As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed countless elections and their impact on various asset classes. In this case, the upcoming US election seems to be causing quite a stir in the cryptocurrency world, particularly Bitcoin.

Just hours before U.S. polling stations were about to close, crypto experts kept sharing their opinions regarding the potential future of Bitcoin and digital currencies.

Numerous financial experts believe that the unpredictable Bitcoin market fluctuations will persist post-election, with some analysts and onlookers offering their price forecasts depending on the election outcome this coming Tuesday.

According to Gautam Chhugani from the Berstein Group, Bitcoin’s value could potentially rise to around $80,000 or $90,000 if Donald Trump wins the election. Conversely, if Kamala Harris is elected, Chhugani predicts that the price of Bitcoin might drop down to approximately $50,000.

As a researcher, I must clarify that while the election may have passed, my team hasn’t ceased its Bitcoin projections. In fact, we maintain our optimistic stance on Bitcoin in the near future and anticipate that it could potentially reach $200,000 by 2025.

Based on the analysis by Bernstein experts, another significant factor influencing Bitcoin’s price is the growing interest in actual Bitcoin ETFs and the escalating U.S. debt levels.

Bernstein Adjusts BTC Price Predictions: $50K Under Harris, $80-90K With Trump

As a crypto investor, I’ve been keeping a close eye on the predictions from Bernstein analysts regarding Bitcoin’s price movement post the U.S. election. Should Vice President Harris take office, they anticipate a potential dip in Bitcoin’s value to approximately $50,000. On the other hand, if the opposite outcome occurs, their forecast suggests a possible Bitcoin surge.

— The Wolf Of All Streets (@scottmelker) November 4, 2024

Bernstein’s Bullish Outlook For Bitcoin Next Year

Analysts at Bernstein are confident Bitcoin’s price will hit $200,000 by the end of next year, irrespective of the election outcome, according to Gautam Chhugani. He also stated that the election results would not significantly affect Bitcoin’s long-term value as an asset.

The analyst’s bullish project on Bitcoin is anchored on several factors. He even likened the asset to a “genie out of the bottle” and said stopping its price trajectory is difficult.

Chhugani pointed out several elements that might influence the value of an asset, such as growing interest in Bitcoin Exchange-Traded Funds (ETFs) and a larger national debt by the government. Last month, Bernstein’s lead analyst initially estimated $100k for Bitcoin, but later adjusted his prediction to account for shifts in market conditions.

BTC’s Erratic Price Action Ahead Of Elections

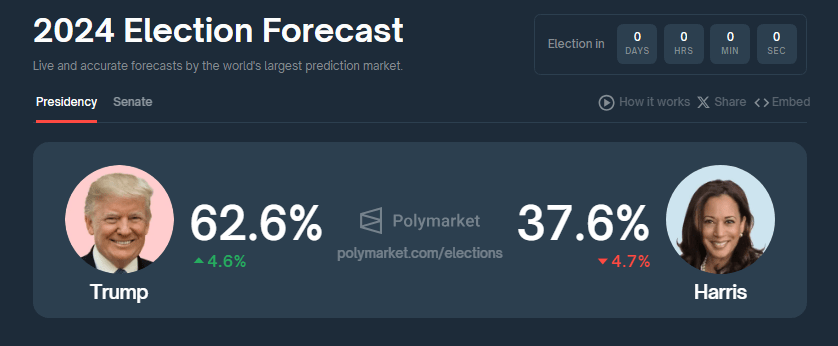

As a researcher immersed in this year’s electoral landscape, I find myself captivated by the heated contest between Trump and Harris. Beyond conventional surveys, the insights gleaned from platforms such as Polymarket, where bets are placed on election outcomes, have generated significant interest and attention.

At Polymarket, it’s Trump who currently leads the most bets, accounting for about 63%, while Harris holds the remaining 38%. According to Bernstein analysts, the value of this asset is expected to experience brief fluctuations in price, regardless of the final outcomes.

According to the same Bernstein analysis, it’s predicted that Bitcoin could potentially reach $90,000 if Donald Trump wins the election, as they anticipate greater benefits for BTC in that scenario.

As an analyst, I’ve observed a recent dip in Bitcoin’s price from $69k to $68k, primarily due to profit-taking among investors. Additionally, the inflows into ETFs this week have been relatively weak, which could be a sign of cautiousness in the market. However, despite these short-term fluctuations, most analysts, including myself, are optimistic about Bitcoin’s potential for a strong end-of-the-year rally.

US Election Results Can Impact Other Digital Assets

Other cryptocurrencies, such as Ether, could also be influenced by U.S. elections. For instance, if Harris is elected, her potential regulatory policies might restrict competitors of Ether, like Solana, thereby potentially boosting Ether’s value.

Conversely, as Chhuhani suggests, if the SEC implements more lenient regulations, it could potentially fuel the growth of Bitcoin and related assets.

2021’s political race has moved digital currencies and blockchain technology to the forefront of discussions. Both contenders have voiced their opinions about cryptocurrency, with one candidate, Trump, proposing more favorable policies for it.

At first, Harris as a Democrat seemed hesitant to present specific policies, but as the campaign progressed, her rhetoric evolved.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-11-06 02:47