As a seasoned crypto investor with battle scars from the 2017 bull run and the subsequent bear market, I’ve learned to navigate the rollercoaster ride that is Bitcoin investing. After watching BTC soar past $66K, it’s now testing the waters at $69K – a critical level that has proven to be both a stumbling block and a stepping stone in the past.

For a few weeks now, Bitcoin has been climbing steadily, and as of now, it’s hovering above $66,000. However, it’s running into some obstacles at the important $69,000 mark, which analysts predict may need some time and substantial resources to surpass.

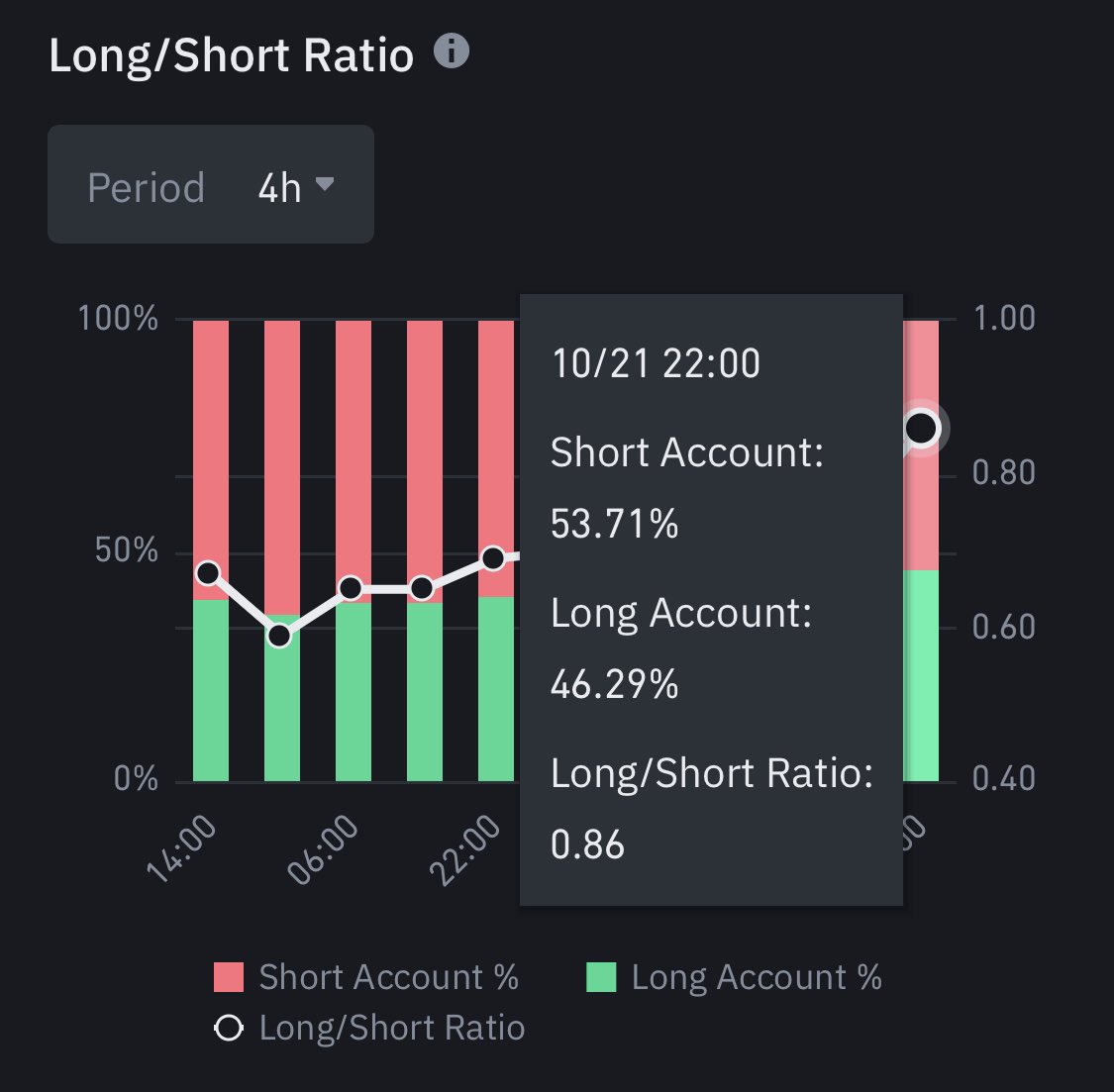

Information from Binance indicates that over half of futures traders have recently sold, or “shorted,” Bitcoin within the last few hours. This activity has generated a contentious atmosphere regarding Bitcoin’s price movement.

In simpler terms, the futures market can act like a gauge for Bitcoin’s momentum and market liquidity, giving us clues about possible price changes. Right now, Bitcoin is holding steady just below the resistance level of $69,000, while keeping its value above $66,000. The upcoming days could be crucial in deciding Bitcoin’s future direction.

Experts and observers are keenly observing Bitcoin’s behavior to decide if it will reach unprecedented record highs or prolong its accumulation phase. This decision could shape the direction of the market in the coming stages.

Bitcoin Future Traders Remain Bearish (For Now)

At present, Bitcoin is experiencing a period of stabilization following several weeks of significant price growth. Even though there’s a temporary halt, experts and investors continue to be positive about Bitcoin’s future price trends over the next few weeks. Many predict that BTC will initiate a strong surge once it surpasses its previous all-time highs. However, this breakout might not happen immediately, as market data from Binance suggests that futures traders are generally bearish.

According to expert analyst and investor Ali Martinez, he disclosed on Binance that approximately 53.71% of futures traders are betting against Bitcoin (BTC). This heavy bearish stance indicates market uncertainty, as traders seem hesitant about when Bitcoin will break through the crucial $69,000 mark. The persistent shorting trend could potentially obstruct Bitcoin’s progress for a while.

On the other hand, the situation may change rapidly due to the possibility that active traders might seize the current drop as an opportunity to purchase Bitcoin. Such increased buying could supply the necessary market liquidity, potentially raising Bitcoin’s value and overturning the pessimistic view in the futures market.

Should purchasing activity continue to strengthen, Bitcoin might soon surmount and exceed the $69,000 barrier, potentially setting a fresh record high. Over the immediate future, traders are keeping a close eye on Bitcoin’s behavior to determine if it will stabilize more or build enough momentum to sustain its upward trajectory.

BTC Testing Key Liquidity Levels

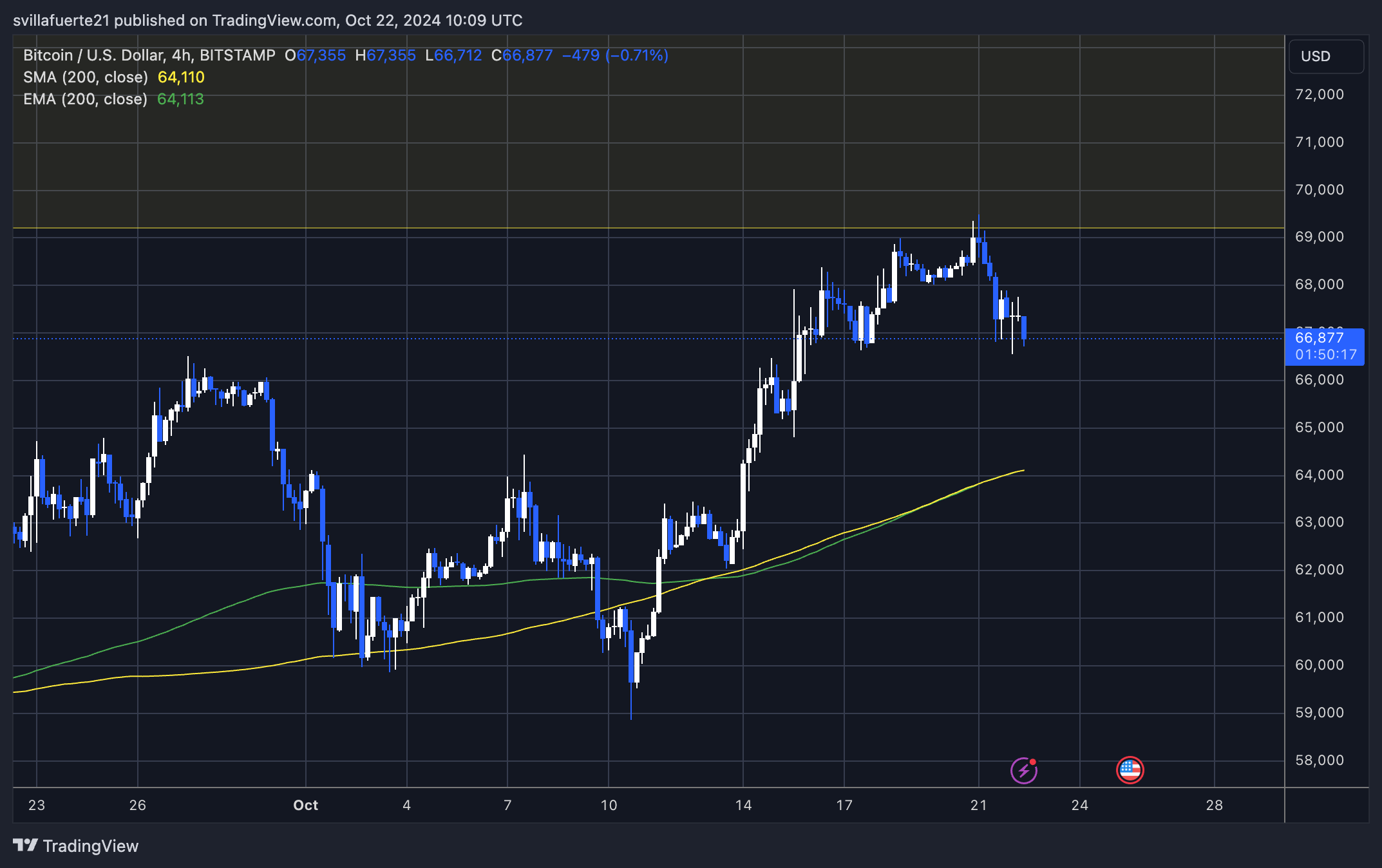

Bitcoin currently trades at approximately $66,800 following a decline from the potential resistance level of $69,000. Although there’s been a slight dip, Bitcoin appears robust, maintaining its position above $66,000. This crucial price point could influence Bitcoin’s trend over the next few days.

From my analysis perspective, if Bitcoin (BTC) is unable to maintain its position above $66,000, I anticipate that the price may dip towards lower support levels, specifically around $64,000. This level holds significant importance as it aligns with both the 4-hour 200 moving average and exponential moving average, making it a focal point for potential buying and selling activities by market participants.

If Bitcoin continues to hold its value above $66,000, it could make another attempt to break through the $69,000 resistance level, or even aim for $70,000 in the future.

Over the next few days, we’ll have a significant impact on whether Bitcoin continues its upward trend or experiences more consolidation around these vital points. Everyone, from traders to investors, is keeping a close eye to see how Bitcoin behaves near the $66,000 support level, as this could determine the direction of the next major price shift.

Read More

- POPCAT PREDICTION. POPCAT cryptocurrency

- Presence Digital, 4K, Blu-ray, & DVD Release Dates Set for Lucy Liu Horror Movie

- The White Lotus’ Aimee Lou Wood’s ‘Teeth’ Comments Explained

- Aaron Taylor-Johnson James Bond Casting Never Had ‘Any Real Movement’

- The Accountant 2 Trailer: Ben Affleck’s Christian Wolff Returns Alongside Jon Bernthal

- Roxanne Perez Addresses Cora Jade Tension Ahead of WWE NXT Vengeance Day 2025

- Who Is Kid Omni-Man in Invincible Season 3? Oliver Grayson’s Powers Explained

- New Malayalam OTT releases this week: Unni Mukundan’s Marco, Govind Padmasurya’s Manorajyam and more

- Beauty in Black Part 2 Trailer Previews Return of Tyler Perry Netflix Show

- Cora Jade Shocks Fans With Powerful Message After TNA Genesis Surprise Appearance

2024-10-23 01:34