As a seasoned analyst who has witnessed Bitcoin’s rollercoaster ride for over a decade now, I find myself on the edge of my seat as BTC hovers tantalizingly close to its all-time high. The current consolidation phase is reminiscent of a cat ready to pounce, and it’s only a matter of time before we see the next big move.

Since Tuesday, Bitcoin has been moving within a narrow 4-hour price band spanning from $71,300 to $73,300, indicating potential for a substantial shift in the near future. This zone is under close scrutiny by analysts and investors as Bitcoin approaches its record high (peak value).

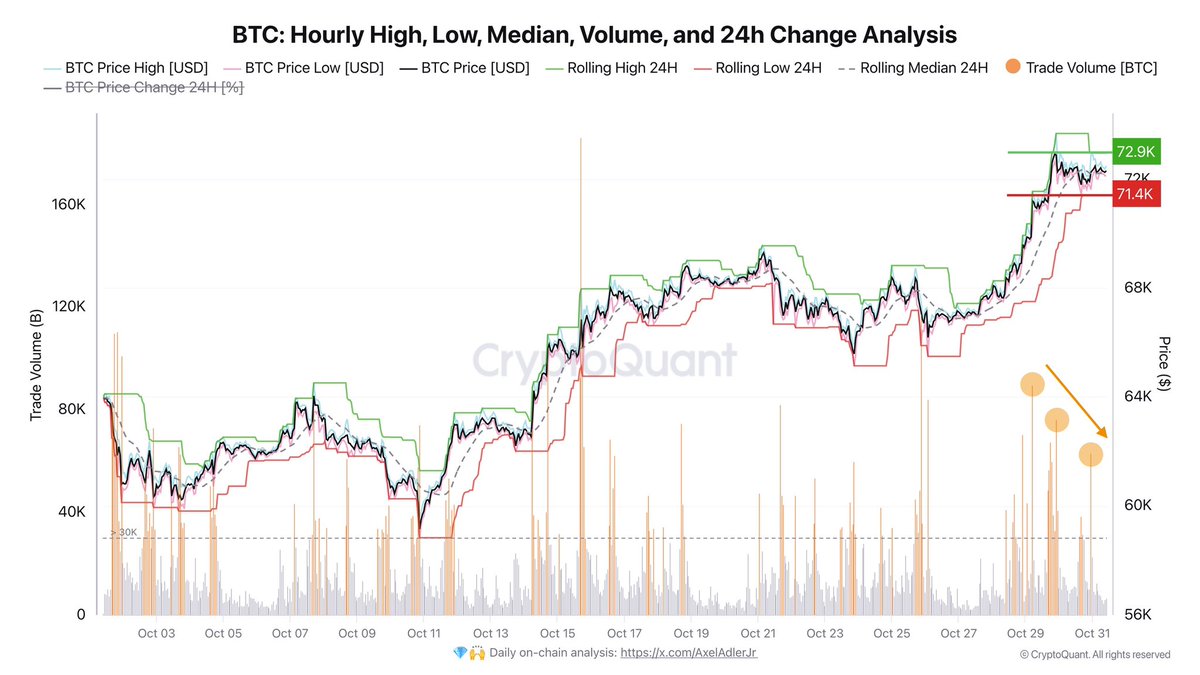

According to expert analyst Axel Adler’s latest insights, data from CryptoQuant reveals that Bitcoin’s trading volume is gradually dropping since it’s staying at its current levels. Generally, such a drop in volume suggests a period of consolidation, which typically occurs before a significant price movement.

Excitement grows as the U.S. election approaches on November 3rd. The general market mood is positive, and there’s a strong belief that Bitcoin could soon burst free from its current boundaries. This breakout might lead it to reach new heights or undergo a beneficial correction, which could boost its future growth even more.

Over the next few days, Bitcoin’s future course may be significantly influenced as traders determine if the current period of consolidation will result in a groundbreaking leap into unexplored regions. With Bitcoin approaching its all-time high (ATH), the scene is set for a critical move that could influence the market trend until the end of this year.

Bitcoin Price About To Move

Bitcoin finds itself at a pivotal juncture in its current cycle, reaching the end of approximately a 7-month phase of accumulation, suggesting it may soon challenge previous record highs. As per a recent analysis by CryptoQuant analyst Axel Adler, Bitcoin is currently confined within a range, oscillating between $72,900 as resistance and $71,400 as support. Notably, trading volumes have been steadily decreasing.

As suggested by Adler’s analysis, the narrowed extent of Bitcoin’s current boundaries seems to indicate an upcoming breakout. Yet, it appears that a fresh factor is required to stimulate this transition and propel BTC beyond its prior record-high levels.

The approaching U.S. election might serve as a significant trigger, and its results could have varying effects on financial markets. There seems to be a general expectation that if Donald Trump wins again, it could fuel optimistic attitudes in the stock market, potentially boosting Bitcoin’s price trend.

Observers believe that this crucial occurrence could serve as a catalyst for Bitcoin’s price to surpass its previous record of $73,794 and venture into unprecedented pricing realms, according to their expectations.

A strong escape from its current price limits might lead Bitcoin into a phase of price exploration, during which fear of missing out (FOMO) could boost buying activity, intensifying the upward trend. Conversely, if Bitcoin is unable to reach new heights, it may slide back towards lower support zones, possibly leading to further consolidation until sufficient momentum is regained.

BTC Flirting With ATH

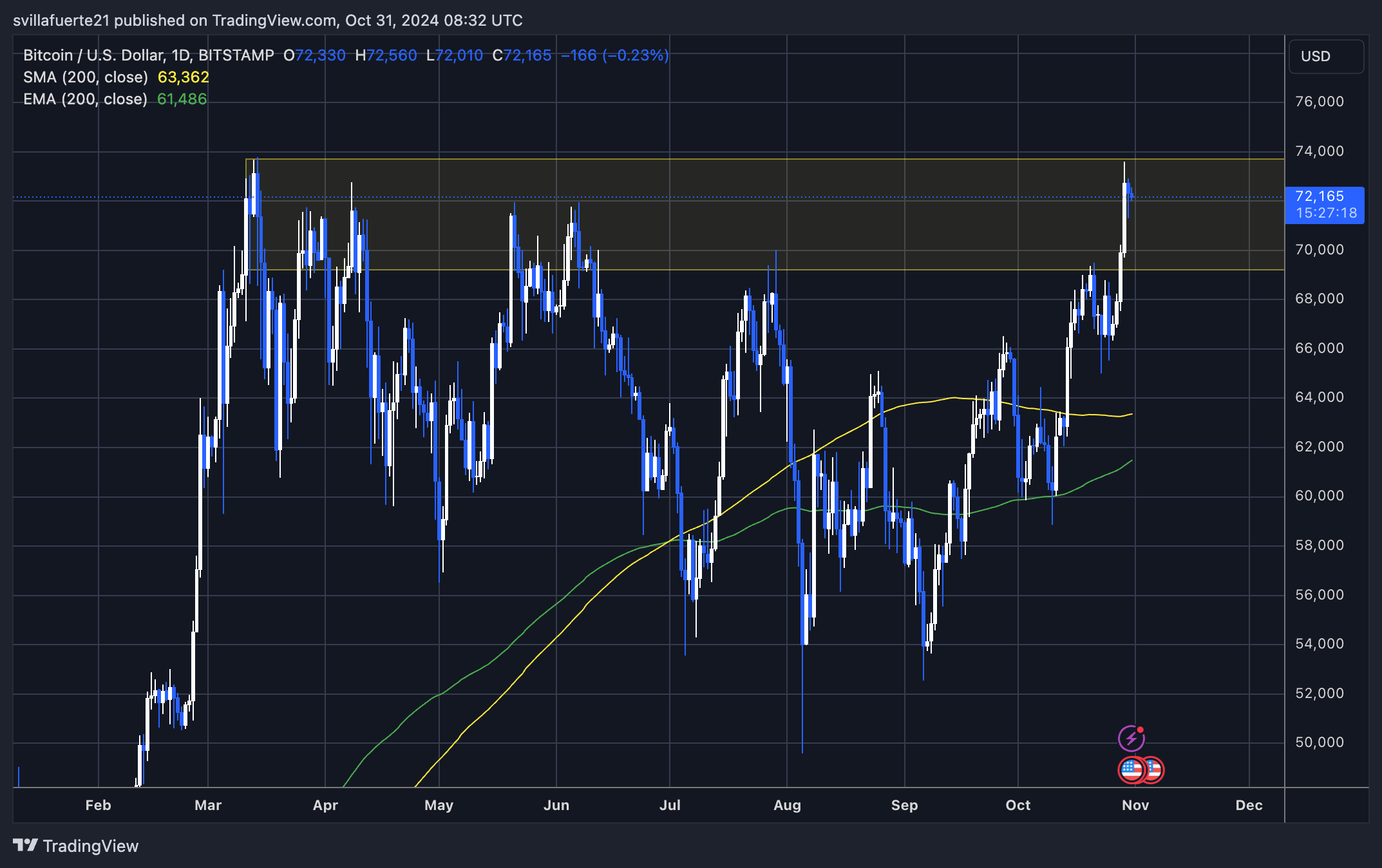

Bitcoin remains robust over the $72,000 mark, approaching its previous record high and venturing into a period of price exploration. This stage often triggers substantial growth due to increased optimism among investors and heightened demand for purchasing.

Nevertheless, Bitcoin hasn’t managed to surpass its all-time high ($73,794) definitively, and it could drop briefly below $70,000 if the demand doesn’t pick up quickly.

The significant support level at $71,000 is crucial for Bitcoin now. If the price manages to stay above this point over the next few days, it could lead to a strengthening trend, making a strong push towards the All-Time High (ATH) more likely. This might initiate another round of optimistic feelings among Bitcoin investors.

Observers in the trading and investment world keep a keen eye on Bitcoin’s behavior around the $73,794 mark, understanding that a consistent rise beyond this point might indicate the beginning of a strong upward trend, as Bitcoin ventures into unexplored territories.

For now, a brief dip to lower support points could offer the necessary liquidity to drive Bitcoin past its current resistance. This could happen either through a strong advance or a slight correction. Given Bitcoin’s current stability above $72,000, it seems likely that we will soon see a test of the All-Time High (ATH), with further price increases and new record highs on the horizon.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-10-31 13:34