As a seasoned analyst with years of experience navigating the crypto market, I can confidently say that the upcoming week is shaping up to be one of the most volatile periods we’ve seen for Bitcoin (BTC) in recent memory. The convergence of geopolitical uncertainties, macroeconomic factors, and the “Trump Trade” narrative has created a perfect storm that could potentially drive BTC prices to new heights.

Based on Bitfinex’s analysis, it appears that the volatility of Bitcoin (BTC) is expected to increase over the coming week. A combination of geopolitical and macroeconomic factors has had a significant impact on Bitcoin’s performance. These include the upcoming U.S. election results and the close of Q4, which could potentially drive Bitcoin’s price up to $80,000 by the end of this year.

Bitcoin Volatility About To Reach Its Peak

According to the latest update from cryptocurrency platform Bitfinex, there’s a possibility that Bitcoin’s value could reach $80,000 by year-end. This forecast is based on several factors including global political instability, economic trends, seasonal patterns, and the growing impact of the “Trump Trade” phenomenon.

From my analysis perspective, it’s evident that historical trends indicate that global economic shifts and geopolitical events have played a significant role in determining Bitcoin’s value. In more recent times, this trend seems to be particularly influenced by the upcoming U.S. Presidential elections, with their anticipated outcomes potentially shaping the price movements of the world’s largest cryptocurrency by market capitalization.

This year’s election results, taking place in a week, have significantly impacted Bitcoin’s performance. Both presidential contenders, including Donald Trump from the Republican party, have recognized the importance of the cryptocurrency industry. In fact, Trump has emerged as a strong advocate for this sector, wholeheartedly endorsing Bitcoin and cryptocurrencies.

Trump’s supportive attitude towards cryptocurrencies boosted the connection between the likelihood of a Republican candidate winning and Bitcoin’s price trend. Essentially, the “Trump Trade” concept signifies the market’s perception of Bitcoin’s potential performance based on the results of the election.

According to the report, this account has contributed to Bitcoin’s price fluctuations, causing it to experience significant intrawek corrections followed by recoveries. Last week, BTC dipped by 6.2% and approached the $65,000 support level before regaining the $68,000 threshold again.

As a crypto investor, I’m keeping a close eye on the analysis from Bitfinex, suggesting that this current pullback could be just the beginning of a series of “tug-of-war price fluctuations” leading up to the elections. These movements might impact Bitcoin’s short-term value due to heightened speculation and volatility.

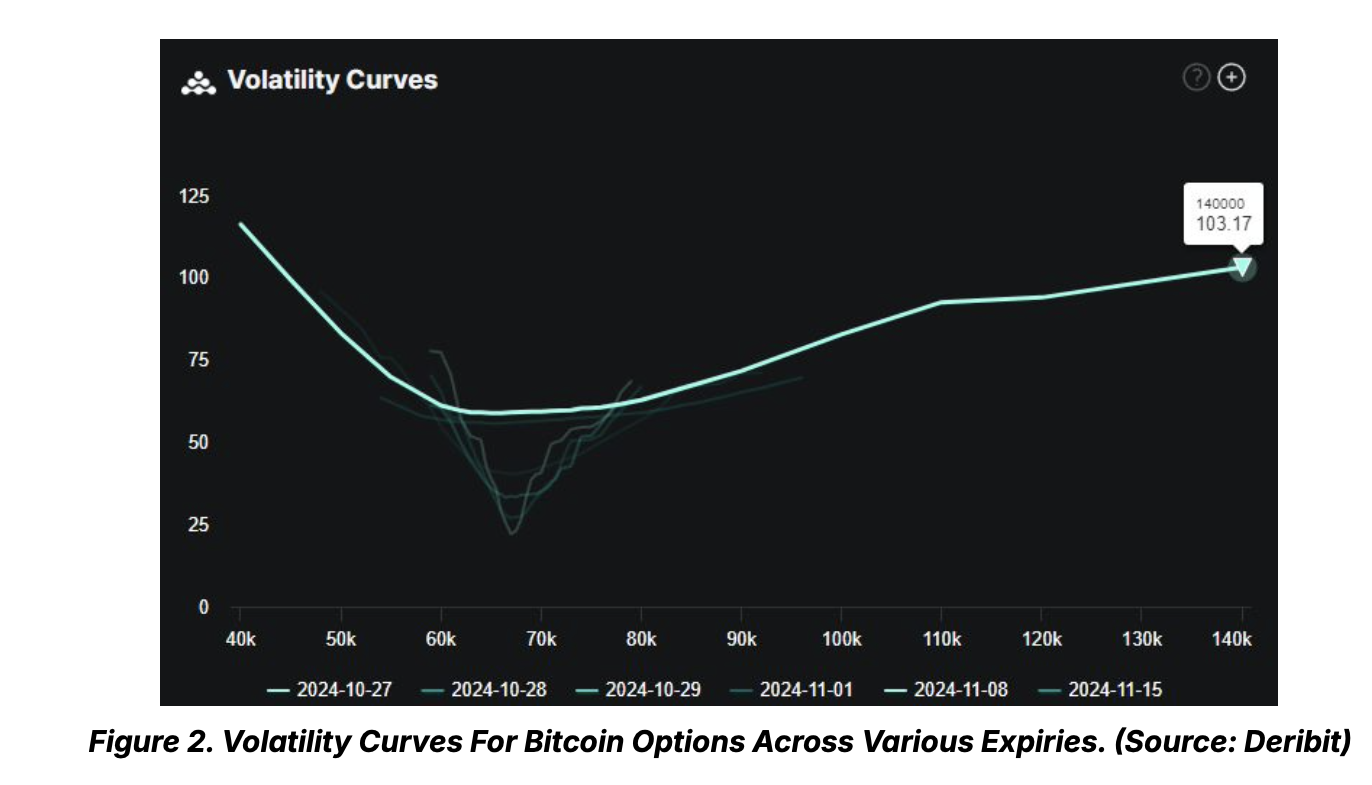

Furthermore, it’s anticipated that the costs for options and the estimated daily fluctuation in both the US stock market and Bitcoin will increase substantially in the upcoming week. The report highlights that Bitcoin’s volatility is likely to peak around November 6th through November 8th, coinciding with the expected delivery of the Election results.

According to reports, the IV for the November 8 strike price could potentially exceed 100 for Bitcoin options with a strike price above $100,000. This means that there’s a high level of expected volatility in the future price movements of Bitcoin.

BTC Poised To Hit $80,000 In Late December

The report observed that Bitcoin demonstrated robustness even as volatility grew. In fact, it “has maintained its fortitude” and has risen approximately 30% compared to its levels in September, rebounding from the previous month’s decline.

Furthermore, Bitcoin wrapped up September – a traditionally difficult period for this digital currency – by registering a 7.29% rise, marking its best monthly close ever. However, the exchange’s forecast indicates that October’s closing might not be as impressive, given the expected volatility.

Despite this, experts at Bitfinex predict that the traditionally bullish trend of Q4 could potentially lead to an upward surge for Bitcoin. The market has witnessed a significant increase in the number of calls being held in end-of-year options during the past few weeks.

In simpler terms, Bitcoin (BTC) might keep showing increased ups and downs, possibly experiencing significant decreases in the near future. However, the overall trend suggests that it could climb beyond its previous record of $73,666 set in March following the elections.

To wrap up, options for call contracts with an expiration date of December 27 and a strike price of $80,000 have been gradually accumulating, implying that this level might be attainable by the end of the year. At present, Bitcoin is being traded at $71,197, representing a daily increase of approximately 3.4%.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-10-30 06:05