As a seasoned analyst with over two decades of experience in the financial markets, I have seen countless trends come and go. However, the growing phenomenon of Bitcoin HODLing is one that truly piques my interest.

As an analyst delving into the dynamic world of cryptocurrencies, I’ve noticed that as Bitcoin and other digital currencies gain value and expand their use cases, various investment approaches have surfaced. For numerous enthusiasts, the investment rationale primarily revolves around Bitcoin and Ethereum, two leading cryptos in terms of market capitalization. Some investors are drawn to discovering the next potential ‘meme coin’ poised for a bull run. However, it seems that the strategy with the longest staying power is the simple yet effective ‘buy-and-hold,’ or ‘HODL.’

The investing strategy is clear: Simply purchase Bitcoin and keep it, allowing its value to grow over time. As per Glassnode, a company specializing in on-chain analysis, the number of Bitcoin holders has reached an all-time high. Moreover, they mention that the amount of Bitcoin not currently in circulation (illiquid supply) has been steadily increasing lately, which could indicate that more users are choosing to hold onto their BTC rather than selling or exchanging it on the market.

Metrics Suggest An Increasing Number Of BTC Holders

Based on market data and indicators, it appears that an increasing number of investors are showing optimism towards cryptocurrencies, indicating a bullish outlook. As reported by Crypto Banter, Bitcoin’s stored supply has been steadily growing over recent months, which could signal a potential market surge, as this trend is reminiscent of the ‘HODLING’ mentality among investors.

Stored supply increasing for months = mega HODLing vibes

— Crypto Banter (@crypto_banter) October 21, 2024

According to Glassnode’s analysis, there seems to be a growing pattern in stored supply and a decreasing one for active supply. The stored supply indicators provided by the company encompass long-term holder supply, coins that are being held or are untraceable, as well as the illiquid supply. Conversely, exchange balances and short-term coin supply are categorized as active supply metrics.

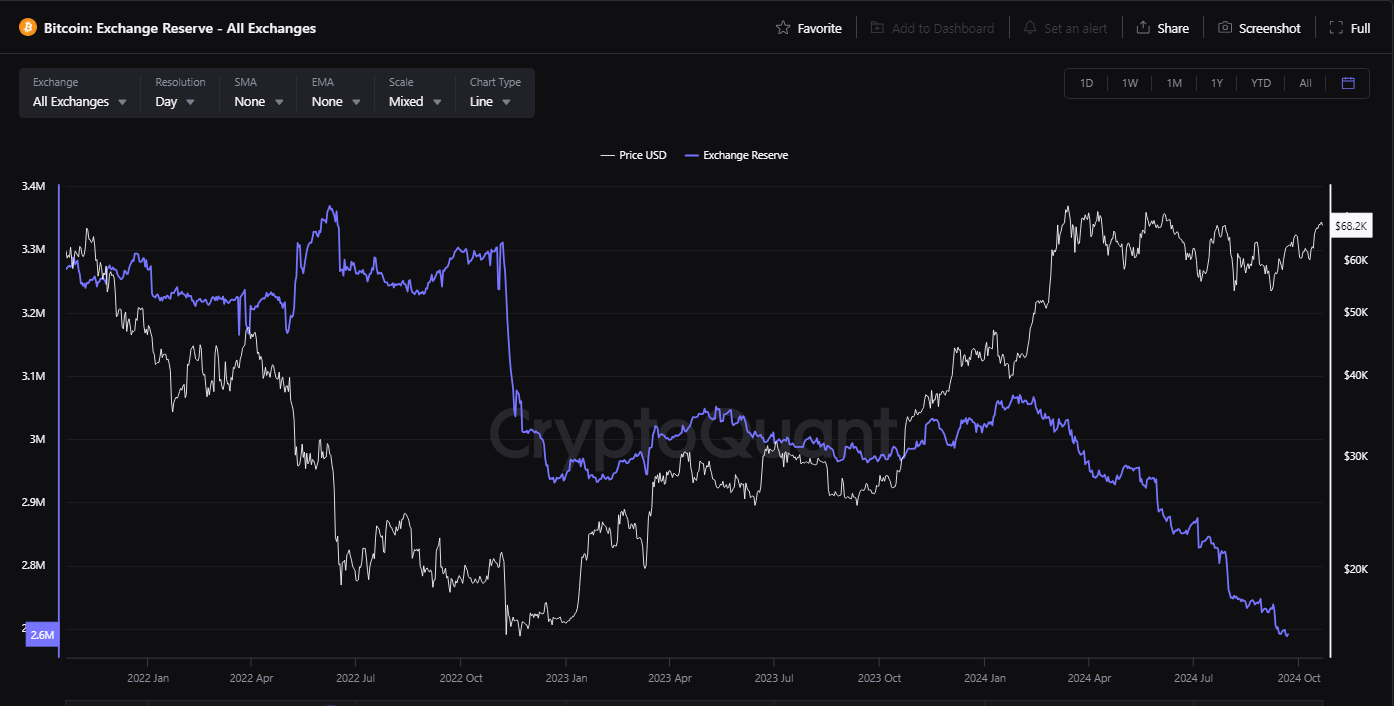

Exchanges Report Declining Reserves

As a crypto investor, I’ve noticed an ongoing yet consistent decline in the circulating supply of Bitcoin since 2024. This trend aligns with the predictions made by various analytics firms. Interestingly, according to Glassnode, the number of lost or unused Bitcoins has decreased compared to the data from the beginning of the year, which could further tighten the supply and potentially impact the market dynamics.

CryptoQuant adds that centralized exchange BTC reserves are falling. At 2.64 million BTC, exchanges keep the coin around its all-time low, after a November 2023 decline. Exchange reserves typically indicate selling pressure, lowering prices. According to CryptoQuant and Glassnode, investors now prefer to buy and hold rather than trade.

Institutional Investors Helping Prop Up Bitcoin

More and more financial institutions and major investors are showing greater interest in the growing number of Bitcoin holders. According to a study by River Financial from September, the use of Bitcoin increased by an impressive 30% over the past year and a staggering 587% since 2020. This analysis also suggests that institutional investors currently possess approximately 8% of all existing Bitcoins in circulation.

Currently, numerous investors view Bitcoin as a more effective safeguard against inflation and a means to broaden investment portfolios. Moreover, River Financial highlights that over 49% of US corporations now possess Bitcoin holdings, with a total worth of approximately $19.7 billion. Furthermore, the surging interest in Bitcoin-based ETFs has contributed significantly to its increasing popularity. The combined value of all Bitcoin assets currently amounts to around $66.11 billion.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-10-21 16:34