As a seasoned researcher with extensive experience in the cryptocurrency market, I find Taran Sabharwal’s analysis of Celestia (TIA) to be compelling and well-researched. The insight into the unlock dynamics and potential impact on TIA’s price action is valuable information that market participants should consider.

Taran Sabharwal, CEO of Stix, a well-known OTC trading platform focusing on private crypto transactions and liquidity solutions, recently discussed the upcoming release of the Celestia (TIA) token, scheduled for October 31, 2024. His perspective indicates that the market might be undervaluing the possible effects on TIA’s price trend as we approach November.

Why Celestia (TIA) Could Be A Buy

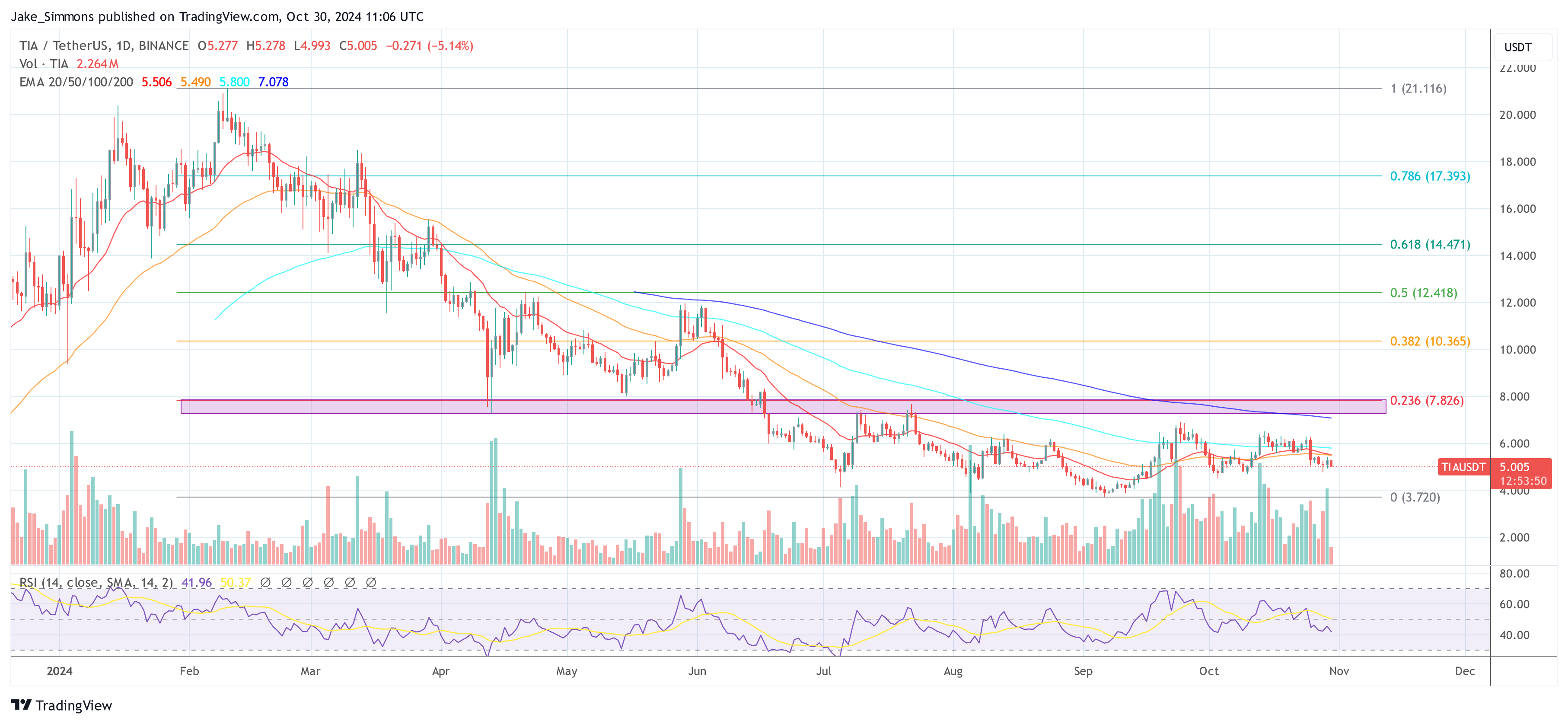

Sabharwal started off by explaining, “TIA is an over-the-counter (OTC) story we’re looking at. Using data from the Celenium.io API, we analyzed how the unlock dynamics could influence TIA’s Price Action heading into November. The findings are displayed in the table above. In summary, approximately 92.3 million TIA tokens will be available following the unlock, which would establish the highest potential for overall spot selling pressure.

It’s worth noting that this figure represents less than half of the overall cliff unlocks, implying that the true sell pressure could be just half as much as the market has been expecting. Furthermore, Sabharwal emphasized that the actual increase in supply compared to the current one suggests a 41.8% dilution.

A crucial aspect influencing this situation is the actions of Over-The-Counter (OTC) purchasers who bought substantial quantities of the initial release and secured themselves by trading on everlasting futures, resulting in a dramatic increase in open interest over the past few months. As he put it, “We anticipate that many of these short positions will be closed out, to some extent lessening the selling pressure in the spot market.” This closing down could indicate a positive trend for spot buyers, as it might lead to a reset in funding rates.

Sabharwal’s analysis incorporated several crucial presuppositions. Over-the-counter (OTC) round buyers are hypothesized to have an 11 million TIA threshold for unlocking, categorized under the group of tokens not staked because these tokens were sourced from treasury wallets that weren’t identified on the blockchain explorer. His team charted a total of 292 vesting wallets, but acknowledged some discrepancies, which were likewise classified in the non-staked category.

Looking back at TIA’s Over-the-Counter (OTC) market transactions on Stix, Sabharwal noted that Celestia has been particularly active among the traded assets during this market cycle. At the start of the cycle, it provided a tempting prospect for directional investors, while those selling were keen to capitalize on substantial unrealized gains, without anticipating a bullish Q3 2023 market.

He continued: “In Q1 2024, the bull had matured and TIA rallied to $20+. OTC activity was minimal here as sellers didn’t want to take larger discounts (40+%) and buyers didn’t want to bid higher than the $8.5 ceiling. We saw almost no activity as sellers were ‘feeling’ rich and wanted to stay risk-on, despite having the opportunity to realize 100-800x on their investments.”

As an analyst, I observed a significant change in the market dynamics when TIA dipped below $5. This occurred approximately during the time when the Celestia Foundation initiated its Over-The-Counter (OTC) fundraising round of $100M at $3. Sabharwal pointed out that the vesting structure for both new and existing private investors was similar, with a 33% unlock scheduled on October 31, 2024, which is less than two months from the round commencement, followed by a 12-month linear unlock.

In the periods spanning from the third to the fourth quarter of 2024, there was a significant increase in over-the-counter (OTC) trading activity, with sellers unloading numerous positions. Notably, Stix has managed around $60 million worth of TIA trade volume since July. Given that Stix is believed to account for 75% of the OTC market share, it’s possible that the overall trading volume could surpass $80 million across all platforms during this timeframe.

In summary, Sabharwal found that shorts will continue to unwind during the unlock period, and funding rates could reset to zero or even become positive. Additionally, those who didn’t meet the 9th October unstaking deadline might have unstaked their coins in October, adding to the available supply for sale in November. Essentially, this significant surge in supply, combined with reduced OTC discounts, could lead to increased activity for the coin, as it’s one of the most widely discussed unlocks during this cycle.

Renowned crypto analyst Will Clemente also weighed in on the developments via X: “Great piece on $TIA OTC activity by Taran from Stix. TLDR: OTC discount to spot in the private market has compressed over the last year, showing growing demand into the unlock. Stix alone has done $60mm in TIA OTC volume since July.”

Clemente expressed his viewpoint regarding the possible market implications: “I believe that the recent Bitcoin price movement has significantly reduced the likelihood of a bearish outcome for Thursday’s TIA release to almost none. With six months of accumulation following an 80% drop, high volumes in over-the-counter transactions, this being one of the most anticipated unlocks in crypto history, massive short positions, and Bitcoin approaching all-time highs, I am currently long.

At press time, TIA traded at $5.00.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Overwatch 2 Season 17 start date and time

2024-10-31 02:10