As a seasoned analyst with over two decades of experience in various financial markets, I’ve seen my fair share of bull runs and bear markets. The recent breakout by Solana (SOL) has piqued my interest, and it seems we might be witnessing the start of something significant.

After a prolonged period of being held back by a significant barrier, Solana’s value has surpassed it at last, leading to renewed enthusiasm among investors. Yet, the breakthrough hasn’t been officially verified, so there’s both anticipation and caution in the air.

Noted analyst and financial backer Carl Runefelt recently provided insights into Solana’s technical analysis, emphasizing that the digital currency is poised for an imminent breakout from a significant bullish structure. If this breakout solidifies, it could potentially drive the price of SOL towards a projected $300 in the upcoming months, as suggested by Runefelt.

As we move forward, the coming days will be crucial for Solana (SOL) since market sentiment and trading activity will decide whether this surge is a continuous rally or merely a false signal (bull trap). For SOL to validate this breakout, it needs to preserve its upward trajectory and create support over its previous resistance. The attention of investors is centered on these levels because a failure to maintain them might cause a reversal.

If Solana (SOL) manages to fortify its stance, it might initiate a robust surge aiming for fresh peaks. Its future course in the cryptocurrency market will be significantly influenced by this development as it strives to rank among the leading performers.

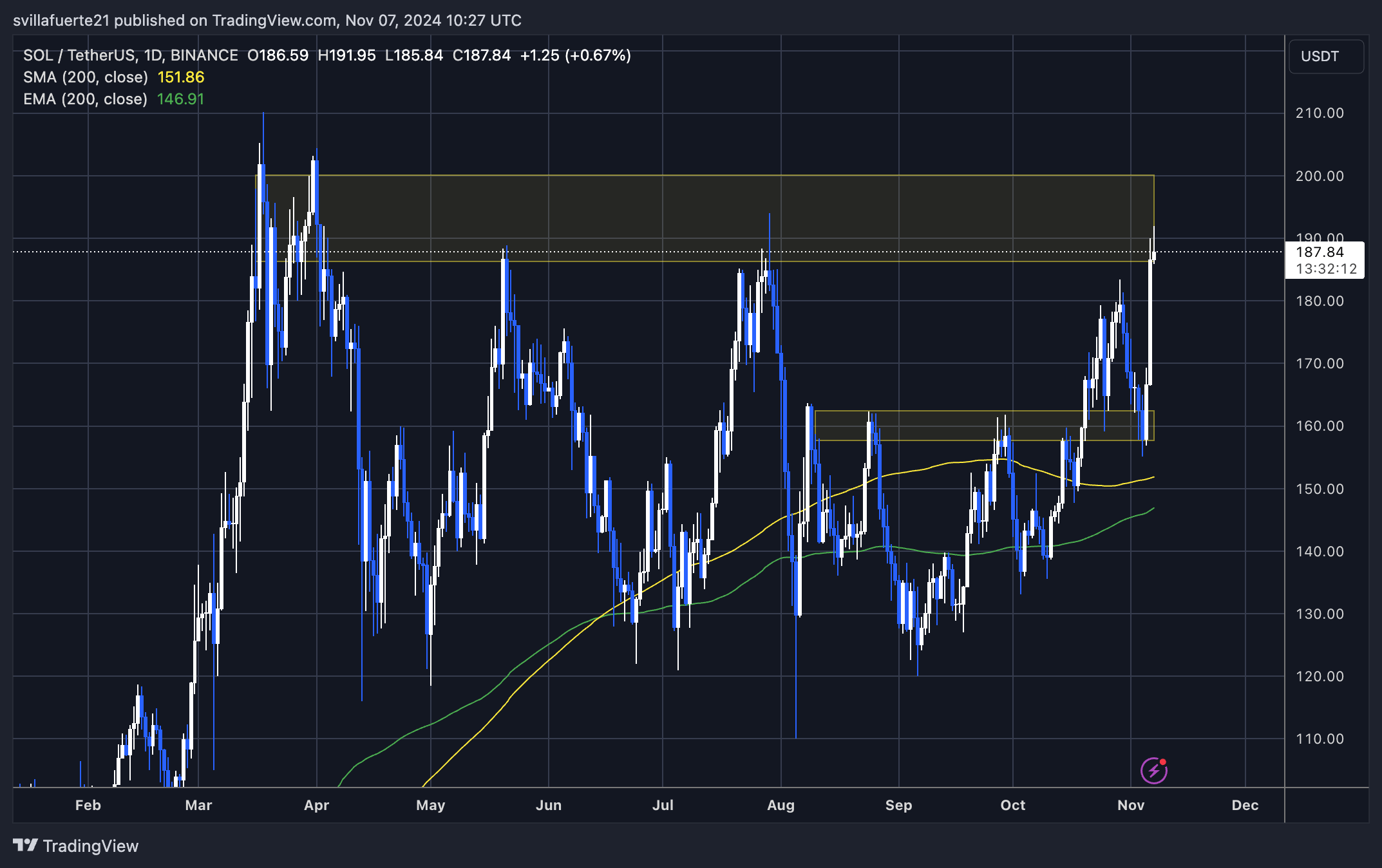

Solana Testing Crucial Supply

At present, Solana is undergoing a crucial test at its resistance level. This area has the potential to either propel SOL towards fresh highs or trigger another period of consolidation. Following its break above the $185 threshold – an important price point that should now serve as solid support – Solana appears primed for a substantial price shift.

As per prominent analyst Carl Runefelt’s technical analysis on X, Solana seems to be bursting free from a substantial Symmetrical Triangle, which is a widely recognized pattern indicating optimistic market trends. If this breakout is confirmed by moving above the current level, it might lead to an instantaneous jump towards $300, a move that Runefelt anticipates would crush bearish sentiments and reignite bullish enthusiasm.

Over the next few days, Solana’s path will be significantly influenced, particularly since the Federal Reserve is due to announce their interest rate decision today. If the Fed indicates a reduction in rates or maintains them as they are, this could stimulate the ongoing rally by encouraging risk-taking within the market. A favorable stance from the Fed might result in increased demand for SOL, potentially driving its price beyond its current record highs.

On the flip side, if the $185 resistance level isn’t maintained, Solana (SOL) may return to a period of consolidation, potentially pausing its upward trend. At this moment, attention is focused on the Federal Reserve’s upcoming decision and its potential influence on overall market sentiment. This factor will significantly impact whether Solana’s bullish trend persists. A successful breakout beyond this level would not only demonstrate strength but could pave the way for Solana to aim for $300 in the forthcoming months.

SOL Technical Analysis

At present, Solana is undergoing a crucial test at the $190 mark, a significant barrier that could potentially allow it to aim for its annual highs near $210. For the bullish trend to persist, SOL must successfully surpass and maintain this level as a foundation. This task might require some time due to the market’s ongoing analysis of Donald Trump’s election outcome and anticipation of the Federal Reserve’s interest rate decision.

As an analyst, if Solana (SOL) doesn’t manage to surpass the $190 resistance, a period of consolidation, around the range of $180 to $190, could prove beneficial for its price movement. This phase would offer the market an opportunity to reevaluate and stabilize, preparing for another strong push upward. It’s crucial that SOL maintains its position above the $180 mark during this consolidation period. If it does, the uptrend is likely to persist, potentially driving us toward the yearly highs.

If the price falls below $180, it might indicate a change in direction, potentially threatening the current upward trend. For the moment, the bulls need to stay in charge by ensuring Solana’s price remains above $180. The market is watching for the Fed’s decision, which could influence risk appetite and determine Solana’s next action.

Read More

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Connections Help, Hints & Clues for Today, March 1

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- The games you need to play to prepare for Elden Ring: Nightreign

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- The Babadook Theatrical Rerelease Date Set in New Trailer

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- What Does Mickey 17’s Nightmare Mean? Dream Explained

- Pepe Battles Price Decline, But Analysts Signal A Potential Rally Ahead

2024-11-07 20:46