As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed countless market cycles and their intricacies. The current situation with Ethereum (ETH) presents an interesting challenge, one that I believe could prove fruitful for long-term investors.

The price of Ethereum is currently at a vital support point after experiencing a 11% drop from its latest peak. This decrease has left analysts and investors concerned because if it falls below this level, it might spark a series of severe sell-offs, possibly causing the value of ETH to decline further.

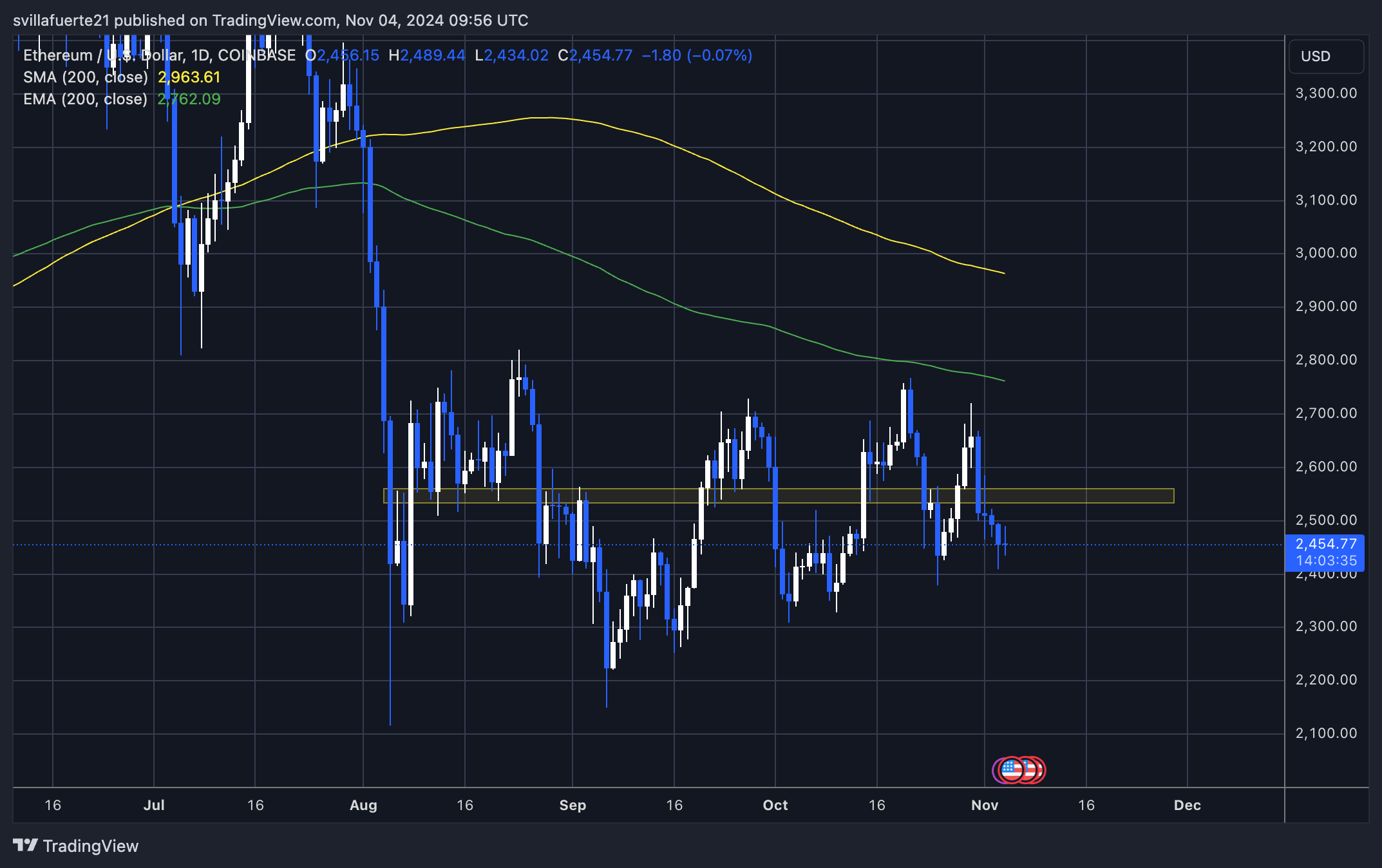

Despite some worries, renowned analyst Ali Martinez has offered an upbeat technical assessment, pointing out a robust risk-to-reward scenario on the Ethereum graph. In his view, the current position presents a tempting entry opportunity, implying that Ethereum might experience substantial growth if it manages to maintain its support level.

As an analyst, I find the timing of this potential market rebound particularly intriguing, given tomorrow’s US election. This event could significantly shape broader market sentiment, and many in the crypto community expect its outcome to pave the way for a new rally. If bullish momentum resumes, Ethereum seems well-positioned to capitalize on such a scenario.

Over the next few days, there’s a lot of anticipation about whether Ethereum can hold its current critical price range. This could either reinforce or contradict the general optimistic outlook in the cryptocurrency market. Right now, Ethereum’s price point is crucial, and traders are keenly observing for indications of its future trend amidst the election and broader economic uncertainty.

Can Ethereum Hold Above Key Demand?

Currently, the price of Ethereum is hovering near an important support point of approximately $2,450. This level is seen as a crucial defensive line by several analysts for Ethereum bulls. If this support fails, Ethereum might face a greater drop, which could lead to it being outperformed by its competitors such as Solana or Bitcoin, that have displayed stronger performance recently.

Investors are keeping a close eye on Ethereum (ETH) as it stands precariously near a significant level of support, causing some unease among them.

Despite some pessimistic views on X, top crypto analyst Ali Martinez offers a more optimistic take, indicating that Ethereum could see a substantial rebound. In his latest analysis, Martinez highlights the appealing risk-to-reward ratio for ETH, making it an enticing prospect for long-term investors to take a position on Ethereum.

Martinez revealed that he’d placed a safety measure to sell if the price drops below $1,880, which serves as a protective barrier for losses. At the same time, he is aiming for an optimistic price of $6,000, which represents a significant increase of 145% from the current prices, emphasizing his belief in Ethereum’s potential growth if it manages to sustain this critical level.

Over the coming hours or days, Ethereum’s position at around $2,450 could be critical. If it manages to gather momentum and test resistance levels, this could indicate that buyers are gaining traction and potentially moving Ethereum towards Martinez’s predicted target.

In simpler terms, it remains to be seen if Ethereum can regain its upward trend or face more downward push based on future price movements. At present, the level of $2,450 serves as a crucial benchmark for Ethereum’s short-term direction.

ETH Technical Analysis

Currently, Ethereum (ETH) stands at approximately $2,450, bouncing back robustly following an unsuccessful drop below the $2,400 threshold. This resilience offers optimism to bullish investors who anticipate a major surge in ETH prices, particularly if Bitcoin manages to surpass its previous record high.

Nevertheless, simply reaching this significant support level may not initiate a prolonged upward trend. For a more convincing uptrend, the price needs to surpass the current 200-day exponential moving average ($2,762), thereby signaling strong momentum and providing a more robust bullish perspective.

Since early August, the 200-day Exponential Moving Average (EMA) has been acting as a strong barrier for ETH’s price, consistently causing it to drop. If ETH manages to break above this average, it would suggest a significant change in trend, possibly transforming the EMA into a fresh support level. This move could pave the way for ETH to aim higher, driven by increased buyer confidence and overall market optimism.

If the EMA (Exponential Moving Average) is not regained by the bulls, Ethereum could face ongoing bear pressure and potentially more tests of its crucial support levels, including around $2,450 at present. However, if the 200-day EMA can be recaptured, it would significantly boost the bulls’ chances for a breakout and continue the upward momentum of a bullish rally.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-11-04 19:54