As a seasoned crypto investor with a knack for recognizing market trends and analyzing technical indicators, I find myself intrigued by Ethereum’s current position. Having witnessed numerous bull and bear cycles, I can attest that every resistance level is crucial, especially one that has held strong since early August.

After Donald Trump’s election win, Ethereum experienced an increase of more than 8%, sparking renewed enthusiasm among investors. However, it remains below a significant barrier for growth, which has kept its cost generally stable since late August.

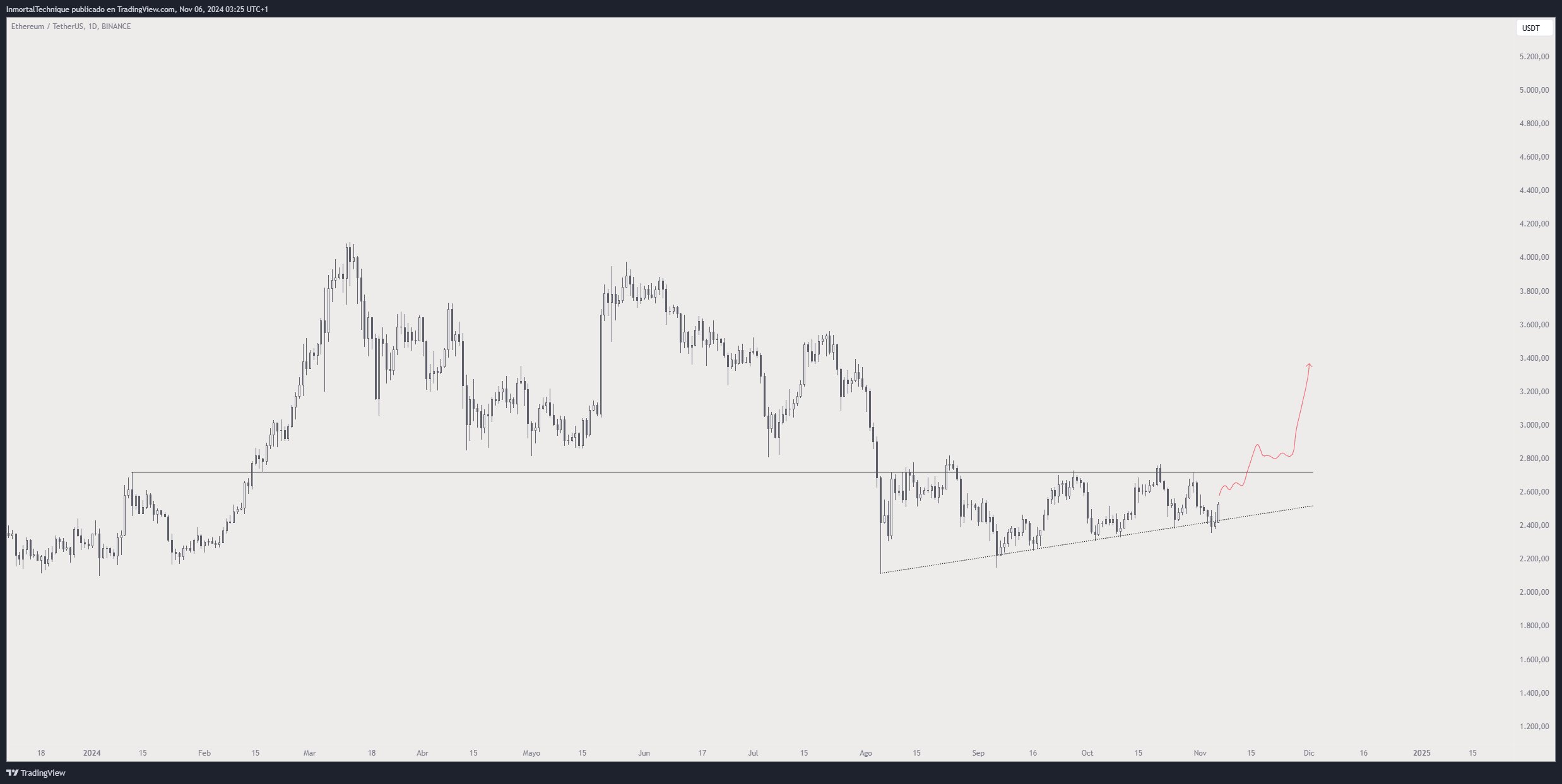

To attain complete bullish recovery, Ethereum needs to overcome this crucial hurdle. Experts are keeping a close eye, as renowned analyst Inmortal has recently provided a technical analysis indicating a possible major surge in Ethereum’s price.

Based on Inmortal’s assessment, it seems that ETH is gaining momentum, and surpassing the current resistance might trigger a prolonged surge. The market’s optimism following Trump’s election, given his pro-crypto stance, has fueled positive sentiment, leading many to expect heightened volatility and potential growth for Ethereum.

Currently, investors are closely watching Ethereum (ETH) as it approaches a significant resistance level. If ETH manages to surpass this barrier, it might indicate the start of a more robust uptrend in its price movement. As Ethereum gets nearer to this crucial point, traders are gearing up for what could be a pivotal event affecting ETH’s behavior during this market cycle.

Ethereum Pushing Key Supply

Ethereum is making an effort to surpass the significant barrier at $2,750, a point that’s been holding ETH back since early August. Overcoming this hurdle is crucial as it would validate a continuous upward trend.

Top crypto analyst and investor Immortal recently shared a detailed technical analysis on X, where he outlined a $3,400 price target for ETH if it successfully clears this key resistance.

In his assessment, Inmortal underscores the significance of keeping Ethereum in focus, even though it has been underperforming lately. This coin, sometimes called the “most criticized token” in today’s market, could prove to be important due to its potential for growth. Some investors have voiced disappointment over ETH not keeping pace with other assets as swiftly as they’d hoped, but a surge above $2,750 might significantly shift sentiment and trading patterns.

Over the next few days, we’ll see crucial developments as the financial world processes the aftermath of Donald Trump’s election win and anticipates the Federal Reserve’s interest rate decision due on Thursday. Trump’s victory has sparked optimism in the crypto market, which may boost Ethereum’s surge, given the change in sentiment. Yet, it’s important to note that volatility might persist, and unexpected news from the Fed could influence Ethereum’s direction.

If Ethereum (ETH) maintains its position above $2,750 and keeps rising, the projected target of $3,400 suggested by Inmortal could become achievable, signifying a robust recovery period for Ethereum. For the moment, the crypto community is keeping a keen eye on this critical threshold, as it could significantly influence Ethereum’s trajectory in the upcoming months.

ETH Technical Analysis

Ethereum is trading at $2,620 after a solid 12% surge from recent lows at $2,355. This price movement has given bulls hope that a rally may be on the horizon. However, ETH must break above the key $2,750 resistance level for the bullish momentum to continue and reclaim price action.

At this point, the level aligns with the 200-day exponential moving average (EMA), an essential marker of long-term robustness. If we see a surge beyond this level and a subsequent successful retest, it suggests a change in market sentiment, implying that Ethereum might be regaining its bullish momentum.

In simpler terms, when the price of Ethereum stays above its 200-day Exponential Moving Average (EMA), this level is generally considered as a strong support point. If Ethereum can end up closing above this level and continues to hold there, it could lead to more upward price movements. However, if Ethereum doesn’t break the $2,750 mark and starts to struggle holding its ground, it would suggest that the previous breakout attempt was unsuccessful.

If current trends continue, Ethereum (ETH) might experience more consolidation or a drop towards less active price zones, potentially reaching approximately $2,500 or even lower. It’s crucial for bullish investors to stay alert as the upcoming days could provide insight into Ethereum’s next direction.

Read More

- Odin Valhalla Rising Codes (April 2025)

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- POPCAT PREDICTION. POPCAT cryptocurrency

- King God Castle Unit Tier List (November 2024)

- Leaked Video Scandal Actress Shruthi Makes Bold Return at Film Event in Blue Saree

- Gold Rate Forecast

- Reddit (RDDT) Q1 2025 earnings results beat EPS and revenue expectations

- Is There a Tracker Season 2 Episode 21 Release Date & Time?

- Incarnon weapon tier list – Warframe

- ARB PREDICTION. ARB cryptocurrency

2024-11-07 05:10