As an analyst with extensive experience in the cryptocurrency market, I find myself intrigued by Ethereum’s current situation. The $2,500 price point presents a unique opportunity for long-term holders, as suggested by top analyst Carl Runefelt. His technical analysis points to a promising setup for accumulation, with ETH‘s bullish pattern emerging around an ascending support level of $2,450.

Ethereum is currently being traded at approximately $2,500, having experienced a 9% drop from its peak after it couldn’t surpass the $2,820 mark and set a new high. This dip has ignited fresh curiosity among investors, as top analyst and investor Carl Runefelt has shared technical analysis suggesting a potentially advantageous setup for buying or accumulating Ethereum.

Runefelt points out a positive trend in Ethereum’s price movements, suggesting that the current dip might present an excellent chance for long-term investors to gather additional Ethereum, possibly ahead of an upcoming surge.

Over the next few days, Ethereum’s fate is significant as the cryptocurrency world keenly observes Bitcoin‘s efforts to surpass its previous record highs. If Bitcoin manages to do so, it will signal the start of a new bull market, which could potentially pull Ethereum up along with it.

The crypto world is excitedly watching as Ethereum tries to maintain its position above $2,400 and push beyond the resistance at $2,820, which might pave the way for further price increases. The current level of Ethereum and its consolidation period indicate that a significant shift could take place soon, making this an important moment in Ethereum’s overall trend within the larger market cycle.

Ethereum Sideways Consolidation

Ethereum appears to be trailing behind Bitcoin and various other cryptocurrencies such as Solana that have experienced stronger market activity lately. This underperformance has sparked interest from both analysts and investors, including prominent analyst Carl Runefelt, who recently provided a detailed technical breakdown of its performance (X).

Runefelt points out that Ethereum is currently structured around an increasing support line, indicating that the current Ethereum price might offer one of the most advantageous periods for amassing ETH ahead of a probable surge.

Runefelt’s examination indicates a significant rising support level near $2,450 remains strong even during Ethereum’s declines, preserving a bullish pattern. He highlights that if Ethereum keeps falling, this support could present an appealing opportunity for long-term investors to purchase ETH at a discounted price as it appears undervalued.

Based on the chart pattern, it seems there might be a potential support level. If traders decide to buy at this point, it could lead to an upward trend.

From a positive perspective, Ethereum encounters a critical barrier around $2,800. As per Runefelt’s observation, breaching this barrier could instigate a substantial surge, possibly aligning ETH with broader market tendencies if Bitcoin surges to new record highs.

As a researcher observing the cryptocurrency market, if Ethereum manages to surpass the $2,800 mark, it would be a strong indication of a bullish trend. This breakthrough could suggest that Ethereum is poised for growth, potentially rivaling Bitcoin and outperforming other altcoins. Such a development would undeniably enhance the overall appeal of ETH within the broader cryptocurrency market.

Over the coming days, Ethereum’s future direction is significant as it maintains its position above a critical support line. Many traders and investors are keenly observing whether ETH can surge past its recent sluggishness and regain its status as a leading altcoin.

ETH Technical Details

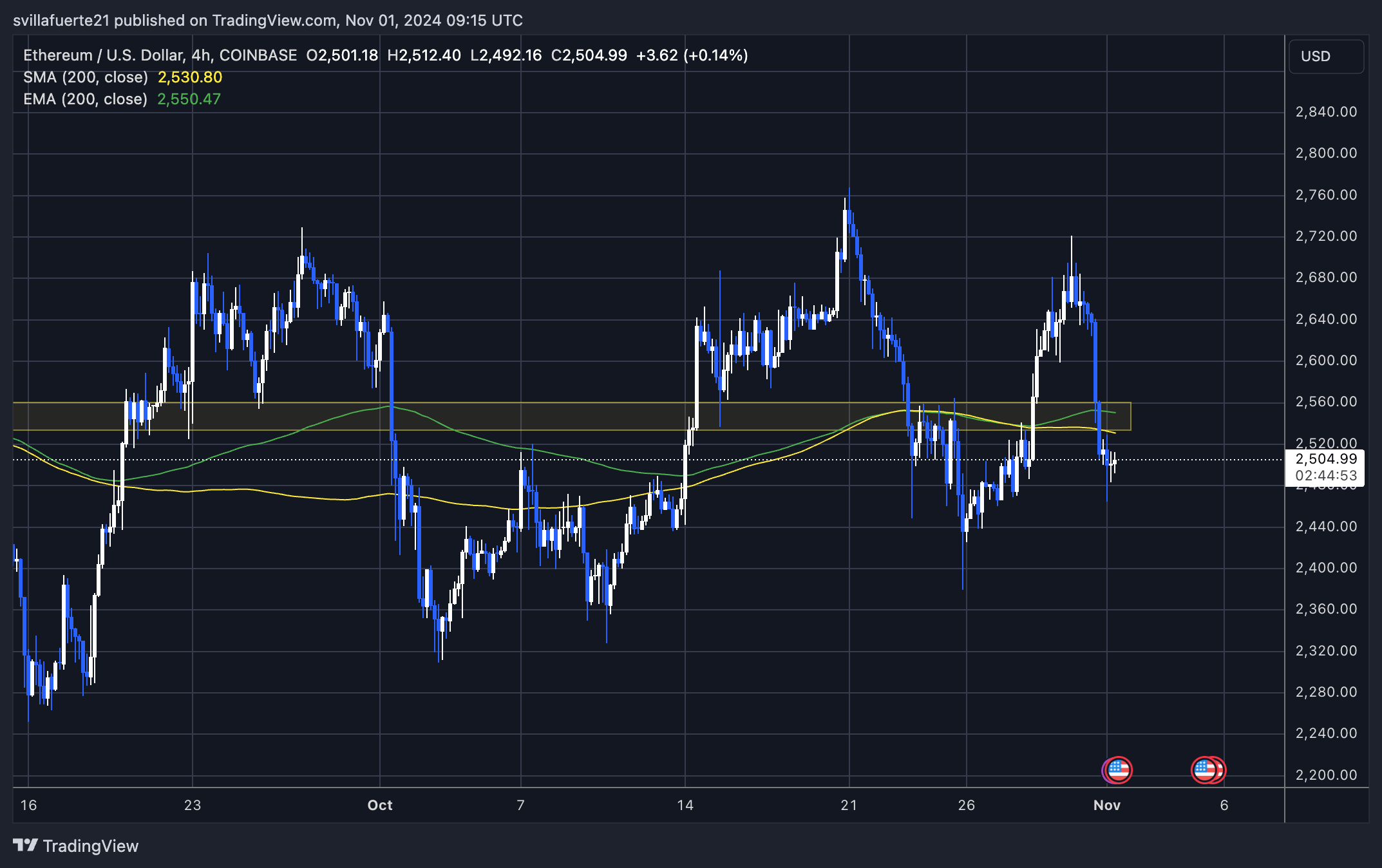

Currently, Ethereum is priced at $2,505 following an unsuccessful effort to maintain its value above the 4-hour 200 moving average (MA) of $2,530. Dropping below this MA has left Ethereum in a vulnerable state as it searches for new price points to balance out the recent decline. The price is approaching a critical support zone, and if it falls beneath this region, it could initiate a substantial correction, potentially increasing the downward pressure on Ethereum’s current market movement.

To prevent Ethereum from experiencing a significant decline further, it’s crucial for it to find stability around the $2,450 price point. If buyers become active and maintain ETH above this figure, it could suggest a change in market direction toward optimism. An even more promising bullish sign would be if ETH surges past $2,550, which might rebuild investor trust and hint at an impending recovery phase.

Making such a move might signal the conclusion of the retracement, setting Ethereum up for potential increases in the upcoming periods. Yet, until the price establishes strong support, Ethereum could still be susceptible to additional drops. Therefore, this juncture is crucial for Ethereum’s short-term prospects.

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Who Is Stephen Miller’s Wife? Katie’s Job & Relationship History

- POPCAT PREDICTION. POPCAT cryptocurrency

- Dig to Earth’s CORE Codes (May 2025)

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- The Righteous Gemstones Season 4: What Happens Kelvin & Keefe in the Finale?

- King God Castle Unit Tier List (November 2024)

- Green County map – DayZ

- Star Trek: Section 31 Digital, 4K, Blu-ray, & DVD Release Date Set for Michelle Yeoh Movie

2024-11-01 22:18