As a seasoned researcher with years of experience in the cryptocurrency market, I have seen my fair share of bull runs and bear markets. The recent Dogecoin price rally has been quite intriguing, to say the least. The surge above $0.21 was a significant milestone, but the subsequent pullback is not surprising given the intense profit-taking we’ve witnessed.

After an impressive surge that took Dogecoin‘s price above $0.21 for the first time since April and hitting a significant seven-month high, the recent rally seems to be slowing down. This intense upward movement has led to profit-taking among traders, which in turn caused a drop in Dogecoin’s price. As I write this, the price of Dogecoin is once more below $0.20, suggesting that further decreases may follow.

Observations show a noticeable decline in the number of substantial transactions among Dogecoin owners, hinting at reduced interest from major investors. This decrease in large-scale purchasing suggests that the meme currency could potentially struggle to maintain its recent progress due to mounting pressure.

Large DOGE Transaction Volume Crashes: Are Dogecoin Whales Selling?

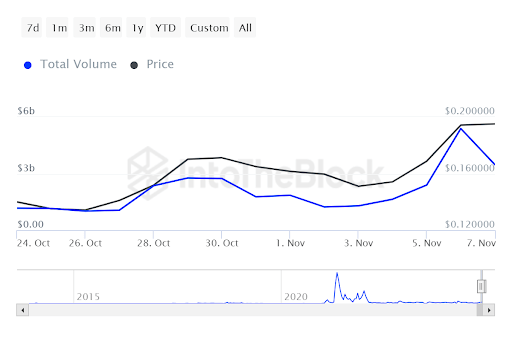

Based on market trends and on-chain indicators, it appears that Dogecoin traders may be cashing out some of their gains following a period of strong price surges. Specifically, data from IntoTheBlock shows a marked decrease in large transactions, with a 36% drop over the last day.

It seems like the decrease in large transactions could indicate that significant Dogecoin investors might be scaling back their involvement with the meme cryptocurrency following substantial returns they’ve made. This intriguing pattern is uncovered using IntoTheBlock’s ‘Large Transactions Volume in USD’ indicator, which monitors the combined worth of trades valued at $100,000 or more.

As a researcher, I’ve noticed a significant shift in the landscape of large Dogecoin transactions over the past day. The total volume of these transactions, measured in USD, stands at approximately $3.46 billion – a substantial drop from the staggering $5.38 billion recorded on November 6, marking a decline of roughly 36%. This downturn is particularly intriguing given that the trading volume had been steadily increasing since November 2.

In essence, the ‘Large Transactions Volume’ indicator demonstrates that approximately 17.76 billion Dogecoin tokens were transferred across just 2,720 transactions within the last day. Compared to the 27.7 billion tokens moved in 4,150 transactions on November 6, this represents a decrease of about 36%.

What Does This Mean For Dogecoin Price?

A sharp reduction in transactions and major trades might signal a change in market opinion, with large investors seeming more cautious. Yet, this drop in large transaction frequency doesn’t automatically mean a mass selling off by major shareholders. Instead, it could be a pause in significant purchases as whales wait for a potential price dip before they decide to further expand their holdings.

It appears that the current price trend indicates some coin owners are choosing to sell. At present, Dogecoin is being traded at approximately $0.1984. It might try to surpass the $0.20 level again in the near future. However, if the momentum slows down, Dogecoin could potentially revisit its support level of $0.187.

Read More

- The Last of Us Season 2 Episode 2 Release Date, Time, Where to Watch

- Beauty in Black Part 2 Trailer Previews Return of Tyler Perry Netflix Show

- Paradise Season 2 Already Has a Release Date Update

- Who Is Christy Carlson Romano’s Husband? Brendan Rooney’s Job & Kids

- What Happened to Daniel Bisogno? Ventaneando Host Passes Away

- Why Is Ellie Angry With Joel in The Last of Us Season 2?

- Why Was William Levy Arrested? Charges Explained

- Arjun Sarja’s younger daughter Anjana gets engaged to long-term boyfriend; drops dreamy PICS from ceremony at Lake Como

- Who Is Kid Omni-Man in Invincible Season 3? Oliver Grayson’s Powers Explained

- Jr NTR and Prashanth Neel’s upcoming project tentatively titled NTRNEEL’s shoot set to begin on Feb 20? REPORT

2024-11-08 17:10