As a seasoned researcher with over two decades of experience in the financial markets, I have seen my fair share of bull and bear markets, and I must admit, the price action in Ethereum has piqued my interest. Having closely monitored the cryptocurrency since its inception, I find myself intrigued by the current situation at hand.

Investor interest and analysis are focusing on the movement of Ethereum‘s price, currently hovering close to a vital support point at approximately $2,600. According to analyst Ali Martinez, this area represents a crucial boundary that Ethereum must surpass before it undertakes its next substantial price shift.

If Martinez is correct and the current support holds, it could trigger a rally aiming to push the cryptocurrency towards the goal of $6,000. But there are signs of trouble, as some analysts and investors believe the current support might crack under stress.

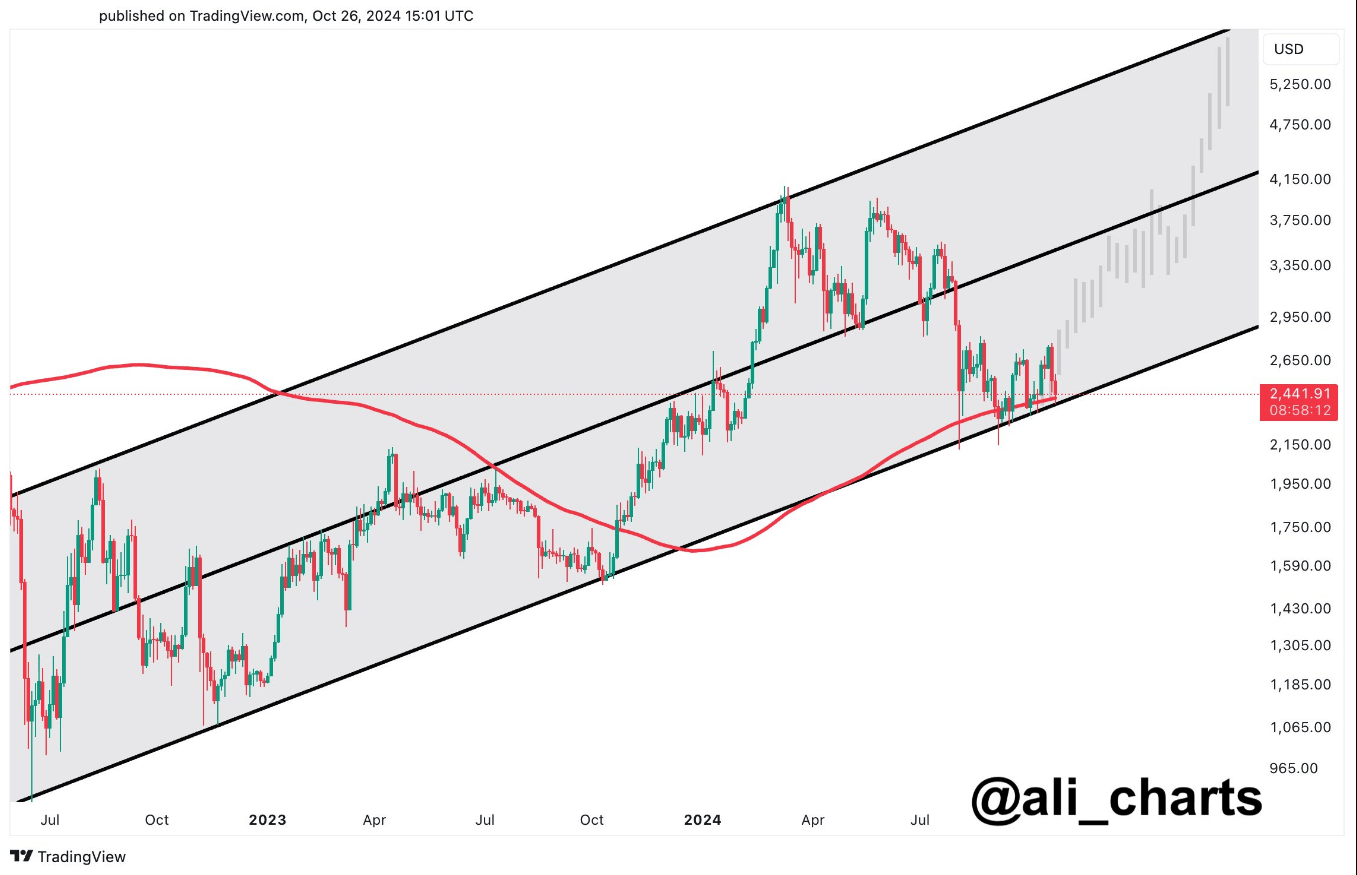

Ethereum is currently testing a significant support area around $2,400. If this level manages to hold strong, there’s a possibility that Ethereum could climb towards the upper limit of its range, roughly around $6,000!

— Ali (@ali_charts) October 26, 2024

Starting from July 2023, Ethereum has started to shape a rising channel. This technical pattern is characterized by two trend lines that denote the support and resistance levels. Lately, the value of Ethereum has been hovering close to the lower boundary of this pathway. According to Martinez’s analysis, Ethereum may surge from this position, making investors quite eager to hold onto their assets.

Important Support And Resistance Zones

The pattern of an ascending channel in Ethereum prices isn’t random; it suggests potential paths for its movement. The upper trend line serves as a resistance level within the channel, while the lower one functions as a support level, allowing the price to rebound. Additionally, Ethereum surpassing $2,600 is a significant point for retesting, which will likely act as a turning point and establish a new projected price goal.

Martinez thinks this presents a beneficial risk versus reward situation for investors and advises setting stop orders approximately between $2,000 and $2,150. The purpose of these stop orders is to cap potential losses, yet they also allow room for Ethereum to rise if it approaches the upper trendline.

As a crypto investor, I’ve noticed that some analysts are voicing worries about a possible crash around the $2,500 mark. Unfortunately, these concerns don’t seem to be backed by much detailed analysis on how this situation could potentially set the stage for another bull run.

Indicators Look Positive: On-Chain Data

7 out of 10 Ethereum owners currently have a profit on their investment. This suggests a generally optimistic outlook, as higher levels of profitability tend to decrease the likelihood of large sellers. With fewer incentives to sell, it’s reasonable to anticipate an uptrend for Ethereum.

Robust Long-Term Projections

For now, Ethereum’s projected values show potential for increase. Compared to forecasted prices for next month, Ethereum is currently sitting around 6.5% below the expected mark, indicating that the value could be undervalued in the market.

Optimistic forecasts for the long term suggest potential gains of up to 173% within a year, as per data from CoinCheckup. This significant growth could potentially boost Ethereum’s price trend, establishing a stronger foundation that might keep prices elevated and steady.

Read More

- Connections Help, Hints & Clues for Today, March 1

- The games you need to play to prepare for Elden Ring: Nightreign

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- Pepe Battles Price Decline, But Analysts Signal A Potential Rally Ahead

- Bitcoin’s Record ATH Surge: Key Factors Behind the Rise and Future Predictions

2024-10-29 16:37