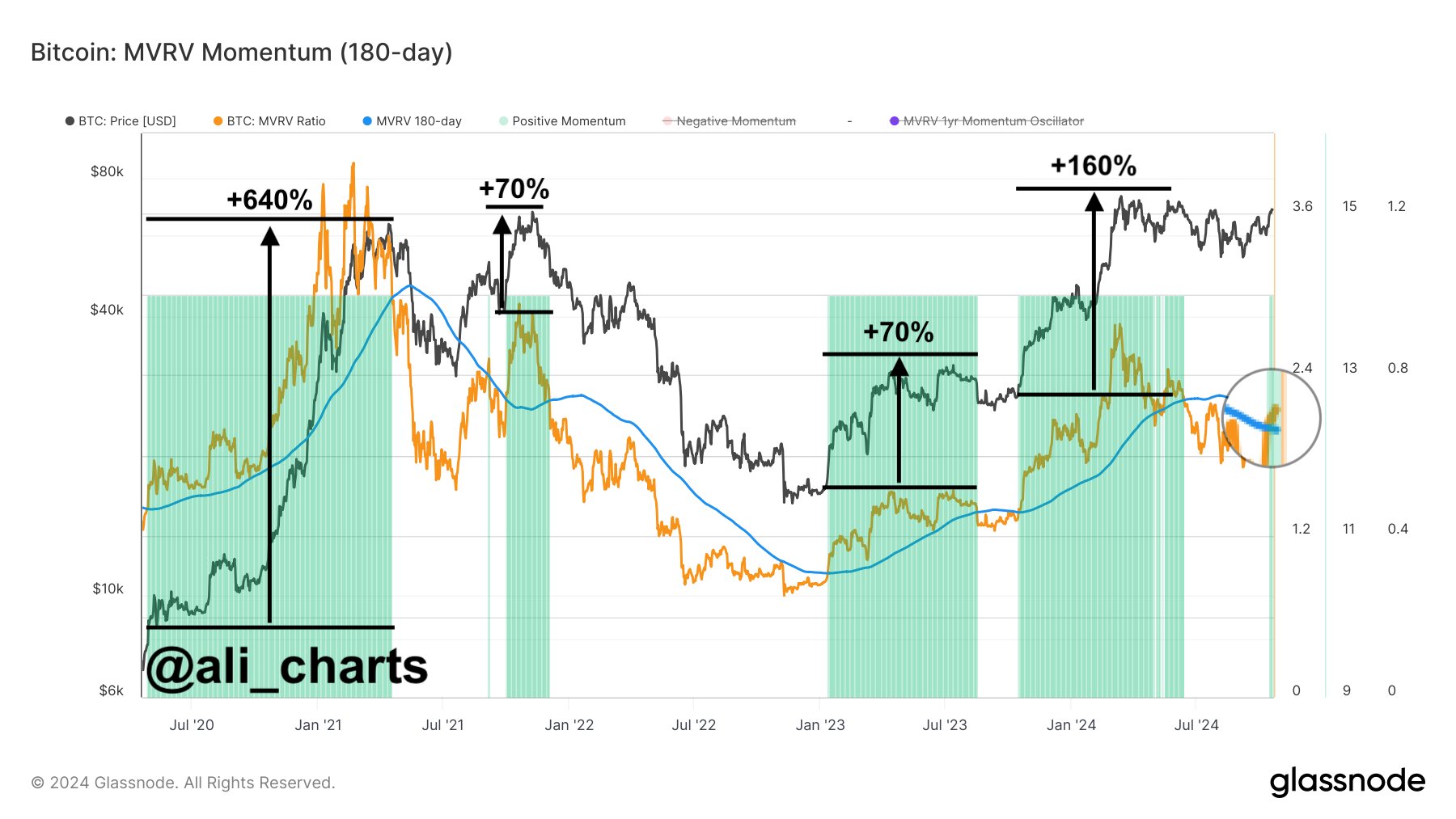

As a seasoned analyst with years of experience tracking the cryptocurrency market, I find myself intrigued by the latest development in Bitcoin’s MVRV Ratio. The surge in this indicator, breaking above its 180-day moving average, is a trend we’ve seen precede significant rallies – at least 70% each time over the last four instances.

Recently, on-chain indicators suggest a Bitcoin signal has been triggered again, which historically has preceded a surge of around 70% in its price over the past four occurrences.

Bitcoin MVRV Momentum Has Seen A Bullish Crossover Recently

Analyst Ali Martinez recently shared insights on X about the current movement in the Bitcoin Market Value to Realized Value (MVRV) Ratio. Essentially, the MVRV Ratio measures the relationship between the total value of all Bitcoins being traded and the worth of all Bitcoins that were previously purchased by investors at different prices.

In simpler terms, the “realized cap” is a method used to determine the total worth of an asset on the blockchain. This is done by considering the value of each token based on the price at which it was last traded on the blockchain, rather than its current market price.

In simpler terms, the final price paid for any cryptocurrency serves as its current cost basis. Therefore, the total realized capital refers to the accumulated amount invested by all investors in these assets. Essentially, this model signifies the money that investors have committed to their holdings.

From my perspective as a researcher, I’d like to highlight that unlike other metrics, the Market Capitalization (often abbreviated as “Market Cap”) is particularly significant because it represents the total worth of all Bitcoin (BTC) in circulation at the current market price. This figure reflects the value that investors currently hold in the cryptocurrency.

If the MVRV Ratio exceeds 1, it means investors have accumulated more value than their initial investment, implying they are currently experiencing a net profit. Conversely, when the ratio falls below 1, it indicates that the overall market may be facing losses.

Currently, let me share this graph which illustrates the evolution of the Bitcoin MVRV Ratio and its 180-day moving average (average trend line) over the past couple of years.

According to the graph, the Bitcoin MVRV Ratio has spiked up lately due to the asset’s price rebound, suggesting that investors are now making more profits with their Bitcoin investments.

After this rise, the indicator has surpassed its moving average of the past 180 days. Typically, when it jumps above this mark, it suggests that the trend of the measurement has shifted positively, which has often indicated a favorable outlook for the price in the future.

The analyst marked in the graph the past price increases that occurred after a reversal in the MVRV Ratio, and it’s worth noting that Bitcoin has experienced gains of around 70% or more in its previous four instances.

Based on past examples, the recent shift in the MVRV Ratio towards green could potentially trigger another Bitcoin price increase. However, it’s uncertain if this potential rise will match the magnitude of previous ones.

BTC Price

At the time of writing, Bitcoin is trading at around $67,500, up almost 3% over the last week.

Read More

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- Brody Jenner Denies Getting Money From Kardashian Family

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

2024-10-22 13:34