As an analyst with over two decades of experience in financial markets, I have seen many instances where market sentiment can shift from euphoria to fear within the blink of an eye. The current situation with Bitcoin is no exception.

Bitcoin had a tumultuous week, swinging between a peak of around $69,500 and a trough of $65,000. Following several weeks of enthusiasm and rising prices, the market has taken a breather, with Bitcoin currently hovering below the significant $70,000 mark. This pause in activity is crucial as traders evaluate Bitcoin’s likely next direction.

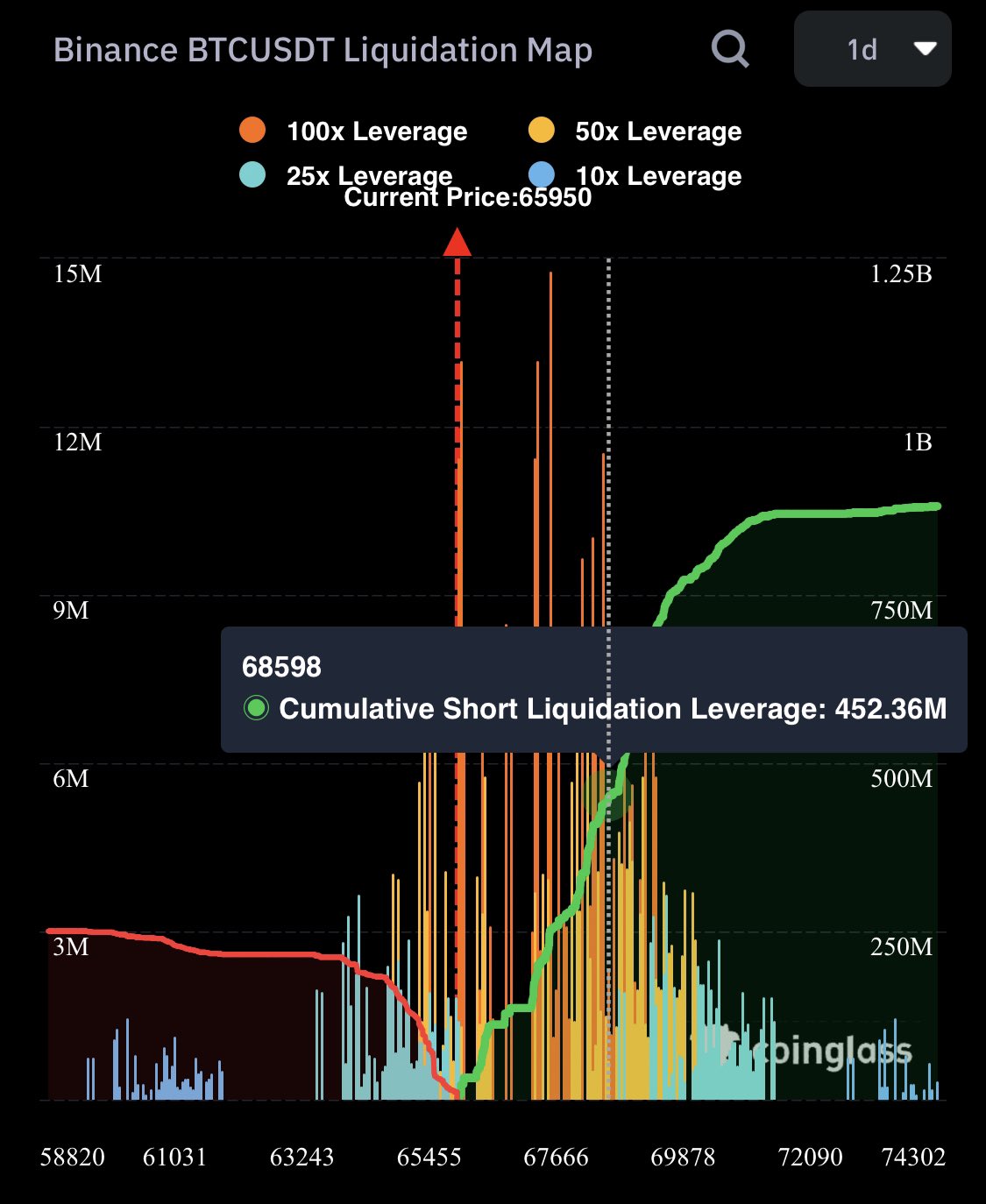

Analyst Ali Martinez has provided crucial findings from Binance, emphasizing that at the $68,500 level, there’s a substantial risk for short positions. When such risks appear, the price usually moves towards areas with more liquidity, hinting that it might trend towards supply zones. This pattern suggests that the market could be aiming for spots where sellers might be located, potentially causing additional price volatility.

The interplay between these resistance and support levels will determine Bitcoin’s trajectory. A decisive move above these levels could signal Bitcoin’s next phase, making it critical for investors to remain vigilant.

Bitcoin Short Squeeze Looms

Bitcoin is approaching a crucial juncture as excitement builds over the possibility of it reaching new record highs. Notably, Martinez has disclosed valuable information about X, suggesting that numerous short positions could be in danger of being liquidated, particularly near the $68,598 price point. This price level has an estimated cumulative short liquidation leverage of around $452.36 million, implying a large chunk of capital might be impacted if the price continues to climb upwards.

In this situation, the high number of short positions that are overleveraged indicates a positive forecast for Bitcoin. This is because when supply levels are reached, there may be an influx of liquidity. This inflow could initiate a series of buying pressure. Once the price surpasses the significant $69,000 threshold, it might spark a sense of FOMO (Fear of Missing Out) among traders and investors who have been observing from the sideline, potentially leading to more purchases.

Clearing out those short positions might push Bitcoin’s value upwards, reinforcing the optimistic outlook. Investors pay close attention to this significant level since a firm breach beyond $69,000 might trigger an upward spike towards uncharted peaks.

Keeping a close eye on market trends and critical price points is vital for traders aiming to handle market fluctuations effectively. The upcoming days are potentially decisive since Bitcoin is approaching a pivotal juncture. Its reaction to these highly leveraged positions could shape its direction over the following weeks.

BTC Liquidity Levels

Currently, Bitcoin (BTC) is being traded at approximately $67,100 following a week filled with fluctuations and doubts. The price has surpassed the $66,000 threshold, suggesting robustness and potentially indicating a rise in the upcoming weeks. This uptrend indicates growing optimism among investors as they search for evidence of continuous bullish energy.

To keep its standing strong, Bitcoin must stay above $65,000. Should it lose this level, there might be a period of price stability (sideways movement) while the market gathers resources, after which it could experience a burst in buying activity as traders anticipate profitable chances. This period of stability may pave the way for increased buying actions.

If the price surpasses the $70,000 mark, it will add weight to the optimistic perspective, possibly triggering a fresh upward trend. This rise might draw more investments and enthusiasm in the market, as participants react to the breakout event.

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- Green County map – DayZ

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

2024-10-27 14:46