As a seasoned crypto investor with a knack for spotting trends and reading between the lines of market data, I find myself cautiously optimistic about XRP‘s current situation. Despite its lackluster performance compared to other altcoins, the recent spike in XRP Ledger activity offers a glimmer of hope.

As a crypto investor, I’ve noticed that the overall cryptocurrency market is experiencing a robust uptrend. However, my focus has been particularly on XRP, which seems to be trailing behind. It’s been hovering just below the crucial $0.55 mark since early October. I, along with many analysts and fellow investors, are keeping a keen eye out for any indications of strength that might suggest XRP is primed for substantial growth in this market cycle.

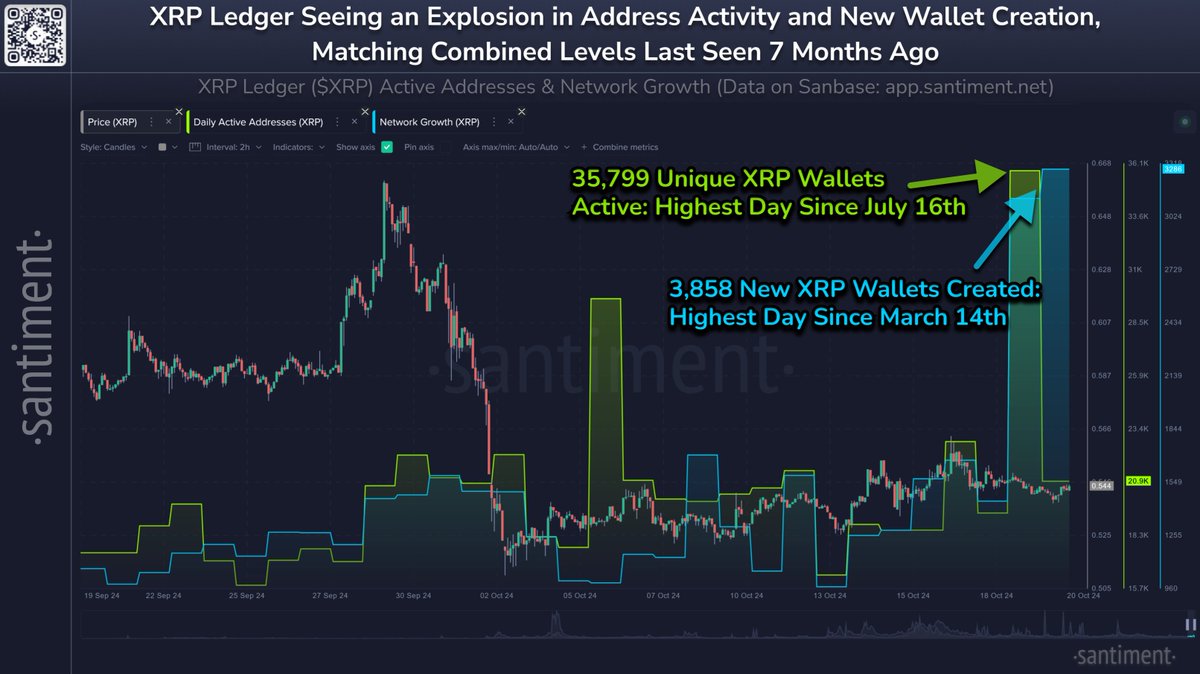

Data provided by Santiment presents a hint of positivity. It indicates a significant increase in active wallets on the XRP Ledger, potentially suggesting a surge in curiosity and hoarding.

From my perspective as an analyst, the upcoming days hold significant importance for XRP, given the ongoing upward momentum in the broader market. The hope among investors is that we’ll witness a breakout, moving beyond the recent phase of sideways movement, which has somewhat muted its price action.

Making a significant leap over $0.55 might spark a surge in positive sentiment for XRP, potentially aligning it with the overall market upswing. At this point, investors are on tenterhooks for more updates, as there’s a strong feeling that XRP could soon experience its time in the limelight.

XRP Ledger Activity Signals A Shift

In the ever-evolving world of cryptocurrencies, XRP continues to be one of the preferred altcoins by many investors. However, there’s growing unease among these investors as the price has failed to regain its previous peaks near $0.65. But even with a lack of positive price movement, data from Santiment presents a potentially encouraging picture.

Over the past few days, there’s been a notable surge in transactions on the XRP Ledger. On average, around 35,799 distinct wallets have been involved in at least one daily transfer – a level of activity not seen for more than three months. Furthermore, an impressive 3,858 new wallets were generated in just one day, which is the most significant increase in seven months.

This surge in network activity is a promising sign for XRP, as spikes in active wallets and new addresses often precede major price movements. The growing interest in XRP could be an early indicator of an impending shift in price action, especially as the broader market trends upwards.

However, the price must still exceed the local highs of around $0.65 to confirm a bullish trend. While the network data points to potential growth, the coming weeks will be crucial for XRP’s price movement.

If XRP manages to regain important resistance points, it could potentially follow the general market’s positive trend, offering a brighter perspective for its investors.

Price Action: Technical Levels To Watch

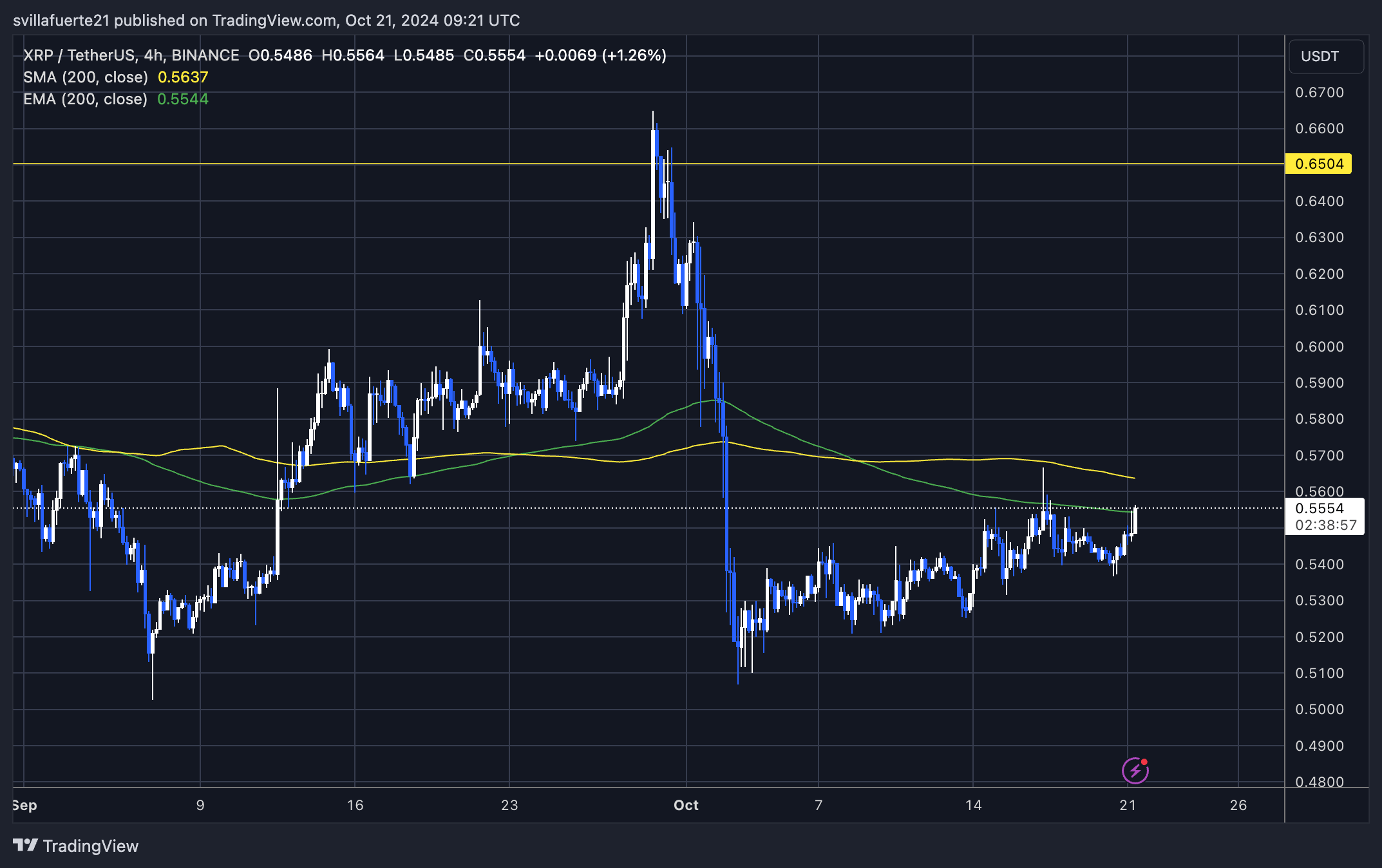

Currently, XRP is priced at approximately $0.555. Over the past three weeks, its price has been moving sideways. Notably, it’s currently encountering the 4-hour 200 exponential moving average (EMA) as a potential resistance point, having previously stayed below this key indicator.

If the price rises above the 200 Exponential Moving Average (EMA) and then stabilizes while maintaining this level as support, it usually suggests an increase in value towards approximate levels of $0.60 and even $0.65. This breakout would imply a resurgence in bullish energy, prompting investors to be patient for a clear upward trend before investing.

If XRP doesn’t manage to surpass its 200 Exponential Moving Average (EMA) and these significant resistance points, there might be an immediate drop towards $0.52, or potentially even lower. Not exceeding this resistance suggests that the market could experience more consolidation or possibly a correction as it looks for areas with less liquidity.

Over the coming days, I find myself closely observing XRP as it approaches a significant technical threshold. The outcome of this encounter could potentially signal a long-awaited breakout from its current trading range, aligning with the optimistic market trends.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-10-22 00:04