As a seasoned researcher with a keen interest in the ever-evolving crypto landscape, I must admit that the rapid growth of Bitcoin ETFs is nothing short of astonishing. Having closely followed the development and approval process for these financial products, it’s truly fascinating to see how they have transformed the investment landscape in less than a year.

In just under a year since they were introduced, Bitcoin (BTC) exchange-traded funds (ETFs) have amassed more than one million Bitcoins due to high investor interest in this digital currency.

Bitcoin ETFs Surpass One Million BTC Milestone

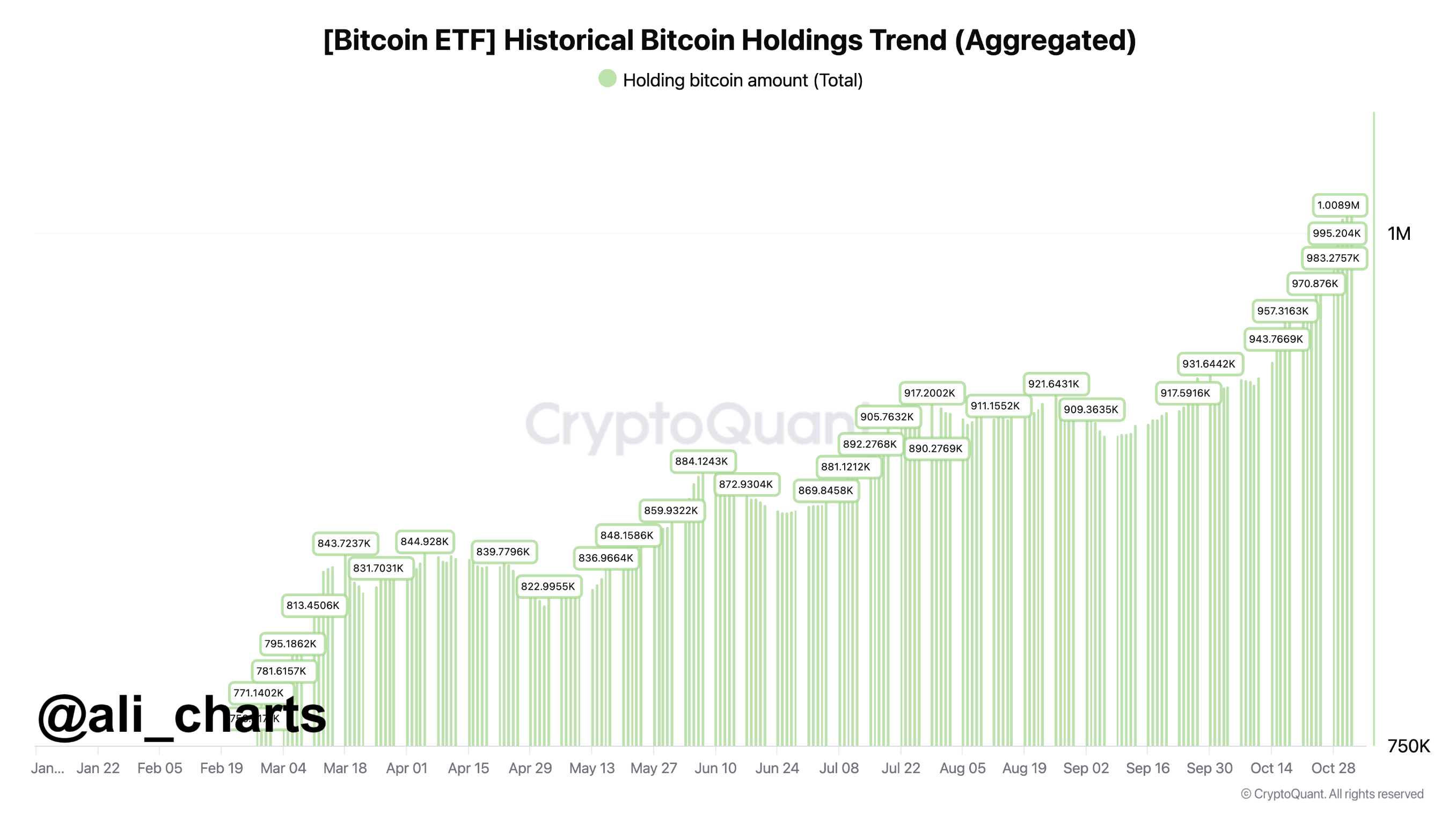

As per a chart posted by crypto analyst Ali Martinez on platform X, it’s been revealed that the total amount of Bitcoin held in Bitcoin Exchange-Traded Funds (ETFs) has surpassed one million Bitcoins over this brief timeframe.

This year in January, following careful consideration, the U.S. Securities and Exchange Commission (SEC) gave its seal of approval for Bitcoin ETFs. It would not be an exaggeration to say that these Bitcoin ETFs have been highly successful since then.

To date, Bitcoin ETFs have accumulated a combined total net investment of around $24.15 billion. Moreover, according to Martinez, the estimated worth of Bitcoin held in these ETFs is roughly $70 billion.

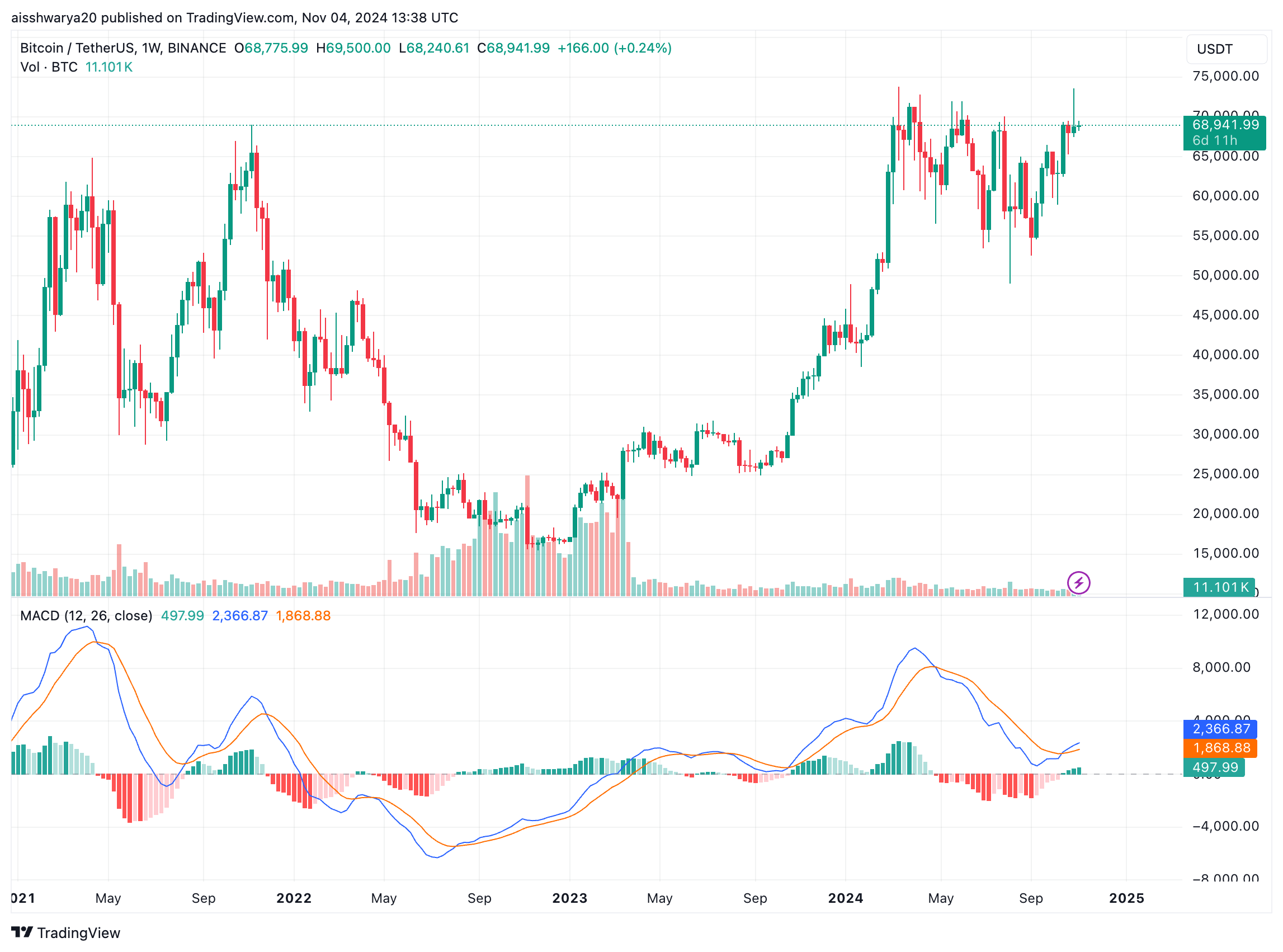

Looking at its price, Bitcoin has significantly surged from approximately $41,900 on January 8 to its current value of $68,941, representing a nearly 65% rise. Over this timeframe, it even reached a new peak (highest record) of $73,737 in March.

Approximately 5% of the total 21 million Bitcoins have been amassed within Bitcoin Exchange-Traded Funds (ETFs), emphasizing that a significant portion of this digital currency’s supply is now locked within financial investment products, thereby underscoring the concept of Bitcoin’s scarcity.

Standout is BlackRock’s IBIT spot BTC ETF, boasting around $30 billion in total assets. Grayscale’s GBTC comes second with $15.22 billion, and Fidelity’s FBTC trails behind with approximately $10.47 billion in assets under management.

The growing interest in Bitcoin ETFs is also highlighted in a recent CoinShares report, which found that digital asset investment products attracted inflows of over $2.2 billion last week.

The increase in cryptocurrency investments, as reported by CoinShares, could be due to the speculation surrounding a potential Republican win during the upcoming U.S. Presidential election on November 3rd.

It’s worth noting that more money came in at the start of the week, whereas towards the end, there were indications of funds going out, as the likelihood of Democratic candidate Kamala Harris winning increased.

Currently, as we speak, the prediction market platform Polymarket indicates that Joe Biden has approximately a 41.6% probability of winning the presidency, while Donald Trump is still leading as the preferred candidate with roughly a 58.5% likelihood.

Trump Win To Benefit Crypto, Experts Opine

It appears that when it comes to other policies, opinions tend to be more divided. However, regarding cryptocurrencies such as Bitcoin and other digital assets, there’s a general feeling that a Trump presidency could potentially be advantageous.

This past month, I’ve found myself aligning with JPMorgan’s perspective regarding Bitcoin (BTC) as an investment. For me, it’s seen more as a ‘debasement trade,’ a strategic move to safeguard the purchasing power of my assets, especially considering the current inflationary climate. Furthermore, if Trump were to secure another term, I believe this could potentially add even more value to BTC.

It’s been reported that Kamala Harris, who is currently Vice President under Biden, is adopting a new strategy towards digital assets, which differs from the seemingly cautious approach of the current administration. Time will tell if this shift will increase her appeal among crypto enthusiasts.

Currently, a single Bitcoin is being exchanged for approximately $68,941, and it has experienced a 0.8% increase over the last 24 hours. As reported by CoinGecko, Bitcoin’s dominance in the market is currently at 56.7%.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-11-05 06:04