As a seasoned crypto investor with a knack for deciphering market trends and a keen interest in politics, I find myself increasingly optimistic about Bitcoin’s future. The recent US elections have undeniably given a significant boost to the crypto industry, with the re-election of President Donald Trump.

The trend seems to favor Bitcoin and cryptocurrencies, and there’s a good chance the price increase might persist until December. A significant factor contributing to Bitcoin’s recent success can be attributed to the election of President Donald Trump.

Trump’s supportive comments about cryptocurrency and his positive tone contributed significantly to its surge above $76k, surpassing the previous record set in March this year.

Currently, numerous market analysts continue to express optimism following the US elections. Notably, Thomas Lee, a CNBC contributor and the Chief Information Officer at Fundstrat Capital, has gone as far as predicting that Bitcoin might reach six-digit figures by the end of this year. According to him, the current economic and political climate seems to be beneficial for Bitcoin, with further potential growth anticipated in digital assets.

Trump’s Election Boosts Crypto Industry

On this coming Friday, the Chief Investment Officer of Fundstrat Capital expressed his views about Trump’s elections and the potential future of Bitcoin on CNBC’s Squawk Box program. During this conversation, Lee predicted that both Bitcoin and many other alternative cryptocurrencies will experience a price surge in the near future.

According to Tom Lee of fundstrat, fixing the budget deficit might prove challenging only by adjusting taxes and spending. He posits that Bitcoin could potentially serve as a component of the Treasury’s reserves. In the event that Bitcoin’s value increases, it could actually help balance out the debt, which corresponds to the deficit.

— Squawk Box (@SquawkCNBC) November 8, 2024

Lee mentioned that just prior to the elections, the worldwide financial markets were filled with numerous doubts. Yet, with Trump’s victory in the U.S. elections and his positive stance towards Bitcoin in his proposed policies, the cryptocurrency sector may experience brighter times ahead.

Lee mentioned that modifications in regulations and supportive cryptocurrency policies might drive the growth of the digital asset in the near term. Furthermore, he attributes Trump’s previous presidency to providing him with valuable expertise to handle potential future obstacles more effectively.

Reflecting on his initial Bitcoin price prediction of $150k, Lee considers it feasible given Trump’s backing and the positive market conditions.

Bitcoin, Digital Assets Can Help Offset US Debt

One of Donald Trump’s election pledges involves reducing the expanding national budget gap, currently exceeding $35 trillion. However, as Lee pointed out, it may prove challenging for Trump to simultaneously reduce taxes and government expenditures in order to tackle this deficit.

As a researcher, I myself perceive Bitcoin as an instrumental solution to our expanding national budget shortfall. To me, it holds immense potential to evolve into a vital Treasury asset, given its escalating market worth throughout the years.

It’s worth noting that Trump has expressed an idea, mentioning that if elected, he could tackle the nation’s financial issues by issuing a “Bitcoin check.

Bitcoin Act Gaining Momentum After The US Elections

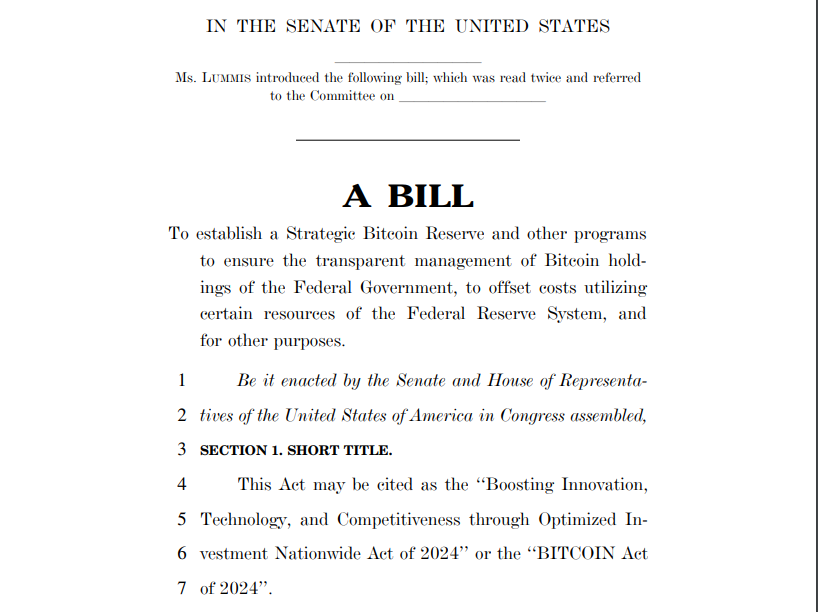

Prior to Senator Lee’s remarks, discourses revolved around Bitcoin’s increasing influence within the nation’s economy. Senator Cynthia Lummis proposed legislation, known as the Bitcoin Act, to officially recognize cryptocurrency as a financial asset.

In the opinion of Senator Lummis, a victory for Trump could strengthen efforts to classify Bitcoin as a financial tool to tackle economic instability. One proposal in the bill suggests that up to 1 million Bitcoins should be held over a period of five years as a protective measure against inflation.

Read More

- Is Average Joe Canceled or Renewed for Season 2?

- How to get all Archon Shards – Warframe

- Mindhunter Season 3 Gets Exciting Update, Could Return Differently Than Expected

- MobLand Season 2: Tom Hardy Show Gets Big Update, Paramount Gives Statement

- Rashmika Mandanna’s heart is filled with joy after Nagarjuna praises her performance in Kuberaa: ‘This is everything…’

- A Supernatural Serial Killer Returns in Strange Harvest Trailer

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Tyler Perry Sued for $260 Million Over Sexual Assault Allegations by The Oval Actor

- ‘Tom Cruise Coconut Cake’ Trends as Fans Resurface His $130 Tradition

- Fitness Boxing 3: Your Personal Trainer review: No punch back

2024-11-10 05:10