As a seasoned analyst with over two decades of experience in traditional and digital markets, I find myself constantly intrigued by Bitcoin’s volatile nature. The recent dip below $69,000, a critical support level, is reminiscent of the rollercoaster ride that Bitcoin often takes us on.

In recent hours, Bitcoin‘s value has seen some volatility and dropped nearly 3%. This downward trend is drawing increased focus on this leading digital currency as the U.S. election nears. Despite some analysts expressing uncertainty about Bitcoin’s short-term direction, pro-trader Justin Bennett has already offered a word of warning regarding its potential future.

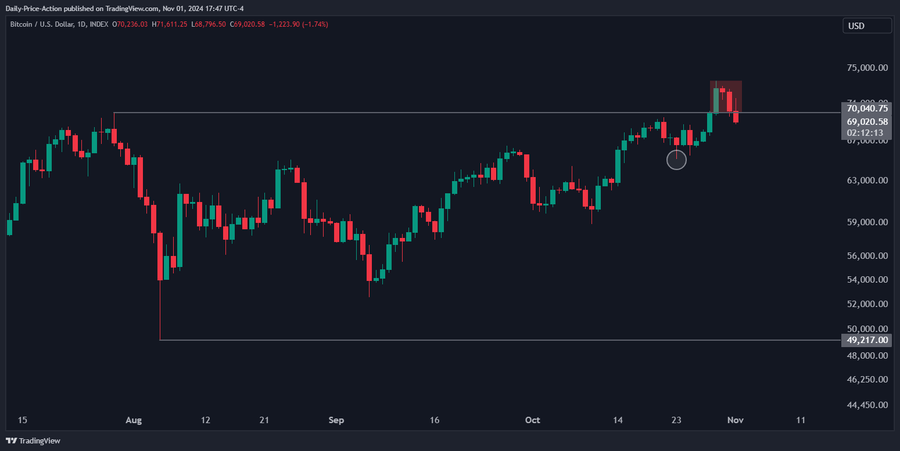

Bitcoin Breaches Crucial $69,000 Support Zone

On November 1st, Bennett posted an update on X discussing the recent fluctuations in the Bitcoin market. Specifically, he pointed out that a dip below $70,000 was cause for concern. It’s worth noting that over the past three weeks, Bitcoin had surged by more than 23%, reaching as high as $73,000 briefly before a downturn to approximately $69,000 on Friday. What caught attention was Bennett’s assertion that $69,000 served as a crucial support area for Bitcoin. He underscored the significance of the token maintaining its value above this price point, likening it to the “last line of defense” for market bulls.

Over the past few hours, the price of Bitcoin has dropped below $69,000, settling around $67,900. As predicted by Bennett, this cryptocurrency might continue to decrease, potentially reaching as low as $65,000. This level represents a significant resistance point. It’s worth noting that if Bitcoin does decline, it would suggest that the digital asset has not yet managed to break free from a prolonged consolidation pattern that has been in place for approximately eight months.

As a crypto investor, I’m optimistic about Bitcoin’s potential future price gains. Analyst Bennet predicts that Bitcoin could eventually surpass its previous all-time high of $73,750. However, he admits there’s uncertainty regarding how low the asset might dip before reaching this peak.

Ever since reaching its all-time high in March, Bitcoin has essentially been stuck within a narrow trading band, fluctuating between $55,000 and $72,000. This is surprising given the optimistic signals from the financial markets like Fed rate cuts and robust investments in the Spot Bitcoin ETF. Nevertheless, with Q4 being historically bullish for cryptocurrencies, the potential continuation of increased ETF inflows, and the upcoming US election on the horizon, there’s a strong likelihood that Bitcoin may soon break free from this range and experience a significant price surge.

Bitcoin Sentiment Bullish As US Election Approaches

Although Bitcoin’s recent price trend indicates a decrease, information from CoinMarketCap suggests that overall investor sentiment towards Bitcoin is very optimistic prior to the US general election. Historically, Bitcoin has experienced a dip in the days approaching an election, with drops of 10.2% in 2016, 6.1% in 2020, and most recently 6.3% in 2024. However, it’s important to note that there might be further price declines before the election on November 5. Nevertheless, investors may remain undeterred as Bitcoin’s value has traditionally surged after elections.

Currently, the top cryptocurrency is being transacted near $68,175 as of this writing, having experienced a 2.52% decrease in value over the past day. Interestingly, the daily trading volume has dropped significantly by 53.91%, currently standing at approximately $21.76 billion.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-11-04 12:53