As a seasoned analyst with years of experience in the crypto market, I’ve seen my fair share of bull runs and corrections. Looking at Solana (SOL) right now, it’s clear that this Layer-1 competitor is making waves, having outperformed Bitcoin and other altcoins this month. However, as with any investment, it’s crucial to consider all factors before jumping in.

In October so far, Solana, a rival to Ethereum on Layer-1, has surpassed Bitcoin and other altcoins with impressive 15% gains. Currently trading around $180, SOL is at a pivotal point, potentially aiming for prices above $200. Yet, there’s a sign suggesting it may be overvalued, which could potentially slow down the Solana rally.

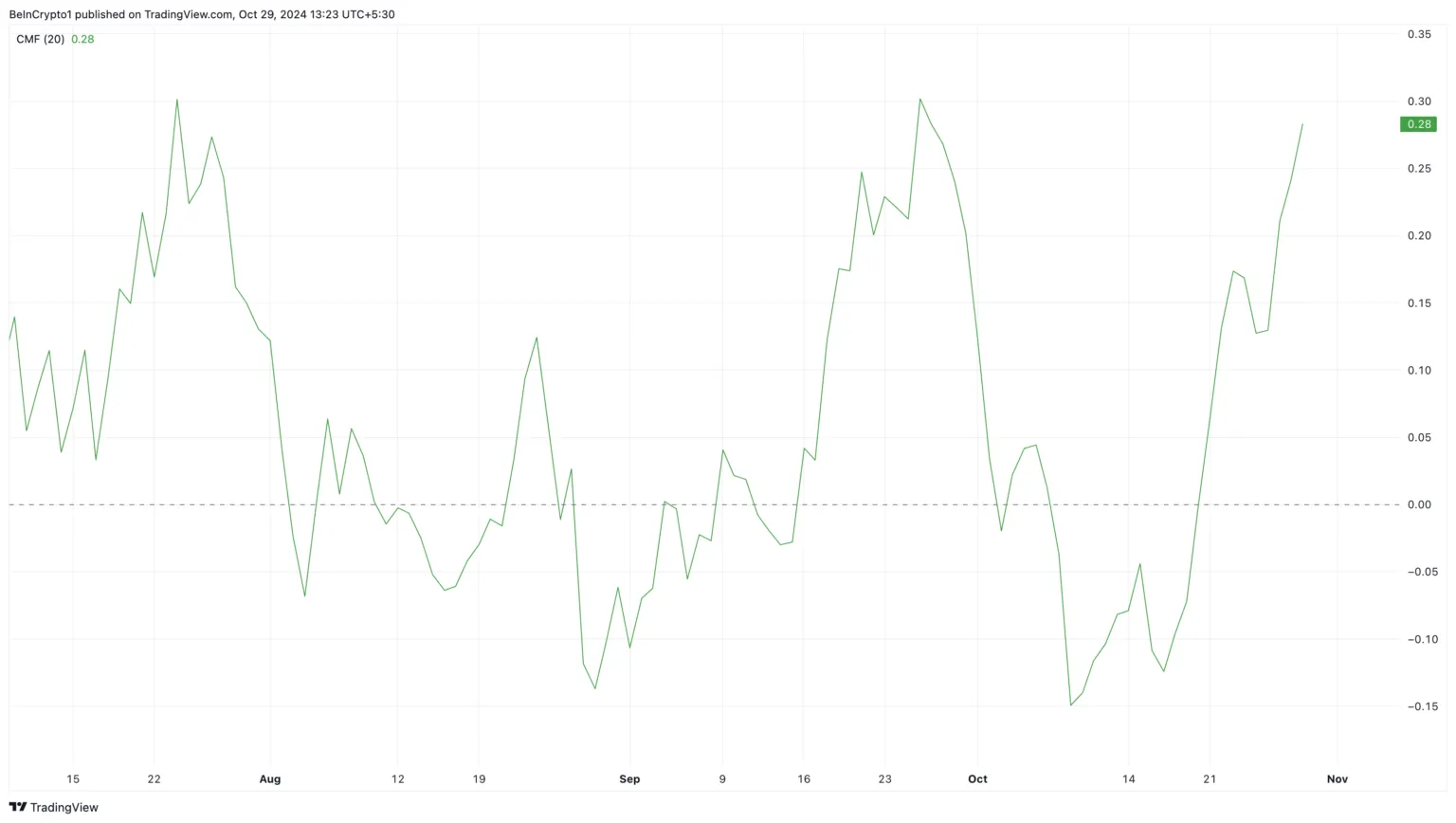

As a researcher, I find that the Chaikin Money Flow (CMF) serves as a valuable signal hinting at a possible correction for Solana. This technical indicator measures the balance between accumulation and distribution of the altcoin, providing insights into the overall buying and selling pressure within its market.

A declining CMF, particularly during a price increase, indicates weakening buying pressure. In contrast, a rising CMF amid an upward trend signifies strong buying support. Additionally, the CMF helps identify whether an asset is overbought or oversold.

When the Composite Money Flow (CMF) exceeds 0.20, it suggests an overbought market situation, while a CMF below -0.20 points towards an oversold condition. In the case of Solana, the CMF has risen to 0.28, demonstrating that the upward price trend has been fueled by substantial buying activity. This implies that the demand for SOL is robust and the market pressure is high, causing speculation about whether the SOL price will sustain its rally towards $200.

Courtesy: TradingView

The Money Flow Index (MFI), another useful indicator for investors, currently signals some caution. Right now, SOL’s MFI value has surpassed 80.00, suggesting that SOL is overbought and may require a brief cooling-off period before a significant price increase occurs. Conversely, if the MFI reading falls below 20.00, it would indicate oversold conditions for SOL, implying a potential pause or correction in its current downward trend. In essence, the Sonala price rally might need to slow down slightly before witnessing a major upward surge.

Courtesy: TradingView

The Possible Solana Price Action Ahead

In the long term, the overall feeling among traders is very positive about Solana (SOL), viewing it as a possible challenger to Ethereum. At present, Ethereum’s price stands at $2632, with a 24-hour volatility of 4.2%. The market cap for Ethereum currently totals $316.86 billion, while its 24-hour volume amounts to $21.61 billion. Notably, the SOL price has recently tested the $180 level following a breakout from an ascending triangular pattern.

Courtesy: TradingView

As a researcher, I find myself cautiously optimistic about the potential growth of SOL. Nevertheless, I must emphasize the significant influence the supply zone at $185 may have on its value. Previously, when SOL hit $185, it underwent a 30% correction and has yet to revisit that price point since then. This historical trend suggests that the supply zone at $185 could potentially exert downward pressure on SOL’s value.

While Solana’s potential rise to $200 isn’t impossible, there might be a temporary halt at the existing resistance levels, potentially causing the price to dip back to around $161.81. Subsequently, if it overcomes the hurdle of $185, this could trigger an immediate surge towards $200.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-10-29 18:08