As a seasoned researcher with over two decades of experience in the tech and crypto industries, I’ve seen my fair share of launches that were marred by technical issues, but still managed to make impressive price rallies. The GRASS token, being one of the latest DePIN projects, is no exception. Despite the rough start during its airdrop and launch, it has undeniably caught the attention of analysts and investors alike.

The GRASS token, a recent development from DePIN, has garnered substantial interest from financial analysts and the general public. As a Layer-2 platform operating on the Solana blockchain, Grass enables users to share their unused internet bandwidth for training AI models via a browser extension. Given its innovative technology, it’s not surprising that the token launch and airdrop on October 28th were eagerly awaited.

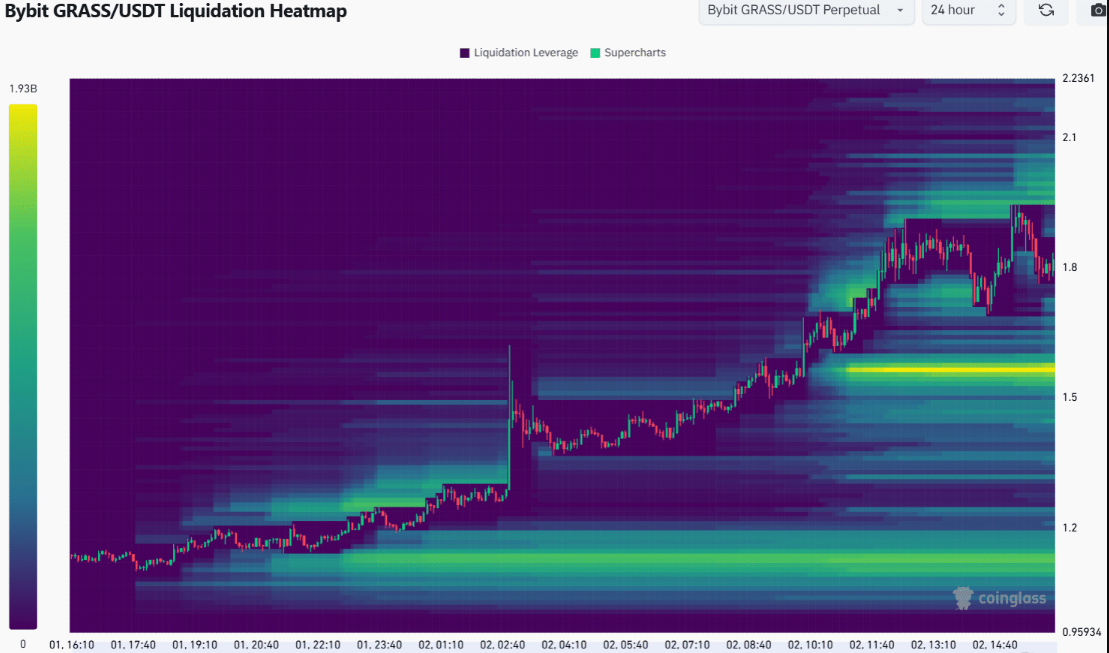

Despite some problems during the airdrop, such as a three-hour interruption, the value of the token surged dramatically. Specifically, on October 29th, the token reached its peak price, and then experienced a significant rally from October 31st to November 2nd, breaking through the $1.50 barrier.

Following a peak of $1.9175 on November 2nd, its pace has since decelerated, dropping below the $1.75 mark and currently trading at approximately $1.45. The GRASS market has thus far resisted reaching the $2 price point, leading analysts to predict a more significant dip. Given this trend, is it an opportune moment to invest?

A Rough Start For GRASS

The process of distributing GRASS tokens began on October 28th, however, there were several obstacles that hindered the token’s airdrop and launch. Technical problems occurred within the team, such as users being unable to retrieve their tokens in their Phantom wallets. Additionally, the high demand for claiming the tokens was complicated by a three-hour power outage. Moreover, some users experienced flagged transactions, and numerous individuals were excluded from receiving the airdrop.

What on earth? Since the very beginning (Epoch 1), I’ve been utilizing @getgrass_io / @grassfdn, but now after 10 months, it claims my wallet isn’t eligible? Is this true?#grassairdrop #grassfoundation #grassScamConcern

— Phantom Soul (@PhantomSoulll) October 28, 2024

Initially, a sum of 1 billion GRASS tokens was distributed. Out of this amount, 10% were allocated to early backers and participants. As of now, it’s premature to fully understand the impact of these matters on GRASS, but the token has had a promising start in terms of its price performance.

Token Tries To Breach $2

As a new crypto investor, I find it hard to decipher GRASS’s price movement given its recent debut. Yet, upon scrutiny, analysts foresee a bullish trajectory on the lower timeframes of the chart. Moreover, the token has demonstrated above-average trading volume in the past 24 hours, which is worth noting.

Additionally, the token’s balance volume and price started rising from October 30th. Essentially, this indicates growing demand for the token, potentially signaling imminent price growth.

Conversely, GRASS failed to accept the $2 level, establishing this as the temporary psychological barrier for the token. Analysts speculate that the price might decrease to $1.75 because the RSI indicates a bearish trend.

Other Analysts See A Deeper Dive For GRASS

According to the technical analysis, there are two significant pockets of trading activity found at $1.56 and $1.96. At the moment, the price seems to be hovering near the liquidity pool at $1.56, while the token shows signs of resisting the $1.96 level.

Given the downward trend and the presence of a liquidity pocket at $1.56, it’s likely that the price could fall below $1.75. Swing traders and new investors looking to enter the market might consider waiting for the token to revisit $1.56 or potentially even $1.4 before making their move.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

- Best Japanese BL Dramas to Watch

2024-11-04 12:49