As a seasoned crypto investor with over a decade of experience navigating the digital asset landscape, I must say that the ebb and flow of ETF inflows is a dance as predictable as the stock market’s. While the recent outflows may seem concerning to some, it’s important to remember that Bitcoin’s journey has always been marked by ups and downs.

Currently, the growing interest in U.S.-based Bitcoin ETFs has taken a pause for now.

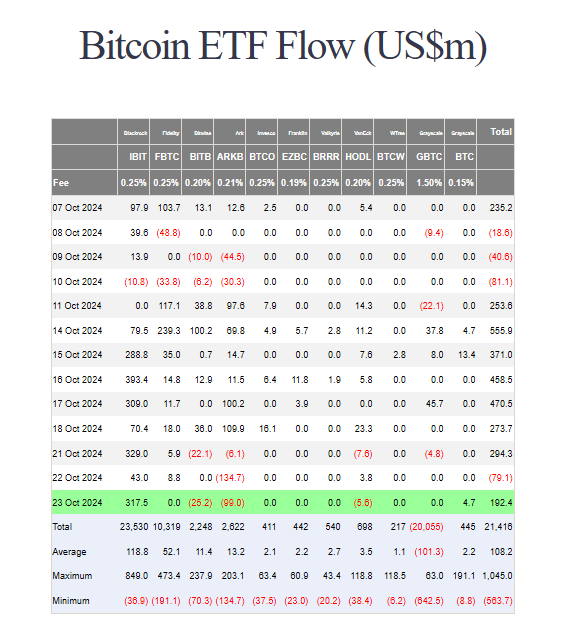

On Tuesday, there was a reversal for these funds, leading to a net withdrawal of approximately $79 million, after a remarkable seven-day period where these investments saw positive inflows. This information comes from Farside Investors, a firm known for their expertise in analyzing ETF flow data.

A Brief Obstacle

The $79 million decrease indicates a substantial change in investor feelings towards Bitcoin ETFs, as they had previously shown high enthusiasm. In just two days last week, the market saw approximately $1 billion in investments coming in, suggesting a strong appetite for these investment tools.

The significant reason for the unfavorable transformation was the combined efforts of Ark and 21Shared through their ARKB initiative, leading to an outflow of approximately $134.7 million.

On a single day, BlackRock’s IBIT, currently leading in bitcoin ETF net assets, attracted approximately $43 million. Additionally, Fidelity’s FBTC and VanEck’s HODL gathered around $8.8 million and $3.8 million respectively. The remaining eight funds, including Grayscаle’s GBTC, did not receive any new investments that day.

Despite this, Bitcoin ETFs have attracted over $21 billion so far, demonstrating a growing acceptance of Bitcoin as a distinct investment category. It’s likely that we will witness an increase in the number of hedge funds significantly increasing their holdings.

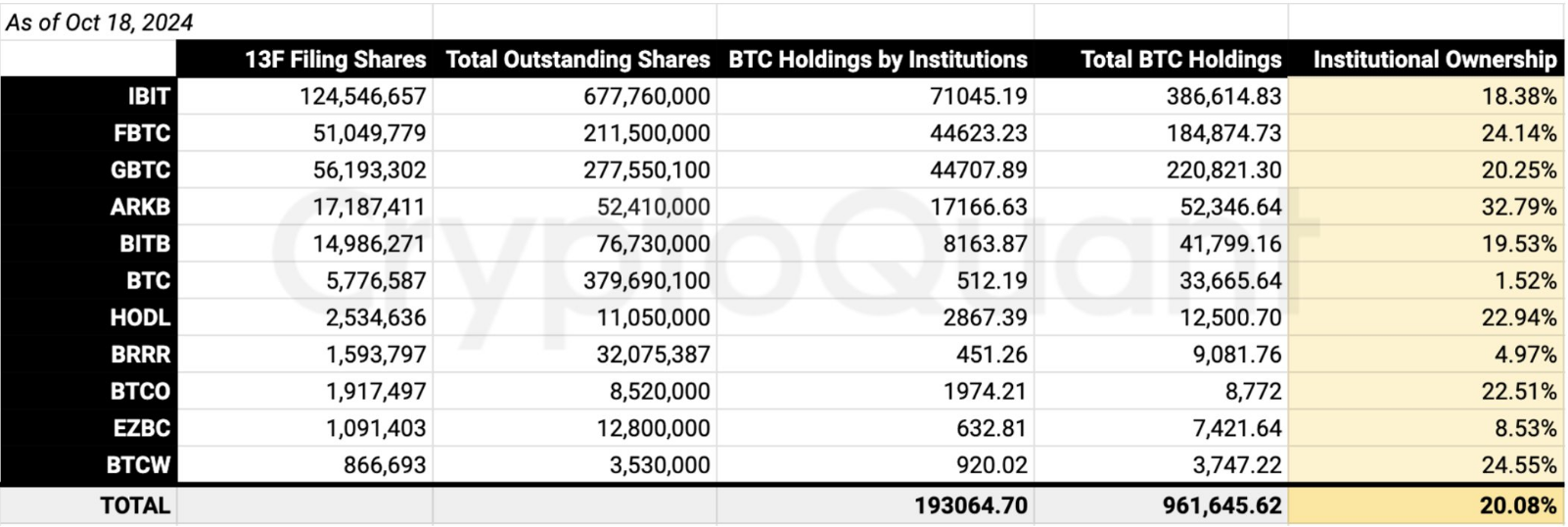

Institutional investors have shown a notable preference for Bitcoin ETFs traded on U.S. markets, owning about 20% of the total market share as of October 22nd.

Approximately 20% of U.S.-listed Bitcoin Spot Exchange-Traded Funds are owned by institutions, and these entities collectively hold about 193,000 Bitcoins as reported in their Form 13F filings.

— Ki Young Ju (@ki_young_ju) October 22, 2024

Institutional Demand Is Still Strong

Despite recent fluctuations in Exchange-Traded Fund (ETF) investments being substantial on their own, they should not overshadow the continuous trend towards institutional Bitcoin adoption. Notably, major players like Goldman Sachs and Millennium Management have been among those making substantial investments in these funds.

Obtaining the SEC’s approval for trading options on 11 Bitcoin ETFs could increase investor enthusiasm by providing a more manageable way to handle their Bitcoin investments.

By utilizing options trading for better position management, investors can contribute to market stabilization and reduce overall volatility in the long run. Many analysts believe that such efficiency could attract more institutional investments, thereby bolstering Bitcoin’s standing as a reliable investment option.

Bitcoin ETF: Looking Ahead

Despite some apprehension surrounding outflows, a number of analysts remain optimistic about Bitcoin ETFs. The approval of options trading by the SEC represents a significant milestone, potentially leading to enhanced market effectiveness and liquidity.

As more institutions enter the market, it’s expected that the existing patterns will evolve. The recent slowdown in investments might just be a short-term occurrence; investors seem to be adjusting their strategies due to the new market circumstances.

For the future of Bitcoin Spot ETFs, it seems optimistic as we look ahead, given the surge in institutional interest and Bitcoin trading reaching close to its highest point over the past three months.

Lately, Bitcoin ETFs have seen withdrawals, which could signal a short-term reversal. But given the ongoing surge in institutional investment and positive regulatory attitudes, it’s clear that this asset class is enduring and may continue to grow. Investors will closely watch as this market quickly changes, eagerly awaiting any fresh updates.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Green County map – DayZ

- Mario Kart World – Every Playable Character & Unlockable Costume

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2024-10-24 13:16