As an analyst with over two decades of experience in the financial markets and a keen interest in the cryptocurrency space, I find Melika Trader’s analysis on Cardano (ADA) both insightful and well-grounded. Her approach combines technical analysis, chart patterns, and key price levels to provide a comprehensive outlook on ADA’s price movement – a strategy that has served me well in my own analyses.

In a recent analysis posted on TradingView, an anonymous crypto expert known as Melika Trader has presented a technical prediction for Cardano (ADA). This prediction suggests a potential long-term increase with a projected price of $1.8. By examining chart patterns and crucial price points, Melika provides both short-term and long-term views on the possible direction of ADA’s price fluctuations.

Long-Term Cardano Price Outlook

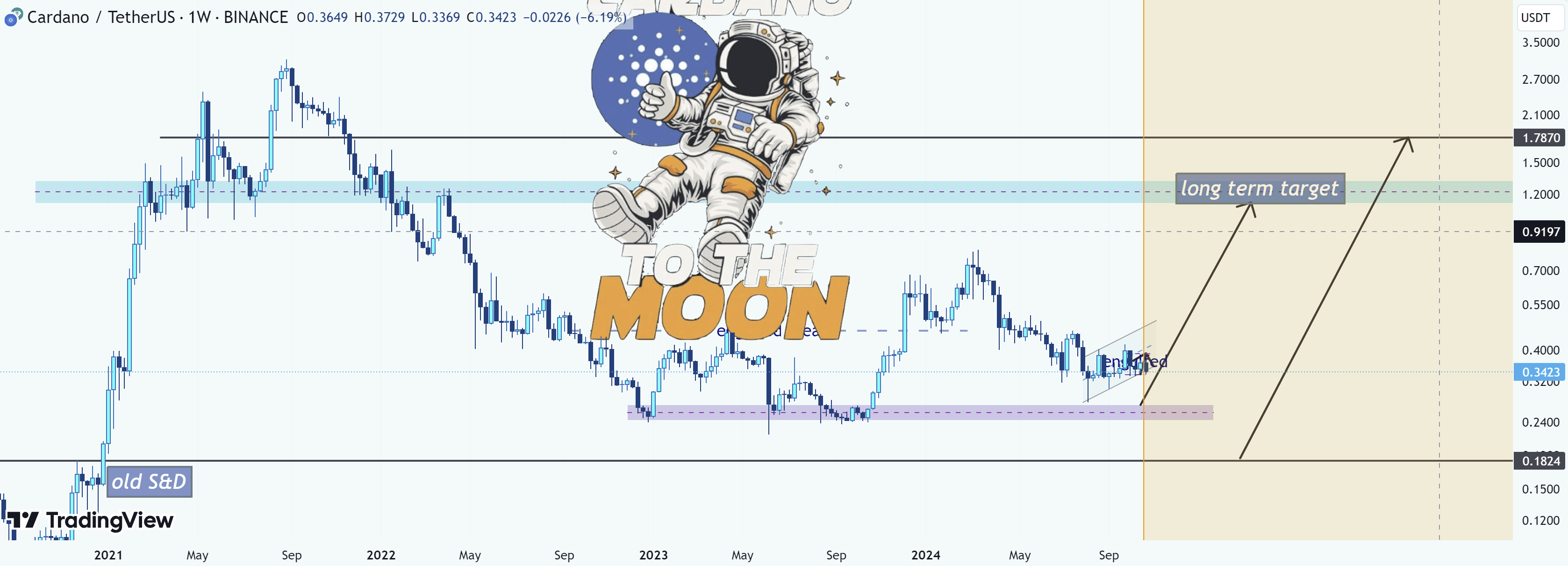

Melika points out that the ADA cryptocurrency could find a solid foundation between $0.30 and $0.35. This area has demonstrated strong buying activity in the past, as indicated by an engulfing candle pattern and previous supply and demand (S&D) zones. This base structure implies a resilient level where Cardano often receives market support.

“The analyst suggests that ADA might experience a bullish reversal, given its price behavior seems to create a support base in this region.

Moving forward, Melika identifies a long-term price range of $1.20 to $1.80 as a potential resistance zone. This area isn’t chosen randomly but is influenced by past highs in price, making it a challenging obstacle for future price fluctuations. If ADA maintains its current support, reaching these higher resistance levels could become a possibility as buyer confidence recovers, potentially triggering a bullish trend.

Melika states that the upcoming significant resistance lies within the $1.20 to $1.80 range, which is also a long-term objective and coincides with previous peak levels. If the current support remains strong, Cardano (ADA) might be poised for a prolonged surge towards this long-term goal, especially as investors regain trust in their purchases.

However, she also cautions investors about a bearish scenario where ADA fails to maintain the $0.30 support level. A breach below this threshold could lead to a decline to levels below $0.18, presenting a substantial risk for holders. “A failure to hold support around $0.30 could see the price retesting to below $0.18,” Melika warns.

ADA Price Analysis: Short-Term Outlook

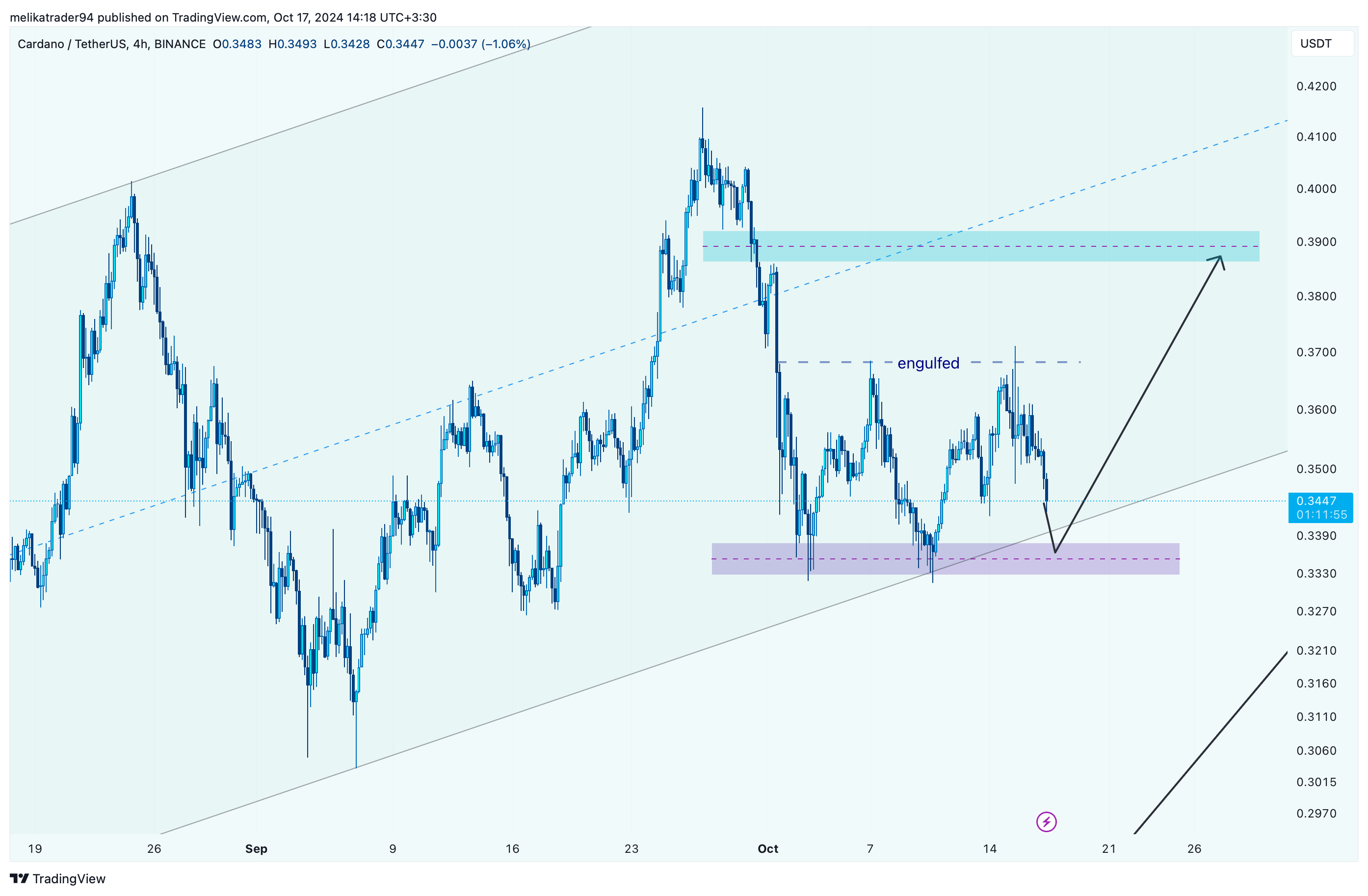

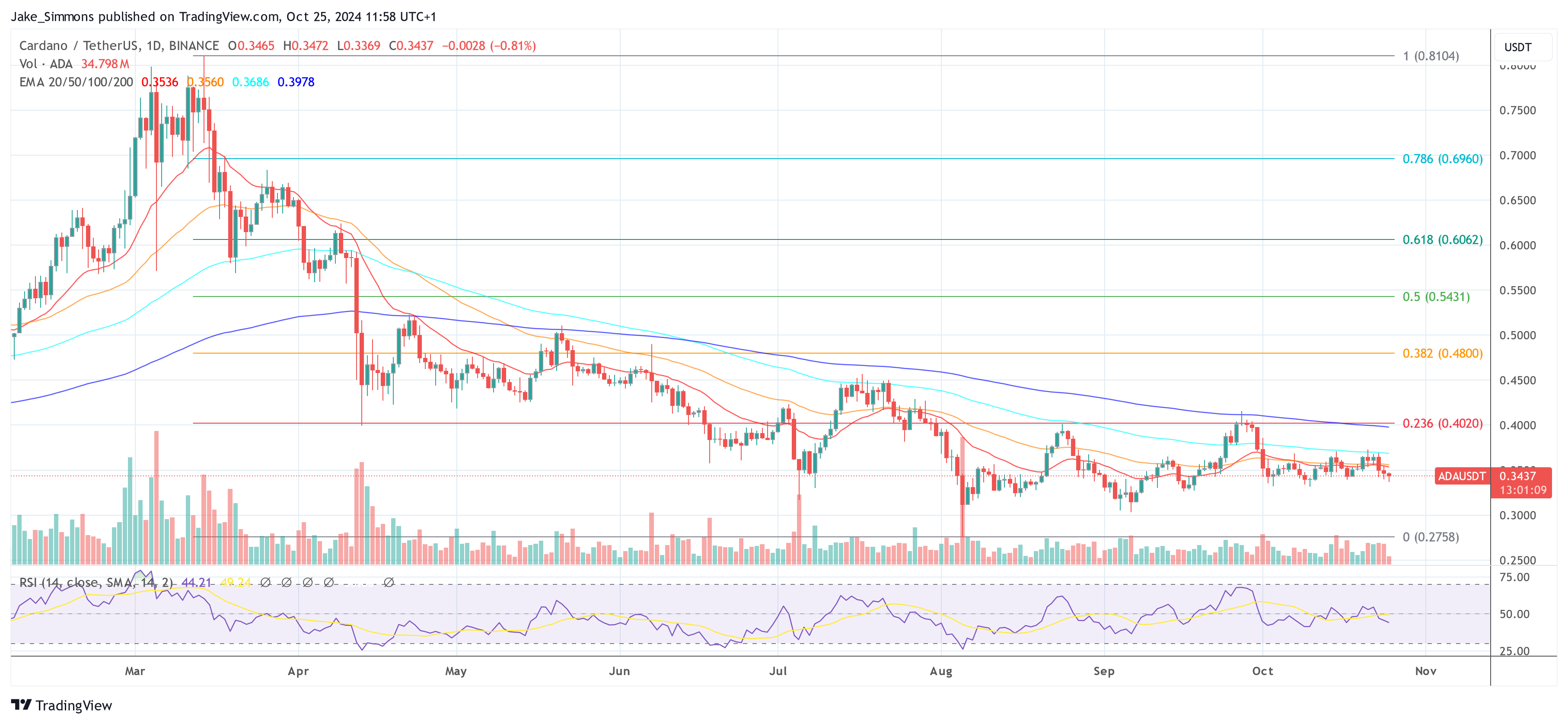

Currently, ADA is finding stability within a significant support region, roughly ranging from $0.33 to $0.34. This area is reinforced by a downward trendline, making it crucial for its short-term direction. If ADA experiences a rebound from this support zone, it might aim for the resistance zone around $0.38 – $0.39. The analyst suggests that the overlapping price action in this region could indicate a potential reversal signal for ADA.

The $0.39 region serves as a crucial resistance point, where past sellers have held sway. This spot becomes a vital area to monitor for any potential breakthrough, as overcoming this resistance could support the theory of an imminent bullish recovery.

If ADA’s current support level doesn’t hold up, there’s a possibility it might pull back to the more substantial long-term support around $0.30, reflecting the potential downward pressure pointed out by Melika.

At press time, ADA traded at $0.3437.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-10-26 02:46