As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous bull and bear cycles, and the current Bitcoin (BTC) market dynamics are reminiscent of some of the most promising periods I’ve seen. The upcoming US elections, while significant, appear to be taking a back seat to BTC’s potential for breaking its previous all-time high (ATH).

Regardless of the outcome of the U.S. presidential election in November, as suggested by crypto options traders, Bitcoin (BTC) appears ready to surpass its prior record high.

US Elections Results Not Consequential

With the U.S. presidential election approaching, there’s a noticeable shift in sentiment among cryptocurrency options traders as they consider potential effects on the digital asset market.

It’s worth noting that options traders are progressively placing larger wagers on Bitcoin reaching $80,000 before November ends, irrespective of who between Donald Trump (Republican) and Kamala Harris (Democratic) emerges as the election winner.

Commenting, David Lawant, head of research at FalconX, a crypto brokerage firm, said:

It seems to me that many people in the market expect Bitcoin to do well, no matter the election results. Our research indicates that there’s a strong leaning towards positive movements in the options activity leading up to the elections.

Among cryptocurrency enthusiasts, there’s a widespread viewpoint that a Trump presidency might be advantageous for the digital asset sector. Conversely, if Vice President Harris wins, it’s thought she would maintain the Biden administration’s perceived cold approach towards cryptocurrencies.

Yet, Harris aims to change the viewpoint of crypto supporters by pledging to cultivate innovations such as AI and digital currencies via a favorable legal system.

Apart from the U.S. elections, several other elements are contributing to an increase in optimism about Bitcoin reaching a new all-time high this year. These include interest rate reductions made by the Federal Reserve (Fed) and a decrease in inflation rates.

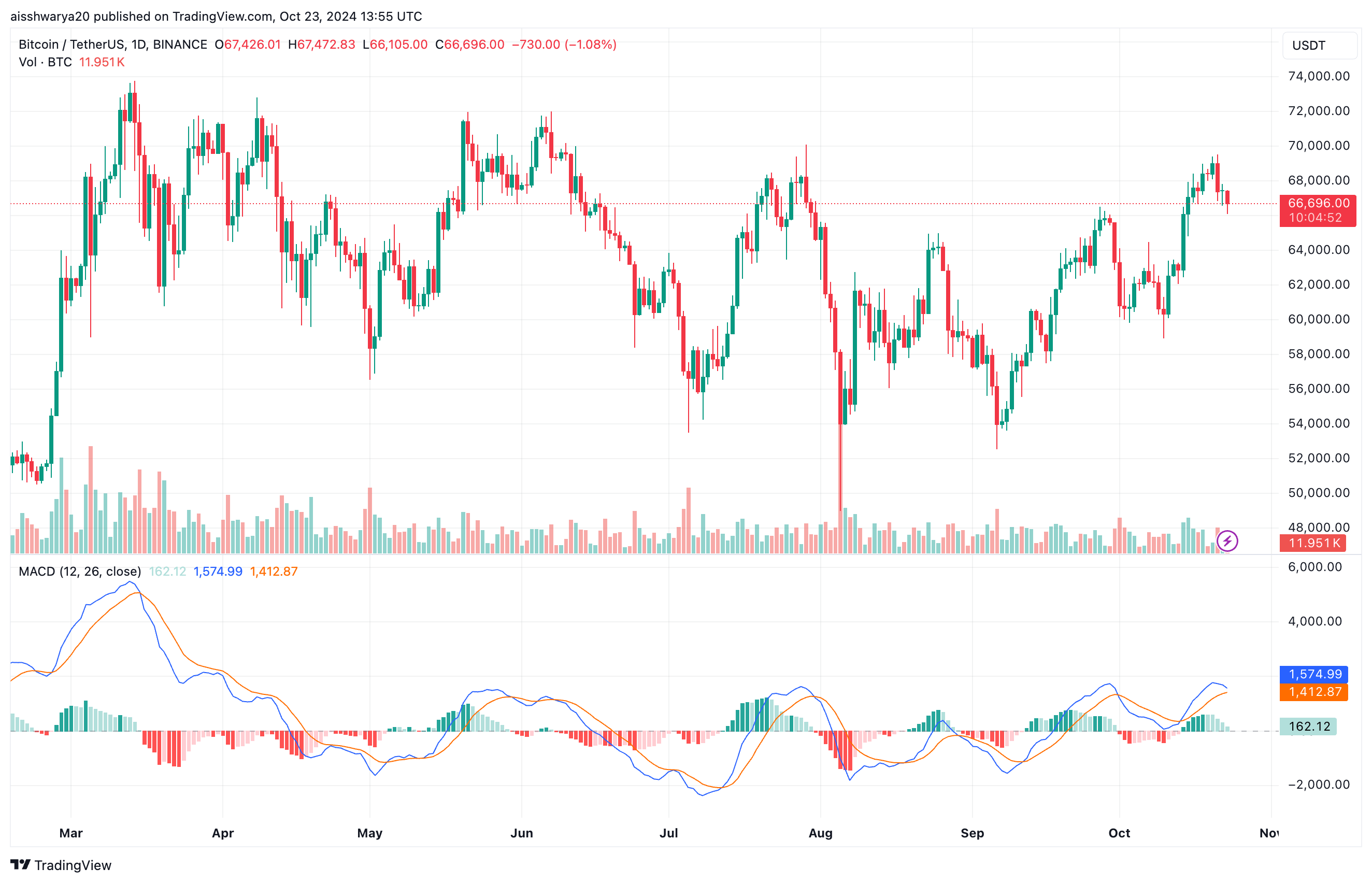

In March 2024, Bitcoin reached its all-time high (ATH) value of $73,797. This significant increase was primarily driven by the expectation of increased demand for the digital currency following the SEC’s approval of Bitcoin exchange-traded funds (ETF).

Initially, Bitcoin dipped to $53,956 in September as a result of increasing interest rates. But after the Fed declared a rate reduction, Bitcoin has seen a significant recovery and is currently trading at around $66,000.

Bitcoin Put To Call Ratio Trending Lower

Based on data collected by Deribit, the leading cryptocurrency options exchange in terms of reported trading volume, the proportion of put options (options to sell) compared to call options (options to buy) is decreasing as we approach the end of the year.

As a researcher studying Bitcoin market trends, I’m observing a lower put-to-call option ratio, which suggests that more traders are betting on call options – options that profit if BTC rises – compared to put options – options that profit if BTC falls. This could imply a collective optimism among traders about potential Bitcoin price growth in the near future.

According to Yev Feldman, one of the founders at SwapGlobal – a cutting-edge cryptocurrency options trading platform designed for institutions – makes this observation:

Traders are frequently purchasing call options close to $68,000 and put options close to $66,000, meaning they’re often adjusting their positions in anticipation of a significant price movement, either upward or downward. Given that there’s not much rationale for a continued decline following the election, it seems more likely that the price will increase rather than decrease.

Furthermore, it appears that for Bitcoin call options expiring on November 29, there’s a significant focus on the $80,000 level, with the $70,000 level being the next most popular choice. On the other hand, for call options expiring on December 27, the preferred strike prices are generally between $80,000 and $100,000.

Lately, it appears that more retail investors are showing increased interest in Bitcoin, suggesting a shift towards a risk-taking mood within the market. This change comes after the market had been relatively stable, or “range-bound,” throughout most of the year, according to analyst Lawant’s observations.

It seems investors are increasingly utilizing the options market primarily to seize possible profits (the upside) instead of protecting themselves from potential losses (downside risks).

Concerns about a potential downside persist due to heightened geopolitical uncertainties in the Middle East and lingering doubts about Bitcoin’s halving earlier this year. BTC trades at $66,696 at press time, down 0.7% in the past 24 hours.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-10-24 06:05