As a seasoned researcher with years of experience in the crypto realm, I find the recent spike in Bitcoin miner-to-exchange transactions intriguing. While this trend may not be unprecedented, it’s always worth delving deeper to understand the underlying factors at play.

Recently, there’s been a significantly increased frequency of Bitcoin transactions from miners to centralized trading platforms, as indicated by on-chain data.

Bitcoin Miner To Exchange Transactions Metric Has Just Seen A Spike

In my recent analysis, I’ve noticed a significant increase in the Miner to Exchange Transactions, as highlighted by CryptoQuant author IT Tech on X. This indicator measures the total number of transactions originating from miner-linked Bitcoin wallets that are being sent to exchange-related addresses.

When the level of this metric is significant, it indicates that miners are frequently transferring a substantial number of transactions to these platforms. Since many chain validators often move their assets to exchanges in order to sell, such a pattern could potentially lead to a decrease in Bitcoin’s price due to increased selling pressure.

Conversely, when the indicator is low, it suggests that miners aren’t transferring their coins to exchanges, possibly indicating they intend to keep their coins for some time. This prolonged holding by this group could potentially be a good sign for the asset’s value.

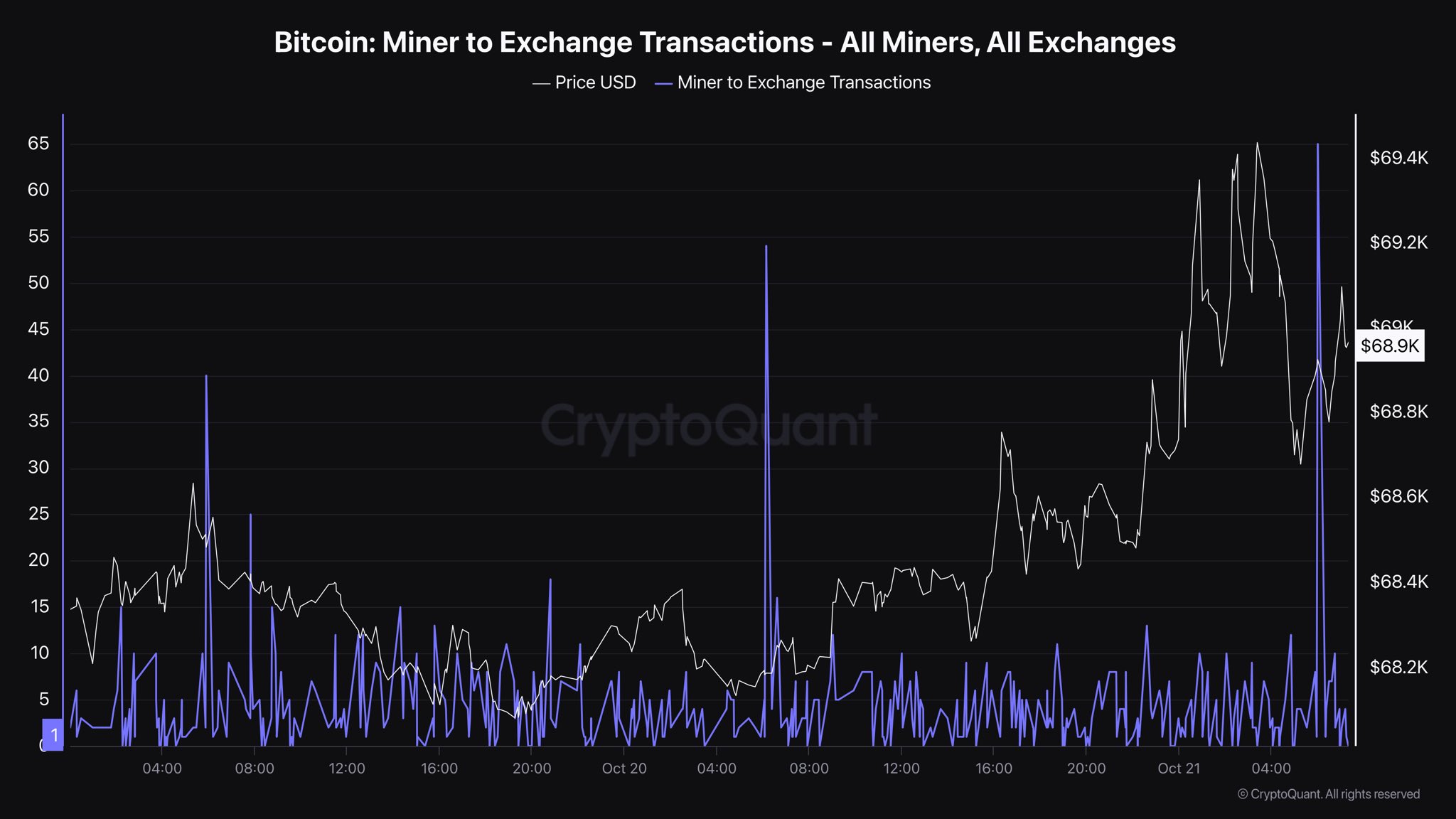

Here’s a graph displaying the recent pattern of Bitcoin Miner-to-Exchange Transactions:

Based on the graph shown earlier, there’s been a significant increase in Bitcoin Miner-to-Exchange Transactions over the last 24 hours, implying that many miners have recently moved a substantial amount of Bitcoins to exchange platforms.

There’s a chance this activity could signal a sell-off by these blockchain validators, but whether such selling significantly impacts the cryptocurrency hinges on the quantity of coins being traded in these transactions.

The analyst has additionally disclosed data regarding a specific indicator known as the “Miner to Exchange Flow,” which offers relevant details about it.

According to the graph, it appears that the increase in this metric’s value coincides with the surge in Miner-to-Exchange Transactions. At its peak, the metric reached approximately 225 Bitcoins, which is roughly equivalent to around $15.4 million at the current exchange rate.

This amount, while not insignificant on its own, is relatively minor compared to the overall size of the Bitcoin market capitalization. Consequently, should miners decide to offload their coins, the market should have no trouble managing this influx.

Miners are consistent users who bear ongoing expenses like electricity bills, thus they typically act as frequent sellers. Normally, their sales volume stays within the usual range, so the current rate at which Miners Sell to Exchanges aligns with the standard.

Keeping an eye on the frequency of direct transactions from miners to exchanges may be advisable, as this trend appears to be quite unusual. It’s worth monitoring closely over the next few days, as further increases could potentially indicate significant developments.

BTC Price

On Sunday, Bitcoin reached over $69,000, but today it’s back down to approximately $68,200.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-10-21 19:34