As a seasoned crypto investor with battle-scarred fingers from past market corrections, I find the analysis presented by Santiment intriguing and not without merit. The Positive Sentiment vs. Negative Sentiment Ratio seems to be a valuable tool for gauging market sentiment, particularly in the memecoin arena.

According to the insights shared by Santiment, a company specializing in blockchain analysis, they’ve proposed an explanation for the recent price drops experienced by Dogecoin and ApeCoin.

Dogecoin & Apecoin Are Among Memecoins That Fell Prey To FOMO Recently

According to Santiment’s recent post on X, there’s been a significant increase in the balance between positive and negative sentiments regarding Dogecoin and other meme coins.

In simpler terms, the “Positive Sentiment vs. Negative Sentiment Ratio” is a measure that shows if popular social media sites are currently receiving more positive or negative comments.

Instead of this indicator, we could say that it employs a machine learning model developed by the analytics company to distinguish between remarks expressing negative and positive feelings or opinions.

If the measurement exceeds zero, it signifies that there are more favorable posts, threads, or messages compared to unfavorable ones. Conversely, when the measurement falls below this level, it indicates a predominance of negative or pessimistic opinions on social media.

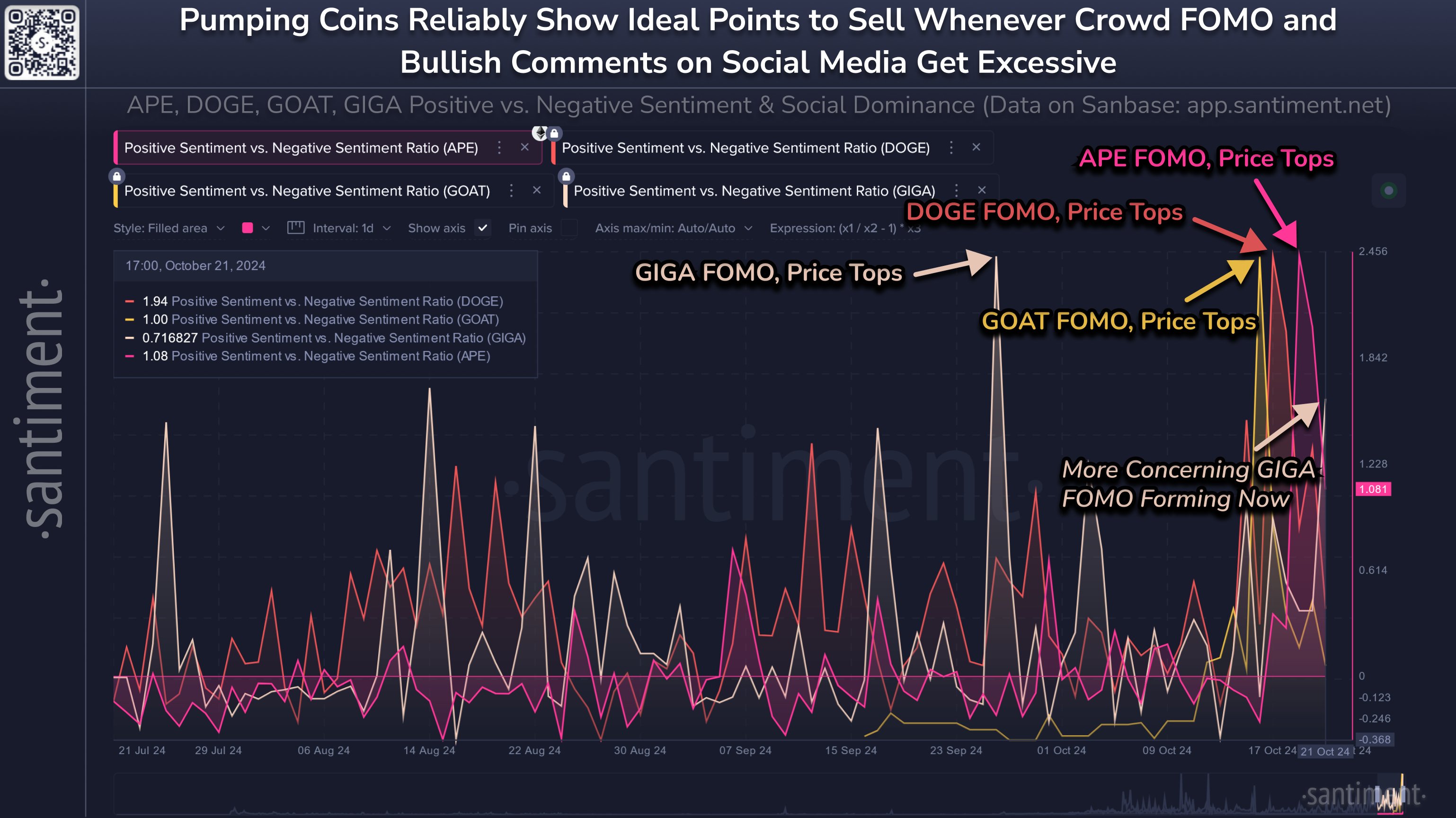

Currently, I’d like to draw your attention to a chart provided by Santiment which highlights the recent trends of this indicator across four different assets over the past several months.

According to the graph shown earlier, there has been an increase in the proportion of positive sentiments over negative ones for both Dogecoin and Apecoin lately. This suggests that a significant number of favorable comments about these digital currencies have been shared on social media platforms.

As an investor in cryptocurrencies, it’s fascinating to note that the surges I observed in the DOGE and APE prices seemed to align with market peaks. Similarly, the other memecoins on my chart, GIGA and GOAT, exhibited a similar trend, albeit with their high points preceding those of DOGE and APE.

An overwhelmingly optimistic outlook towards the market might imply confidence, but excessively positive sentiment could also indicate unwarranted excitement or hype. This type of situation has often preceded market peaks, not only for meme-based coins but across the broader cryptocurrency landscape as well.

Santiment explains that prices often move in the opposite way of what the crowd anticipates. When the crowd’s sentiments become extremely positive (bullish) or negative (bearish), it becomes quite foreseeable to either buy or sell.

Based on the current surge in the indicator, it seems plausible that the fear of missing out (FOMO) experienced by investors could have contributed to the price adjustments encountered by Dogecoin and similar assets.

In the upcoming days, it might be interesting to observe whether any decreases in the Positive Sentiment vs. Negative Sentiment Ratio will create a path for renewed bullish trends in these cryptocurrencies.

DOGE Price

A while back, Dogecoin almost hit the $0.150 price point, but after the recent downward adjustment, it’s now settled at around $0.136.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

2024-10-24 09:04