As a seasoned crypto investor with more than a decade of rollercoaster rides under my belt, I can’t help but feel a sense of familiar excitement when I hear Peter Brandt’s bullish forecast on Ethereum. The inverted Head and Shoulders formation he points out is not just another technical pattern; it’s a beacon that has often signaled the start of a new bull run for me.

As per experienced trader Peter Brandt’s perspective, it appears that Ethereum could be headed towards a more promising future. Renowned for his technical predictions, Brandt suggests that the cryptocurrency might be about to undergo a bullish reversal.

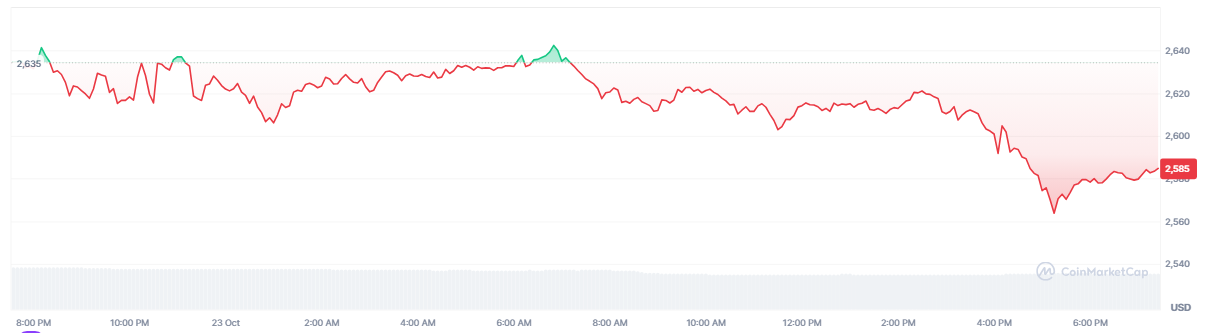

He’s identified an inverted Head and Shoulders formation on the daily chart of Ethereum. This is one of the most classic buy signals in technical analysis. If ETH can hold above that neckline at $2,745, we could be looking at a breakout.

The most interesting chart developments I see right now

See thread

#1$ETH closing price chart inverted H&S pattern

I am flat in ETH— Peter Brandt (@PeterLBrandt) October 21, 2024

But the excitement doesn’t stop there. Data from IntoTheBlock shows that Ethereum’s network is stronger than ever, boasting over 5 million active addresses across its mainnet and Layer 2 networks.

Despite a divided sentiment among market participants, this data underscores Ethereum’s significance within the cryptocurrency landscape. While some speculators anticipate a positive evolution for Ethereum in the long run, others express concerns about potential obstacles in the near term.

Currently, there are more than 5 million actively used Ether (ETH) addresses on the Ethereum main network and leading layer 2 platforms, surpassing all other Layer 1 assets by a substantial distance.

— IntoTheBlock (@intotheblock) October 21, 2024

A Long-Term Play

Without a doubt, Ethereum has seen its fair share of highs and lows. Its price has ranged from just $10 to an impressive $4,900 at one point, turning many early supporters into believers. Despite these rollercoaster-like price fluctuations, which can be quite nerve-wracking, Ethereum consistently demonstrates its resilience by focusing on the development and deployment of smart contracts and decentralized applications within the blockchain sector.

As the Ethereum market has developed, the cost basis for many investors has increased, making short-term profits harder to come by. This cautious approach is being adopted by some traders. Yet, for those with a long-term perspective, Ethereum’s impressive roadmap and history of overcoming difficulties still make it an enticing choice.

Ethereum: The Next Path

The current market trends of Ethereum showcase some intriguing technical characteristics, particularly its interplay with the Point of Control (POC). Typically seen as a critical point for either support or resistance, this level might play a pivotal role in determining Ethereum’s future trajectory.

When Ethereum’s price is close to this particular point, it may indicate a potential buying chance for those focusing on long-term gains. If the Point of Control (POC) remains strong, Ethereum could establish a robust base for future expansion. However, falling below this level might be a warning sign, so investors should exercise caution.

Will The Bullish Reversal Hold?

Brandt’s positive forecast instills hope among Ethereum enthusiasts. If Ethereum can sustain above $2,745 and continues to exhibit the inverted Head and Shoulders pattern, it could potentially experience a substantial increase.

Indeed, while focusing on Ethereum’s growth, it’s crucial for me, as a researcher, not to overlook other influential market elements. These encompass broader industry tendencies, technical signals, and overall market psychology. Each of these factors significantly contributes to the future trajectory of Ethereum in the dynamic cryptocurrency landscape.

Despite facing some hurdles, Ethereum’s upward trend looks compelling and difficult to overlook. Regardless if you’re playing the long-term strategy or keeping tabs for short-term profits, Ethereum’s impending decision might hold substantial implications.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-10-24 01:16