As a seasoned researcher with years spent delving into the intricacies of blockchain technology, I find myself awestruck by the latest developments in Bitcoin mining. The network’s hashrate surpassing 703 EH/s is a testament to the resilience and growth of this revolutionary digital asset.

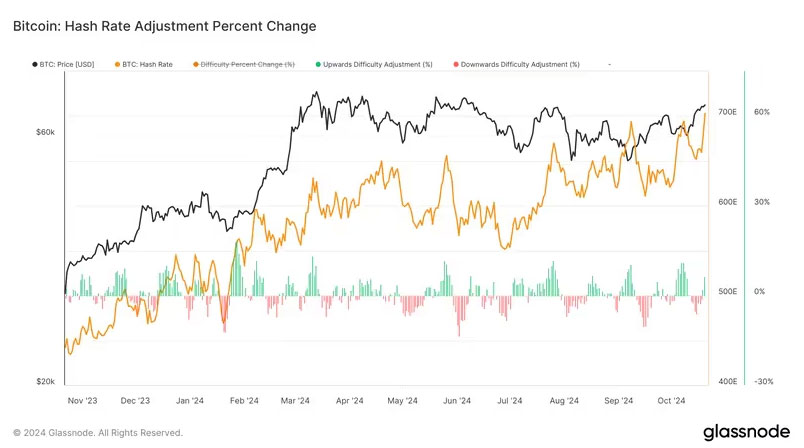

The computational power of Bitcoin has recently soared to an unparalleled high, as the seven-day moving average of the network’s hashrate reached 703 exahashes per second (EH/s). This remarkable milestone signifies the first time the hashrate surpassed the 700 EH/s barrier, based on the most recent data from Glassnode.

1) The amount of computational power employed in mining Bitcoin and handling transactions, known as hashrate, has increased by approximately 13% since the halving event in April. This event decreased the daily production of Bitcoin from 900 to 450 units, potentially leading to a tighter supply and possibly contributing to price increases.

Bitcoin mining companies that are publicly traded have played a substantial role in the recent increase of the network’s hashrate. As per mining expert Sebastian Ski, these miners currently represent about 28.9% of the total network’s hashrate, which translates to over 200 Exahash per second (EH/s). Since October of last year, their market share has climbed by almost 10%.

Public Miners Lead Hashrate Growth Surge

Ski pointed out that these publicly listed entities progressively capture market share from other global miners. Among them, CleanSpark, MARA Holdings, Riot Platforms, and IREN have recorded the most substantial growth in hashrate over the past year. This aligns with data indicating consistent month-over-month production growth for these miners as of September.

The process of Bitcoin mining is extremely competitive and requires a significant amount of capital. Since the rewards for mining a block decrease approximately every four years, the pressure on miners increases. Those with less financial resources or energy efficiency may struggle to keep up, leading to them shutting down their operations. This natural process tends to favor miners who have lower energy costs or more financial support.

Additionally, it’s worth noting that the cost of mining a single Bitcoin (Bitcoin’s hashprice) has surged to approximately $50 per petahash per second (PH/s). As reported by Glassnode, this rise occurred concurrently with Bitcoin’s price peaking at $68,000 and a surge in transaction fees. This increase can be attributed partly to the high on-chain activities associated with the creation of runes protocol, which accounted for more than half (over 50%) of all transaction fees on October 17.

Bitcoin Difficulty to Increase by 4%

With Bitcoin’s hashrate reaching new peaks, the network is preparing for an anticipated difficulty increase of more than 4% on October 23rd. These adjustments, which happen approximately every 2016 blocks mined, are designed to keep a steady rate of block discoveries, around once every 10 minutes, even as the network’s total computational power ebbs and flows.

An increase in hashrate boosts both the safety and speed of Bitcoin transactions. It also underscores the growing influence of publicly-traded mining companies within the blockchain industry. As these miners enhance their technology and processes, they will mold the future of Bitcoin mining, possibly affecting market patterns and operational strategies.

Read More

- POPCAT PREDICTION. POPCAT cryptocurrency

- Who Is Finn Balor’s Wife? Vero Rodriguez’s Job & Relationship History

- The White Lotus’ Aimee Lou Wood’s ‘Teeth’ Comments Explained

- General Hospital Cast: List of Every Actor Who Is Joining in 2025

- Beauty in Black Part 2 Trailer Previews Return of Tyler Perry Netflix Show

- Leaked Video Scandal Actress Shruthi Makes Bold Return at Film Event in Blue Saree

- Kingdom Come Deliverance 2: How To Clean Your Horse

- Who Is Al Roker’s Wife? Deborah Roberts’ Job & Relationship History

- One Piece Chapter 1140 Release Date, Time & Where to Read the Manga

- Clare Crawley Subtly Reacts to Matt James & Rachael Kirkconnell Split

2024-10-21 17:36