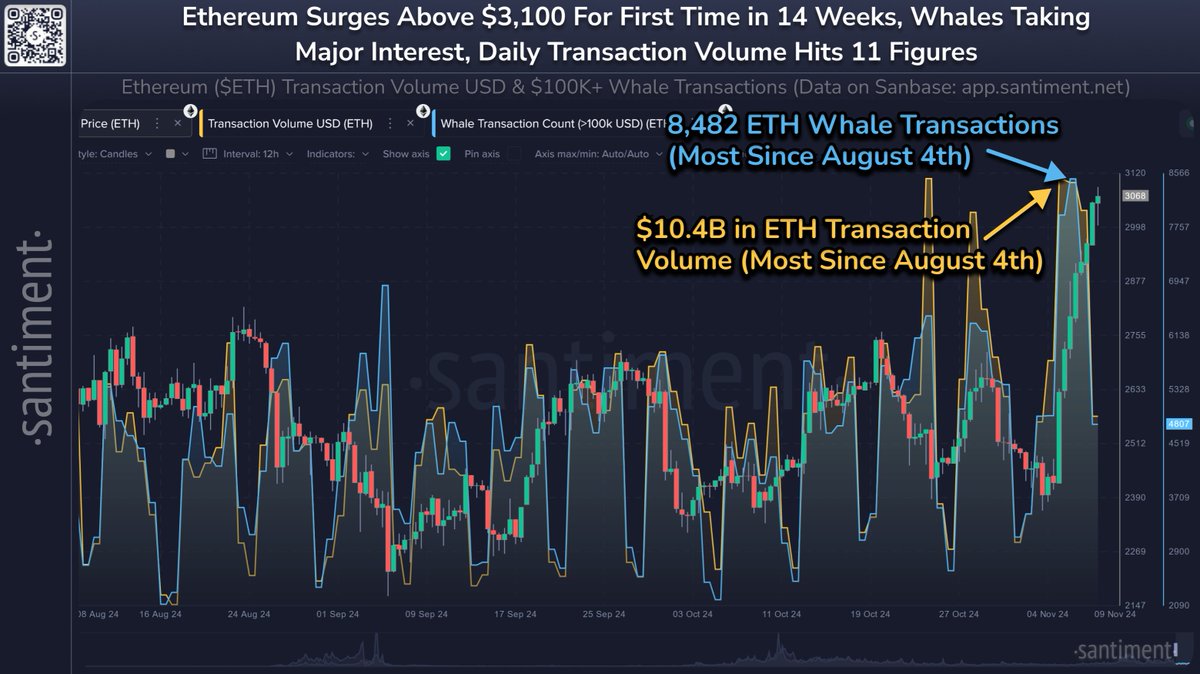

Key data from Santiment supports this bullish outlook, highlighting a significant spike in whale transactions. Increased activity among large ETH holders often signals accumulation, suggesting that influential players see the potential for Ethereum’s continued growth. This uptick in whale transactions is typically seen as a precursor to further price appreciation, as it indicates sustained interest from high-volume investors.

Observers are keeping a close eye on Ethereum’s progress relative to Bitcoin, as Ethereum’s current surge might be signaling the start of a prolonged upward trajectory.

Ethereum Bull Phase Starting

It appears that Ethereum has moved into an optimistic stage, having successfully surpassed crucial resistance points and creating a favorable pricing pattern. The latest findings from Santiment underscore this bullish momentum, as Ethereum currently demonstrates robust performance indicators suggesting possible additional increases in the future.

The information from whale transactions suggests a notable surge in activity by prominent players, those with large quantities of Ether (ETH), who appear to have played a key role in pushing Ethereum to its highest price point in more than fourteen weeks.

Besides increased whale behavior, Ethereum’s transaction volume has significantly increased, peaking at approximately $10.4 billion over the past few days. This surge in volume is a positive indication of growing interest and demand for ETH at its current price points. Large transactions typically represent confidence from institutional investors and high-net-worth individuals, further fueling optimism about Ethereum as they accumulate more ETH.

As a researcher studying cryptocurrency markets, I find it intriguing that Santiment analysts propose Bitcoin’s bull run could spark a catalyst for Ethereum. This dynamic might lead investors to redistribute their profits from Bitcoin towards top altcoins like Ethereum as they diversify their portfolios. This trend has shown to be advantageous for Ethereum during robust market periods, hinting that ETH may revisit its past record high once again.

As a researcher, I’ve noticed that Ethereum’s network activity remains strong, which is another sign of its potential for sustained growth. With more stakeholders jumping on board, high transaction volumes, and a thriving network, Ethereum seems poised to maintain its positive trajectory in this bullish market climate.

ETH Testing Fresh Supply

As a researcher, I’m observing that Ethereum (ETH) is presently trading at approximately $3,170, demonstrating resilience following a robust push surpassing the 200-day moving average (MA) at around $2,955. This surge beyond a significant resistance level suggests that the bulls have taken charge as ETH approaches new supply zones. Maintaining above the 200-day MA is a promising sign for upholding the bullish trend, as this level typically bolsters price activity when exceeded during an upward trajectory.

As a crypto investor, I anticipate that if Ethereum (ETH) experiences a pullback, it might find support around its 200-day moving average, which is approximately $2,955. This pullback could be considered healthy and may even pave the way for potential future growth. If ETH consolidates at or near this level, it’s likely to catch the attention of more investors, boosting demand and supporting the continuation of the uptrend.

In simple terms, the robust price surge along with new demand flowing into the market could potentially drive Ethereum to even greater heights without a significant dip. The momentum Ethereum is gaining right now might help it overcome successive resistance levels in the short term, moving towards higher goals. At present, Ethereum’s upward trend appears strong due to solid technical indicators and a market context that seems more conducive for further growth.

Read More

- Ana build, powers, and items – Overwatch 2 Stadium

- The Hunger Games: Sunrise On the Reaping Finally Reveals Its Cast and Fans Couldn’t Be Happier

- Arjun Sarja’s younger daughter Anjana gets engaged to long-term boyfriend; drops dreamy PICS from ceremony at Lake Como

- The Hunger Games: Sunrise on the Reaping Cast Finds Young Haymitch & More

- Beauty in Black Part 2 Trailer Previews Return of Tyler Perry Netflix Show

- The Last of Us Season 2 Episode 2 Release Date, Time, Where to Watch

- PSP/USD

- Jade Cargill’s WWE TV Return: Huge Update on Her Creative Plans

- Why Fans Think Days of Our Lives’ Best Couple Is Sarah & Xander

- POPCAT PREDICTION. POPCAT cryptocurrency

2024-11-10 23:10