As a seasoned analyst with over two decades of experience in the crypto market, I’ve witnessed numerous ups and downs, bull runs, and bear markets. The current state of Bitcoin is intriguing, to say the least. Despite the recent rejection at $69,000 levels and the 5% retracement, I remain optimistic about its future.

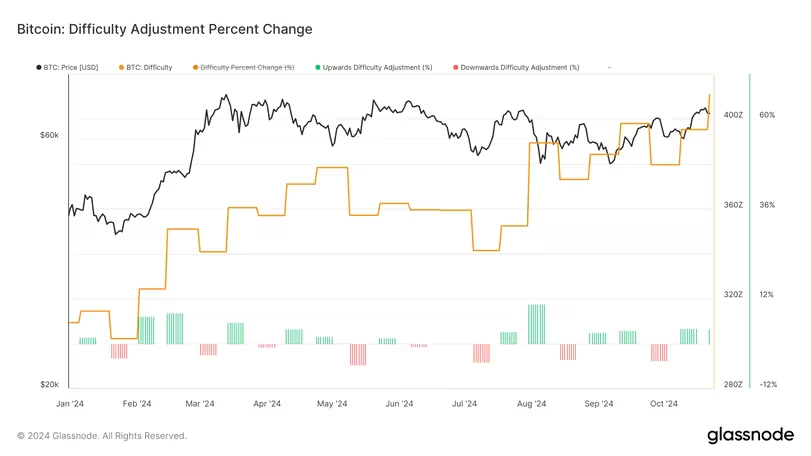

Regardless of Bitcoin‘s current price at around $66,699, exhibiting a daily volatility of only 0.6% and boasting a market capitalization of $1.32 trillion, it seems to be encountering resistance at the $69,000 mark and is retracing by approximately 5%. However, the Bitcoin mining difficulty has reached an unprecedented high of 95.67 terahashes (T), increasing by a significant 4% over the past 24 hours. This year alone, there have been 22 adjustments to the Bitcoin blockchain’s difficulty, with 13 of these changes being positive.

This year, the Bitcoin hashing power significantly increased by 27%, rising from 72 quadrillion to 92 quadrillion. Simultaneously, this increase in Bitcoin mining difficulty coincides with a record-breaking BTC hashrate. Currently, the BTC hashrate has surpassed 700 exahashes per second (EH/s).

As the challenge of Bitcoin mining increases due to a rise in difficulty, miners are under growing stress to keep their operations profitable. Consequently, since there’s a higher need for computational resources, the associated mining expenses are expected to go up as well.

As a researcher, I’ve observed an interesting development post the Bitcoin halving event in April 2024. With the reduction of mining rewards by 50%, it seems that less efficient miners with outdated equipment have had to close shop due to reduced profits. This has been followed by a 15% decrease in network hashrate, as smaller miners appear to be exiting the scene.

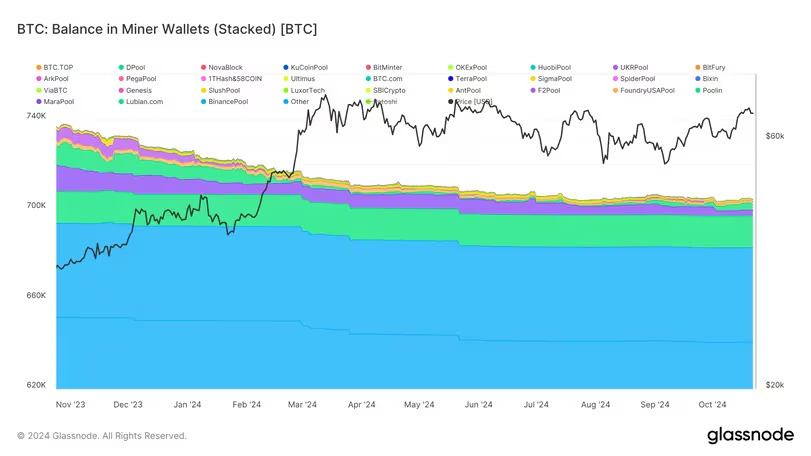

Additionally, other participants are liquidating some of their Bitcoin holdings to cover increasing operational expenses. As per data from Glassnode, miner reserves have decreased this year as less profitable miners prepared for the upcoming halving and aimed to secure their operations. Over a span of around 8 months between November 2023 and July 2024, approximately 30,000 bitcoins were withdrawn from miner wallets, signifying one of the prolonged distribution periods on record.

Over the past few months, starting from July, I’ve noticed a steady and increasingly accumulative trend in miner balances. This suggests that the remaining miners are adapting well to the evolving market conditions. As for the Bitcoin mining industry, it seems poised for consolidation, with powerful players likely to dominate. Notably, public miners have nearly reached a 30% control over the sector’s shares.

BTC Price Rally and Bull Run Ahead?

Bitcoin’s bull runs often coincide with rising miner income because when prices go up, so does mining profitability. According to Glassnode data, the daily revenue from mining (calculated using a 7-day moving average) has exceeded $35 million recently, marking an increase of over $10 million compared to the levels seen in September.

Despite the halving in April, Bitcoin mining income has consistently been below the 365-simple moving average (SMA) which is approximately $40 million at present. Typically, when the total miner revenue exceeds this 365-SMA, it tends to correspond with a Bitcoin market rally.

#BTC

Based on our expectations, the price seems to be dropping slightly more into the broader range, potentially attracting more buyers.

Generally, BTC needs to hold the Channel Top (black) as support

Still successfully doing that, despite market-wide fear$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) October 23, 2024

The current BTC price retracement from $69,000 has led to a bearish sentiment. However, the technical chart shows that the BTC price is taking support at the upper end of the channel. Bitcoin must hold $66,000 for this rally to continue.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-10-23 17:33