As a seasoned crypto investor with over a decade of experience navigating the volatile digital asset landscape, I find myself intrigued by Michaël van de Poppe’s analysis regarding Ethereum (ETH). The massive option expiry event and whale activity are certainly factors that could significantly impact ETH’s price movement.

Michael van de Poppe, a well-known cryptocurrency analyst, has pointed out crucial price points in the Ethereum (ETH) market after a significant options expiration occurred. Notably, this occurs at a time when there is increased whale activity on the Ethereum network.

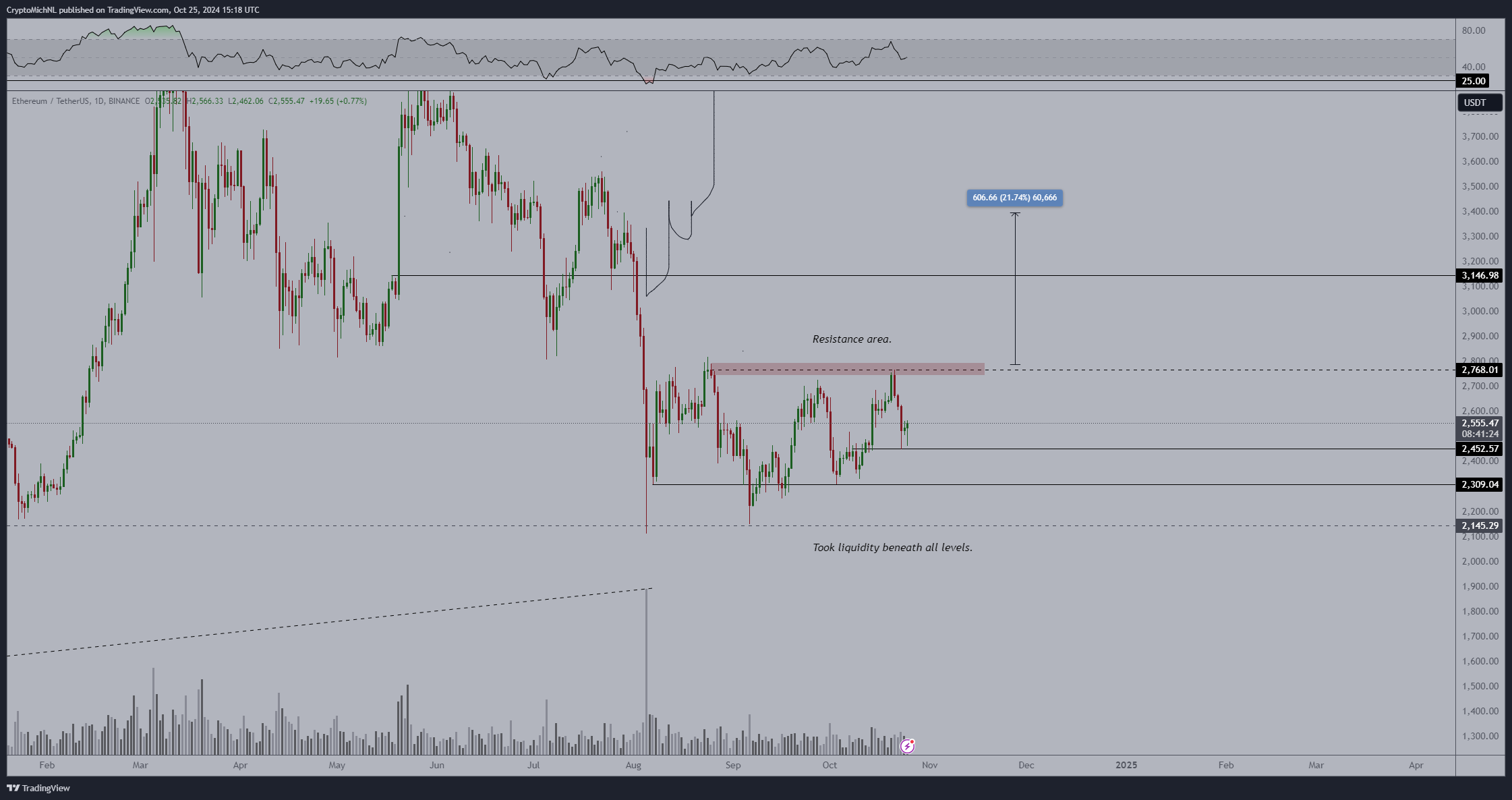

ETH To Break Out At $2,750, Analyst Says

Last Friday, about 1 billion dollars’ worth of Ethereum options contracts were cashed out with the highest potential loss set at $2,600. In a significant event involving option expiration, ETH’s price surged by more than 3% to reach $2,547, bucking expectations of a price drop due to heightened market turbulence.

After this price increase, Van de Poppe implies that Ethereum is currently at a crossroads, particularly with the upcoming “macroeconomic weeks.

Options expire day is done!$ETH bounced upwards, and now the macroeconomic weeks are kicking in.

The question is: are we going to see some upward momentum or will it retest $2,000?

Testing $2,750 again = breakout.

— Michaël van de Poppe (@CryptoMichNL) October 25, 2024

In just two weeks, the U.S. elections will take place, and their outcome may have a substantial impact on the cryptocurrency market. Additionally, it’s predicted that the Federal Reserve might reduce interest rates in November, potentially providing more funds for investing in unstable assets like Ethereum.

Initially, an analyst anticipates that Ethereum (ETH) may experience a strong upward trend potentially peaking at around $2750. This level has previously proven to be a significant resistance point where ETH has faced rejection on three occasions since August. Yet, van de Poppe suggests that if Ethereum, the second-largest cryptocurrency, revisits its price range again, it could lead to a breakout, potentially propelling the token’s value as high as $3,350.

The crypto expert predicts Ethereum might decrease in price due to its current trend of tightening range. If this happens, ETH would first try to regain support at around $2,300. Under heavy bearish influence, though, the digital coin could potentially slide down to $2,000.

Ethereum Whale Activity Reaches Six-Week High

Meanwhile, analytics company Santiment shares that Ethereum has seen its maximum whale activity within the past six weeks during its price drop. Historically, such increased market activity suggests that significant investors are amassing Ethereum on its network, implying faith in the asset’s future financial potential.

Currently, Ethereum (ETH) is being traded at approximately $2,445 per unit, representing a 1.67% decrease in its value over the past day. In contrast, its daily trading volume has significantly increased by 57.97%, reaching a staggering $23.14 billion. The recent drop in ETH’s price can be linked to a contentious report concerning Tether, the operator of the USDT stablecoin, and also reports of Israeli attacks on Iran.

It appears that Ethereum continues to be the preferred choice for investors, as anticipation builds towards an expected cryptocurrency market surge. Several experts have indicated a potential price of $10,000 based on past performance during previous market upswings.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Gold Rate Forecast

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-10-26 20:46