As a seasoned crypto investor with over five years of experience navigating the volatile digital asset market, I can’t help but feel both excited and cautiously optimistic about Bitcoin’s current positioning. With its recent surge to $69,000 and holding above this critical level, it appears that we may be on the brink of a breakthrough into uncharted territory.

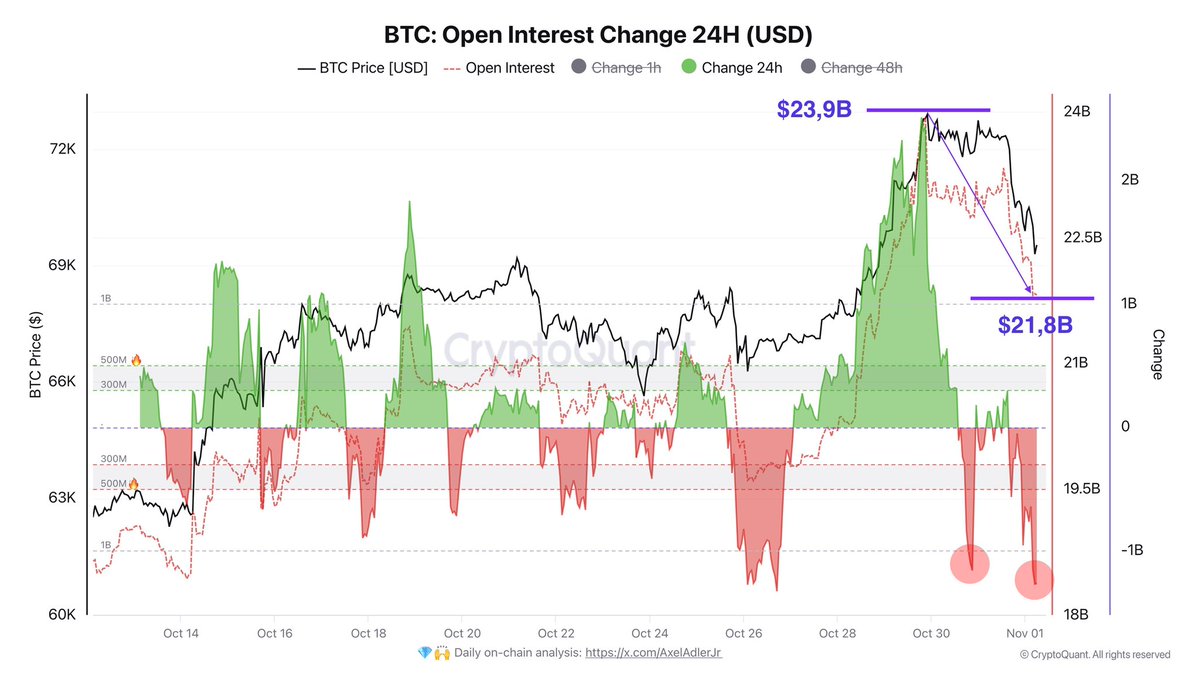

At the moment, Bitcoin is being traded above $69,000, after experiencing a 6% decline from its highest point at $73,600. The escalation in open interest has been a major contributor to Bitcoin’s price fluctuations, as open interest peaked at an impressive $23.9 billion on October 30, signifying increased market participation.

Over the last day, data from CryptoQuant shows that open interest has dropped by approximately $2.1 billion, indicating a change in trend as Bitcoin’s price moves towards lower values.

As a researcher observing the current market dynamics, I’m keeping a keen eye on potential buying interest from spot investors in Bitcoin (BTC). Such activity could serve as the spark needed to ignite another rally for BTC, given its proximity to significant support levels. If this momentum materializes, it might pave the way for a robust recovery.

Over the next few days, I find myself in a state of anticipation alongside traders and analysts, eagerly waiting for potential fresh inflows that could bolster Bitcoin’s robustness and ready it for another attempt at reaching its all-time highs. At present, Bitcoin is maintaining its position around $69,000, and the overall market sentiment remains guardedly optimistic. I am closely monitoring spot activity to ascertain whether this temporary pullback might soon transition into renewed vigor.

Bitcoin Hype Slowing Down?

Bitcoin’s recent surge in market interest has almost reached its record high from March, sparking discussions about a major breakthrough. Yet, this momentum seems to be waning as Bitcoin hasn’t managed to set a new peak, and the open interest – a gauge of total futures contracts value – is now decreasing.

Renowned analyst Axel Adler recently shared key data on X, revealing a $2.1 billion reduction in open interest within the last 24 hours. This decline, from a peak of $23.9 billion to $21.8 billion, indicates that speculative futures trading alone may not be sufficient to push Bitcoin to new heights.

Adler proposes that in order for Bitcoin to surpass this threshold, there needs to be increased participation from direct buyers (referred to as spot investors) in the market. As futures markets appear to be diminishing, purchases by these fresh spot investors could serve as a significant trigger, propelling Bitcoin beyond its previous record high and potentially paving the way for further growth.

The importance of timing is significant right now, considering that Bitcoin is nearly at its all-time high. With the U.S. election scheduled for November 5th approaching, there’s an additional factor that could cause market turbulence. Many investors are looking to this election as a potential trigger for a broader market surge, and some predict a Bitcoin price increase might follow if there’s a significant political event.

Currently, Bitcoin is slightly below its highest recorded value, yet the futures market is retreating. This has caused a shift in focus towards spot purchases as they could influence whether Bitcoin can continue its upward trend. As Bitcoin maintains close proximity to its record highs, the coming days are crucial for determining its short-term path and the possibility of another bullish phase.

BTC Holding Above Key Levels

At present, Bitcoin is trading beyond the significant threshold of $69,000, a level that had served as robust resistance since late July. Maintaining this price point as a support level is crucial for Bitcoin bulls who are aiming to drive BTC towards fresh record-breaking highs.

As a researcher observing the Bitcoin market, if the price consistently holds above $69,000, it might pave the way for an unprecedented leap into unexplored territory, initiating a phase of price discovery. Conversely, should Bitcoin’s price dip below this threshold, it would suggest that the asset requires further momentum to challenge and exceed its record high.

If Bitcoin experiences a decline, $66,500 is an important level that could act as support. This point would help preserve Bitcoin’s bullish trend and offer a strong foundation for a possible recovery. Such a drop might spark new buying activity and provide the necessary momentum to further fuel Bitcoin’s surge, setting the stage for another round of price exploration in the market.

With Bitcoin currently holding steady near a crucial support point, investors are keeping a close eye for indications of sustained growth or a beneficial correction that strengthens the foundation for the upcoming rise. Maintaining above $69,000 is essential, and even a short-term drop to $66,500 would preserve Bitcoin’s overall bullish perspective.

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2024-11-01 15:40